Good morning. Happy Thursday.

The Asian/Pacific markets closed down across-the-board, but only Singapore dropped more than 1%. Europe is mixed with a slight bullish bias. There are no 1% movers. Futures here in the States point towards a flat open for the cash market.

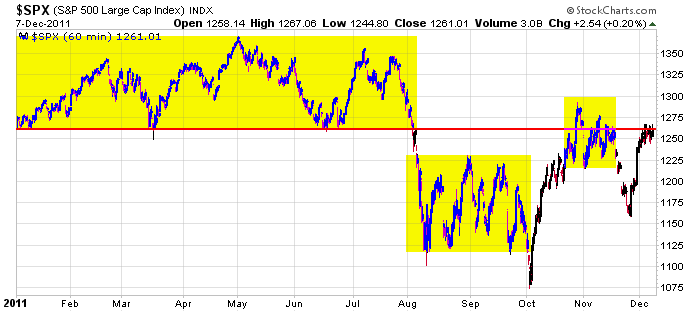

The market moved up again yesterday, but the gains were small and the movement lacked conviction. It was the fifth consecutive day the market lacked any type of intraday direction. It moved up and down, and if the closing bell rang 30 min sooner or later, small losses could have easily been recorded. I don’t like the slow, range-bound movement that comes on light volume. No doubt the market is resting and waiting for news from Europe tomorrow. My bias is to the long side, but there’s a small part of me that cautions to be careless – perhaps we’ll have a sell the news scenario. The S&P is, after all, up over 100 points the last two weeks. On the flip side we are warned not to short a dull market. I’ve seen these “slow grinds up” quickly surge to the upside, so I have little interest in going short here.

At this point in time, entering a trade is like entering a trade the day before an FOMC meeting. You have to guess the result and guess the market’s reaction. No thanks. I’m a technical trader, not a guesser of good or bad news.

Having said this, the 1260 area seems to be an important one for the S&P. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 8)”

Leave a Reply

You must be logged in to post a comment.

I like the short side on a rally failure at SPX 1252-1255 for a day trade.

I’m short at 1252 and looking for downside momentum to build.

If SPX 1245 finds support I’m covering my short position. If it breaks & becomes resistence, I’ll target 1240.

As I see it, SPX 1245 is important support as the bottom of this short term topping area. 1240 is the 10 day EMA and the beginning of another important shelf of support down to 1232. I’ll cover my 1252 short position if the next test of 1245 from above can’t break through.

I’ve covered my short 1252 position at 1245 and I’ll short again if 1245-1248 area becomes resistance.

Having seen resistance at just above 1247, I’m short again at 1245 and looking for a retest of the day’s low.

I’ve added a short position at 1243 and need to see 1240 broken or I’ll cover at least one position.

there was insto selling today that may have bottomed for the day,or just resting

europe closed with not to much damage but still down and in a wait and see mode re europe

the instos are fearfull——who is going to be left to save the big bank instos world wide

no one

Pete,

for this move down,where do u see a target and if u see it as a B down or the start of 3 of 3

This move down appears to be a 3rd wave of some degree. The question is, will it be the end of a 5 wave sequence of wave “C” of an ABC pattern targeting 1232 and the end of the correction of the move up that began at SPX 1158 or, is this only part of a deeper correction targeting 1220-1225 or even 1200?

If 1240 becomes overhead resistance, I’d be tempted to short a third time.

Thanks Pete,

i was thinking even longer term—–with y/days high as ‘A’—1220 or even 1200 as B and 1300 as C

OR will we never again see y/days high

I’ve added a 3rd short position at 1239 and I’m looking for 1232 as a downside objective. if we get there and it finds support, I’d cover 1or 2 short psoitions. If the low of 1237+ isn’t broken, I’ll cover at least one position quickly.

I don’t trust myself to act objectively, so I’m putting in a a buy stop & I’ll cover 2 positions at just above 1241 where SPX just turned down from.

I’ve been stopped out of the last 2 short positions and remain short 1 position from 1245. I still like the short side and will look for another short opportunity.

AussieJS – Yes! I see the top around SPX 1266 on MON as either wave 1 (bullish count) or wave A (bearish). This pullback is either wave 2 or wave B. If it’s wave 2, we go much higher (test 1370) and if wave B, then wave C targets 1300-1330 and completes the ABC up from 1075. Either way, we should go higher but I favor the ABC.

I’ve covered my last short position (1245) at 1239. The downside momentum seems to have ended. My target is still 1232 minimum, but maybe it doesn’t happen until tomorrow or into the today’s close, but I don’t want to take any more positions at this time of day.

Thanks Pete

the big question tomorrow will be the direction of the euro

up

Pete M…u really loove the sound of yuor own voice….yak yak yak….