Good morning. Happy Tuesday.

The Asian/Pacific markets closed down across the board. Taiwan dropped 2%. Australia, Hong Kong, Japan and South Korea dropped more than 1%. Europe is currently mixed. Belgium and Stockholm are the only 1% movers (down 1.1% and 1.2% respectively). Futures here in the States point towards a relatively small gap up open for the cash market.

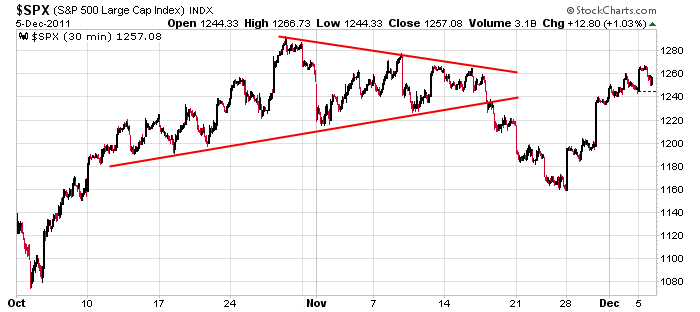

Here’s the 30-min S&P chart since the beginning of October. Everything that was lost after the index broke support of the consolidation pattern has been recaptured. Price is right back in the middle of the range. The market dropped when Italian bond yields moved above 7%, Spanish bond yields moved above 6% and even French bond yields moved up. Then news hit suggesting the central bankers were going to work together to provide liquidity to the global financial system. The market dropped because of news and then rallied because of news. There’s no question this is a news driven market, and Europe is in control. Funny how that works. They have no control over their finances, but they have control over Wall St.

The internals have improved. Key groups are moving up. Key stocks are doing well. Safe-havens are lagging. Everything is lining up for a year-end rally. The market still has work to do, and there’s a key European summit schedule for Friday that will produce a few headlines. But once we get this week behind us, the path of least resistance is up. Things can always change, but for now, my bias remains to the upside. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 6)”

Leave a Reply

You must be logged in to post a comment.

For what it’s worth, the EW wave structure is in sync with Jason’s analysis. We have a completed 5 wave structure or a wave “A” from SPX 1158. In either case, further upside would be expected after a downside consolidation. SPX 1232 down to 1215 is an area I’m looking for as support before a test of 1292 or higher.

I’m short at SPX 1257 and looking for a test of 1250-1253 minimum or I’m out quickly.

A quick exit at breakeven and I’ll look for another place to short.

A move above 1260 and a failure may be a low risk place to short again.

Another short position at 1260 and I need to see at least 1253 to feel OK about this short position.

I’ve added a second short position at SPX 1257 and I need 1253 broken on the downside to maintain both positions.

I’m short a third position at 1256 on the thinking that downside momentum amy building since the intraday high. i’ll cover the last 2 short positions quickly if 1255 isn’t broken soon.

The third attempt to break below SPX 1255 finally proved successful. But, 1253 has held and I’ve covered my last short position at breakeven 1256. 1257 must hold as resistance or I’ll cover the remaining short positions as downside momentum can’t seem to get established as we enter noontime.

well, I’ve now covered my econd short position at breakeven 1257 but I’m OK holding onto my first short position established at SPX 1260. From what I’m seeing so far, the downside seems to be limited to perhaps the upper end for the time being of the 1232-1215 range mentioned early today and maybe as high as the 1240 area.

Funny how an American can say: There’s no question this is a news driven market, and Europe is in control. Funny how that works. “”They have no control over their finances, but they have control over Wall St””.

Remember 2008? Remember Bush?

I’ve covered my last short position at 1257 and I’ll stand aside.

I’d like to see a new hi for today a failure to follow through and then I’d look to short again.

Ok Shortie! It looks like you’ll get your chance about now.

Well I was wrong. I guess that’s one of them there FootPrints.

short

RichE!! – I joined you on the short side at SPX 1264.

the vix is not confirming the instos have gone into accumulation mode

therefore looking at motives

the instos that are moving this simply on conman santa bonuses for the bigboy gamblers inc oil can harry

and opts ex related before they close there books for the year

charts are footprints of motives

lets have a few rumours

I’ll cover unless it c

I’LL COVER UNLESS IT CAN BREAK AND HOLD BELOW 1259 INTO THE CLOSE

Close enough to remain short overnight, What about you, RichE?

I’m flat.