Good morning. Happy Friday.

The Asian/Pacific markets closed down across the board. Hong Kong lost 2.7%; Australia, India, Japan, Singapore, South Korea and Taiwan dropped more than 1%. Europe is currently mixed. Germany and France are up; Austria and Belgium are down. Futures here in the States point towards a positive open for the cash market.

The 17 euro countries plus 6 others have agreed to a new treaty that requires stricter budget rules and oversight of national budgets. An agreement on fiscal discipline is necessary before the ECB, IMF and others would commit to help countries that have huge debt and unsustainable borrowing costs. This is the news. The response in Europe was lukewarm, and justifiably so. They already have a treaty that dictates financial risk, but all countries ignored it. Oh well, we’ll see what happens. They’re meeting again to work out what exactly the treaty will contain and how violations of the budget rules will be dealt with. The goal is to have the treaty written by March.

The reaction by the futures market in the US has been positive. Coming up with some sort of agreement is better than nothing. The euro moved up slightly; the dollar down. Gold and silver are up as is oil and copper.

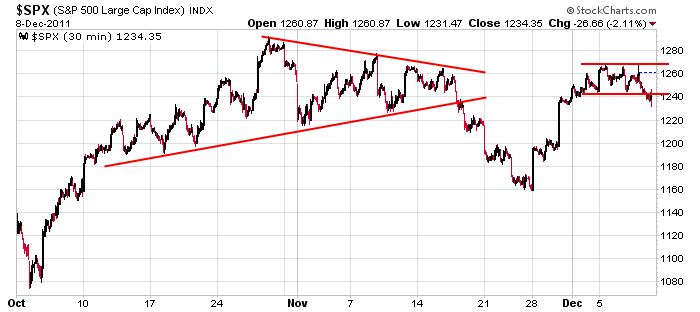

A lot of damage was done to the charts yesterday. In most cases the indexes closed at a 6-day low. That’s what happens when the market trades quietly for several days – it only takes on bad one to wipe everything out. Any stocks that were consolidating with the market dropped out of their little flag patterns. Any stocks that were already lagging got hit hard. And stocks that had recently broken out are mostly back into their ranges. Perhaps it was a little nervousness ahead of the European summit. If so the market should right itself soon. I’ll give it one more weakish day to shake the tree and scare the weak hands. Then it needs to move up. Here’s the 30-min S&P chart. Other than a brief move down and then back up in late November, the S&P has traded between 1200 and 1280 for two months…and there have been many large gaps. Today’s open will be very close to 1240 – the middle of the range. From a technical standpoint you can’t be overly bullish or bearish. From a news standpoint, it’s nice to get some uncertainty from Europe out of the way. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 9)”

Leave a Reply

You must be logged in to post a comment.

News aside, that 30 min chart shows a very nice reverse head and shoulders and could have been bought at about 1225. Just an observation, since many people have left technicals behind in this volatile, news filled market.

The European countries are using the public news to position themselves.

Jason…how about the financial transaction tax that is part of the European agreement. This may be more important to us than anything. The bozos in our government will be reconsidering this for us if Europe goes ahead with it…although London is not agreeing as of right now…

http://www.forbes.com/sites/greatspeculations/2011/12/08/while-europe-slides-germany-plays-hardball/

I’d like to add to Jason’s comments as well as those of Chris, but from an EW perspective. Using Jason’s 30 min chart – I’m counting the 1st wave up from 1158 to just under 1200 as a minor wave 1 and the pullback as minor wave 2. Then, you’ll notice an even smaller 5 wave sequence up to about 1250 which makes up minor wave 3. Notice that within that smaller 5 wave sequence, wave 4 terminates around 1232. Minor wave 3 (ending around 1250) is followed by an small irreguler flat wave 4 (a = 1240ish, b = 1260ish, c = 1260ish). This is followed by minor wave 5 and completes what could be a larger wave 1 (which is bullish) OR wave A (less bullish or irt could even signal the bearish end of the rally from 1158). The action that followed (Chris’ H&S), is all part of wave 2 structure with a Chris’ downside target of 1225.

With the above in mind, you’ll note that yesterday’s pullback to 1232 fell right to the bottom of smaller wave 4 of minor wave 3. In EW analysis, that’s a typical place for a corrective wave to end, which is why I said yesterday that 1232-1240 (small wave 4 area) was significant. So, we could have ended larger wave 2 (or larger wave B) with larger wave 3 (or C) to the upside dead ahead. I’ll follow up on Chris’ commnets in the next post.

ESZ1: I think this is going to fail. The EUR/USD didn’t make a higher-high.

The EUR/USD is falling. The ESZ1 is confused. I’m short.

EUR/USD : Lower-high but higher-low. I’m going to cover if next bar isn’t bearish.

Holding my short. It’s lime-green.

To complete my thoughts from my last post – if you take a Fibo retracements from 1158 – 1266 rally, .382 is at 1225 (Chris’ H&S projection, the 50 day EMA & 50 day SMA at 1220), .500 is 1212 & .618 is 1200ish (Jason’s previously mentioned downside targt after 1240).

To me, if this correction holds 1225 (.382 retrace) to 1232, the probability increases that we have a bullish larger 5 wave pattern building with wave 3 dead ahead and 1370 as the 5th target. However, if we come down to 1200-1215, the probability increases that we’re seeing an ABC sequence with wave B having ended in 1200-1215 area, to be followed by wave C to the 1300-1330 area.

So that’s my thinking, which makes today/MON important in that any rally in 5 waves makes me want to go long thinking 1232 is the end of the correction and any 3 wave sequence raises the chances of further downside action targeting 1225 in an ongoing correction (as Chris pointed out) or even 1200 – in which case, I’ll I’d look to short today’s rally.

I’d sell a reversal in the SPX 1251-1256 area, but if it blows through it, I’d begin to prepare to get long for a test of 1266 and larger wave 3 possibly eveloping.

Agreed, I believe I was premature with my short.

Ahhhh, resistance! Going short again.

When I referred to Chris’ H&S comments, I meant Stephen’s comments ( I get excited sometimes!).

Pete, we knew that and considered the source………….lol

It doesn’t seem impulsive (certainly not explosive wave 3 impulsive) and we’re at a .618 retracement area of yesterday’s high to low down move, so I’m going to pull the trigger on the short side at 1253 or better.

I’m short at SPX 1253 and looking for a break below 1251 to confirm staying short.

If I’m going to stay short & add more positions, I’d need to see not just 1251, but 1250 broken on the downside – ideally with some acceleration on the break.

I’m now short twice at 1253 and I r-e-a-l-l-y need to see 1250-1251 broken with some momentum.

Take a Valium.

EUR/USD isn’t making head way. I’m holding my short.

I’m out of both psoitions at breakeven, but I still like the short side intraday.

Where’s the upside momentum if this is the beginning of a wave 3? Or is this still part of the corrective wave 2 pattern since the orthodox wave 1 (or wave A) peak at 1260? I dunno the answer.

Too many waves for such a volatile and news driven market. I realize that Elliot intended to describe the mood of the market with some consistency, but this market changes direction with every breath of EURO news.

When it is difficult to determine if you are in a one wave or another, it’s time to sit on your hands or stop out frequently. You can’t catch any fish if you’re bait is not in the water, but sometimes the bites are so light and you have so many misses, you can run out of bait.