Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific market closed mixed and with a slight bullish bias. Australia, Japan and South Korea gained more than 1%. India dropped 2%, and China dropped 1%. Europe is currently down across the board. Austria, Belgium, France, Germany and Norway are all down at least 1%. Futures here in the States point towards a moderate gap down for the cash market.

The dollar is up big. Oil and copper are down. Gold and silver are getting hit hard.

There’s a headline that reads: “Markets fall as mood darkens over EU crisis pact: Stocks, euro and Italian bonds fall as mood darkens over EU plan to fix debt crisis.” Really??? The countries comprising the EU knowingly and willfully violated the last treaty (Germany was the first to do it). Now they’re writing a new treaty which essentially renews their committment to the same fiscal discipline, and we’re supposed to believe they’re going to follow it this time around. What a joke. Any treaty they come up with just pacifies the market and perhaps distracts investors from the fact that many southern European countries have massive debt issues, and agreeing to a new treaty now – with all its great intentions – isn’t going to help Italy make a debt payment next month.

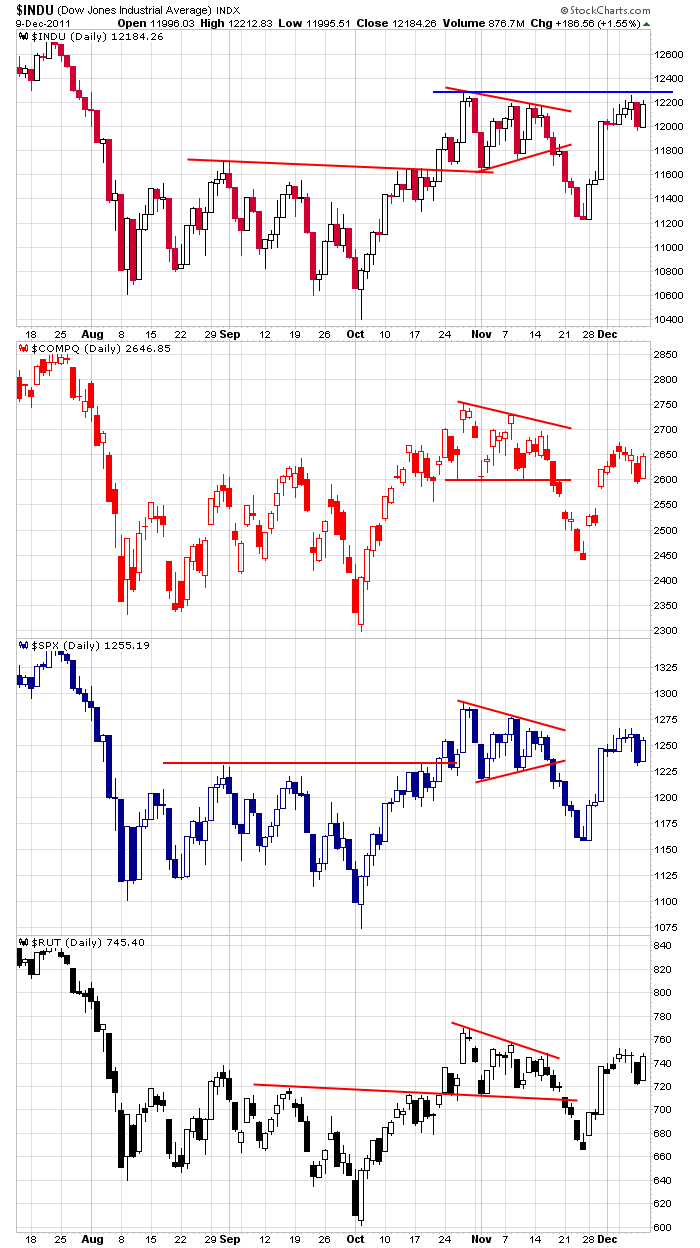

That said, I think the indexes are in decent shape. They fell out of their early-November consolidation periods and then quickly recovered. Right now they’re unchanged over the last 8 weeks. Barring bad news, odds favor a move up into the end of the year, but with this morning’s headlines, apparantely agreeing on a treaty last week wasn’t sufficient. News risk remains.

Here are the daily charts. For me to believe the market is healthy and gaining strength, I’d rather not see last week’s low taken out. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 12)”

Leave a Reply

You must be logged in to post a comment.

Same old, same old headline news driving these markets. It won’t be too difficult

for the BOYZ to pull a head fake out of their bag with their nitro guns waiting

in the wings. Seasonality is still in favor of the bulls. Wait and watch on CMG.

my pet elephant—jumbo-

wants a trunckcation for xmas

and i have called on the quad witches to give it to him

the dji my get a lower double top with the ftse held at 5500

the dax will cause the ndx to limbo lower now

will bond holders take a xmas haircut

and who will pay santas xmas bonuses

Today/tomorrow may be setting up as key days regarding the anticipated Sant Claus rally. A lot of technicals point to SPX 1220-25 as a key support area, in my opinon, if last week’s low around 1231-32 fails to hold. Below 1225 is Jason’s 1200 (also a Fibo .618 retrace of the rally from 1158 to 1266-67. The 200 day SMA (now at 1263ish) has capped this rally so far from 1158 and seems to have all the technical analysts’ attention as the key reisistence.

I continue the think 1260 was the EW wave 1 (or wave “a”) completion with evrything after that a complex wave 2 (or wave “b”) correction in progress of the move from 1158. At this point, I’m looking to take a long position on signs of support & a reversal anywhere from 1231-32 down to 1200. The higher the area of support develops, the more bullish, in my opinion

ESZ1 >>> ESH2 rollover. I’m long ESZ1 until ???

I’m “probing” the long side with a long position at SPX 1234.

“Probing”??? Yuck!

The ESH2 and EUR/USD are sleeping together. I wonder what will wake them up.

I think they just went into ‘REM’. I’m not hopeful of a long or short today.

Long

there are toooooooooooo many xmas bulls with calls

i have called upon the liquidator and dow 10000 should be easy

intraday the trend is still down with a tick in the negative zone all day

it may change

So much for “probing” (sorry, RichE) the long side. The noon time bounce afforded me a chance to cut my loss and I’m out at a little under the 1231 level. I guess we now need to test the day’s low and perhaps the 1220-25 area.

Yep.

EUR/USD looks weak, but the ESH2 isn’t corresponding. Short anyway.

london has identifyed itself as the head of the rogues with no financial transaction tax

and its banks will be the first to go bankrupt this week

it was leemans london that went bankrupt before

Lost enough money today. See ya tomorrow.