Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

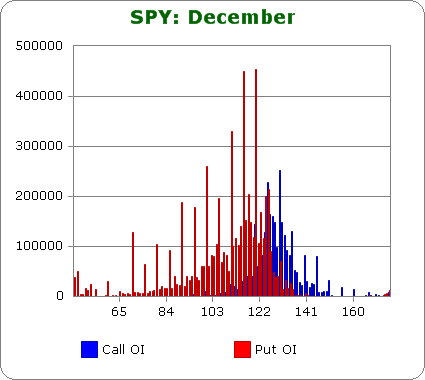

SPY (closed 124.21)

Puts out-number calls 2.2-to-1.0 – slightly less bearish than last month.

Call OI is highest between 120 & 136.

Put OI is highest at 125 and below with big spikes at 120, 115, 110, 105, 100, 95 & 90 – literally every 5 strikes.

There’s overlap between 120 & 125. If call and put open-interest were equal, a close in the middle of that range would cause the most pain, but since puts dominate, a close in the high end of the range is needed. With today’s close at 124.21, SPY is already positioned to cause lots of pain, so flat trading the rest of the week is sufficient.

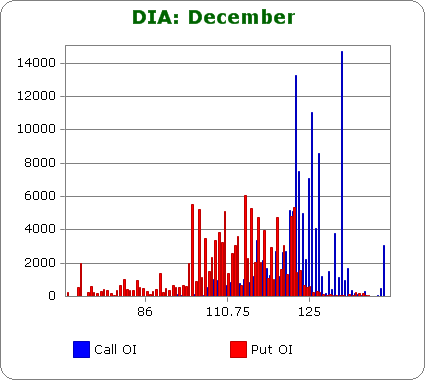

DIA (closed 120.26)

Puts out-number calls 1.0-to-1.0 – slightly less bearish than last month.

Call OI is highest between 122 & 124 and then at 126 and 128.

Put OI is highest at 121 and below.

The DIA OI doesn’t matter because volume is so small, but I’ll go through the numbers anyways. The call and put OI configurations butt up against each other around 121 and 122, so a close there would result in the most number of options expiring worthless. Today’s close was at 120.26 – good enough to cause lots of pain – but not quite in the middle. Flat trading or a slight move up will do the trick.

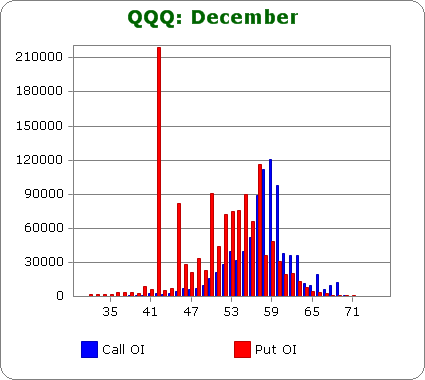

QQQ (closed 56.45)

Puts out-number calls 1.5-to-1.0 – same as last month.

Call OI is highest between 57 & 60 and tapers off in both directions.

Put OI is highest between 52 & 57, and there’s a big spike at 50, 45 and 42.

If you only look at the biggest OI spikes, the call and put OI configurations butt up against each other around 57, but obviously there’s lots of over down 53ish. To cause the most pain, QQQ needs to close such that most of the puts expire worthless and at least those high-OI call strikes between 57 & 60 do the same. In my opinion that level is 57. Today’s close was at 56.45 – essentially exactly where it needs to be. Hence, flat trading the rest of the week will cause the most pain.

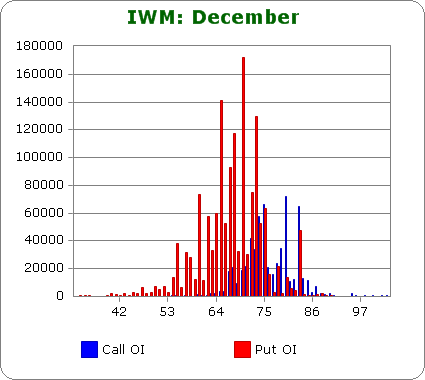

IWM (closed 73.51)

Puts out-number calls 2.6-to-1.0 – slightly more bearish than last month.

Call OI is highest at 74, 75, 80 & 83 – very inconsistent profile.

Put OI is highest between 65 & 75, and there are a couple spikes below 65.

The call and put OI configurations overlap between 74 and 75, but since puts dominate calls, let’s focus on those to determine where max pain is. If IWM closes at 75, most of the puts will expire worthless, and coincidentally a close there won’t allow call buyers to make much money – if any at all. With today’s close at 73.51, a slight move up is needed to cause the most pain.

Overall Conclusion: For the most part, the market is already positioned to cause lots of pain among option buyers. Flat trading the rest of the week would cause lots of pain. A slight move up would cause a little more.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

as we know insto holders roll over opts at least starting 5 days before ,whilst retailers leave it till the last minute——–so it can still be volitile -even if flat on fri at ur levels

So there will be mini releif rally on Thu/Fri to cause max damage!