Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. South Korea lost 3.4%, Australia and Taiwan more than 2%, and Hong Kong, Japan and Singapore more than 1%. Europe is currently mostly up, but only France (up 1.1%) has moved more than 1%. Futures here in the States point towards a positive open for the cash market.

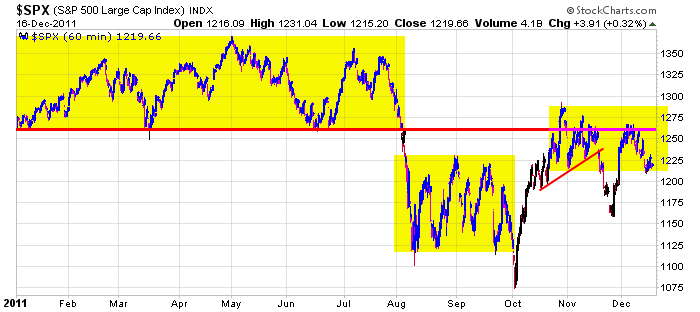

I don’t have anything to add to the comments I made over the weekend in the Index Report. We start this week with the indexes trending down in the near term and being neutral over the last couple months. Last week the market dropped Mon, Tues and Wed and on Thurs and Fri it closed up but well off its intraday highs. Rallies are getting sold into – this has been the case for two weeks. But if we back the chart up we’d realize the S&P is unchanged since the end of Nov, the middle of Nov, the middle of Oct, the middle and beginning of Sept and the first week of Aug. Yes the current level has been visited from both directions many times. This makes the market neutral on an intermediate term basis, but I lean to the downside overall because of the following chart.

The S&P formed a large topping pattern the first 7 months of this year and then broke down in early August. Since then most of the price action has taken place below support (near 1260). Until the S&P can reclaim this level, the long term picture leans to the downside. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 19)”

Leave a Reply

You must be logged in to post a comment.

Happy Kwanza everybody! Sincerely, HW/nyc

++ my New Years resolution for 2012 is

to start drinking again. :))

Start drinking again LOL. Have one for me Howard. I gave it up years ago. One now and then but I ain’t 20-something no more 🙂

OK, Howard! To open the Kwanza celebration, I’ll go short SPX on a reversal off of 1225. Say hello to Max for me.

Oddly enough I gave up Max back to the ASPCA. They give you a one year no questions

asked return policy. So then I decided to give Max back. He wasn’t a very good

market timer you know. 1 bark = BUY 2 barks = SELL Lost a bundle on that guy.

Close enough to SPX 1225, so I’m short the reversal at 1223 looking for 1214, then 1210.

Short a second time at 1221 looking for downside acceleration now or I’ll cover at breakeven or better.

Sideways for a 1/2 hr is not my idea of downward acceleration. I’ve covered my second short position at breakeven and will leave on my first short at 1223 with my stop loss entered at breakeven. Going shopping for the wife’s Christmas gift.

with spx-ndx-rut rebalancing at close fri and the witch effect–europe gave a merry dance today–down/up /down—just closed out my shorts

perhaps santa will bring some whipsaws to play with for xmas

AussieJS – you’re sure right about the whipsaw as I got stopped out of my short positions this AM before SPX resumed its dwonmove to my original targets.

From an EW perspective, I’m still thinking we can see SPX 1200+/- 5 pts on this (final?) down move. I mentioned last week that I’m thnking we’re in a “triple zig zag” down from the 1st top of SPX 1266 DEC 5th. On my hourly chart, counting from 1230-31, the question now is, does the decline occur in 3 or 5 waves for wave “c” of this last “abc” pattern that began from 1230-32? If we bounce from 1210ish to above 1215 right now, I’m thinking it’ll be a 3 wave decline and I’ll short it. Otherwise, we’re probably in a wave 3 of a 5 wave decline and I won’t chase it.

By the way, that beautiful downward channel on the SPX hourly chart is impressive. Forgetting EW, sometimes the “Kid With A Ruler” drawing simple trendlines can give you the entry and exit points at trendline support & resistance with no need to count the waves!

If SPX cna’t get above 1213, I may not wait for 1215 or higher to get short. I’m thinking we’re in a 3 wave decline on the hourly chart from 1230-31 into 1210ish for wave “a” and we’re now a wave “b” bounce that’s struggling to get above 1213.

With apologies to Aussie Jay for posting so much, some may find the following of interest.

From an EW perspective, the 3 waves down from 1230-31 looks as though waves “a” & “c” are equal in length. If so, this completes larger wave “a” around 1210ish. Wave “b” is in progress with Fibo resitance at 1215-1219ish. that’s why I’m looking to short on any reversal at/ve 1215 looking for wave “c” down into 1200+/- 5 pts. Wave “c” can be 3 or 5 waves down.

I’m short SPX at 1213.50.

I’m going to cover my 1213.50 short position if SPX can’t puch through 1211 on this 4th attempt since just befroe 1pm. Wave “b” may not be complete yet.

As far as EW analysis, this should be the final movement down and we’ll figure the wave “c” count out later. The target zone is 1200 +/- 5 points, unless there’s a wave “extension” which would allow for down to 1190ish.

A point to consider: on this move lower – so far the momentum indicators that I’m watching aren’t as strong as the move down into last week’s low. I’m thinking of covering now.

I covered my short position at 1205 and will wait for confirmation that a longer term reversal is taking place at or below 1205 before venturing on the long side.

when looking at the ndx 100 their is a big triangle from oct low with small e up to finish it