Good morning. Happy Monday. I hope you had a nice weekend.

The Asian/Pacific markets closed mixed and with a slight bullish bias. China dropped 1.2%. Europe is currently up across-the-board. Belgium is up 2%; France, Germany and Amsterdam are up better than 1%. Futures here in the States suggest a relatively large gap up open for the cash market that will put the indexes near last week’s high.

I don’t have anything to add to the report I wrote over the weekend. Things changed last week. Technically the charts are in much better shape. Psychologically the mood and feeling improved greatly. News wise, there is much less fear sudden bad news will hit the wires. There’s a European Union summit scheduled for later this week. Barring unexpected bad news, December should be a decent month for stocks. Things change fast when news rules, and news suddenly is very encouraging.

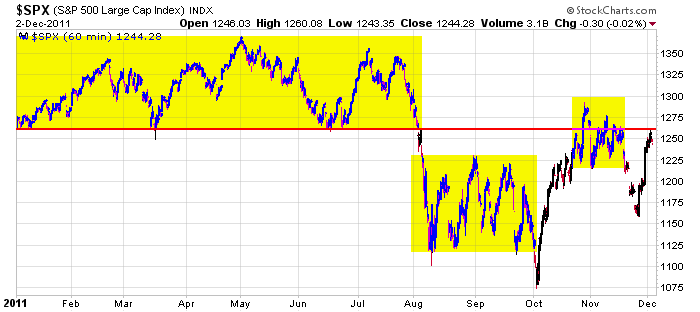

As I stated last week, my bias for now is to the upside, but we are far from being in the clear. The financials and semis are lagging some, and I’ll want to see money rotate out of the safe-haven groups. 2011 has not been a trending year for stocks. Jan-Jul was a big range. Then a smaller range established itself in Aug and Sept at a lower level. Then a consolidation pattern formed in late Oct, early Nov. Other than a late-summer sell-off and Oct rally, it’s been a stocks picker’s market because a trend never established itself. It’s not a surprise the indexes are almost flat on the year. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 5)”

Leave a Reply

You must be logged in to post a comment.

dec may have more news than expected

infact the whole ponsi could fail

“anyone for musical chairs”