Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India dropped 1.3%. Otherwise there were no 1% movers. Europe is currently mostly up. Germany, Norway and Amsterdam are up more than 1%. Futures here in the States point towards a relatively big gap up for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

But let’s not get overly excited. This will be the forth straight day the market is gapping up. The first three couldn’t hold their gains. On the flip side yesterday had a capitulation feel. There were several times I found myself saying: “Are you kidding! The S&P can’t even bounce a measly 3 points before sellers re-assert themselves.” This is when longs throw all caution to the wind and dump positions regardless of price…this is how bottoms are formed. I’m not predicting this or saying you should blindly buy the open. I am however saying the odds are starting to lean towards a bounce rather than further selling pressure. And remember, the biggest up days occur within downtrends.

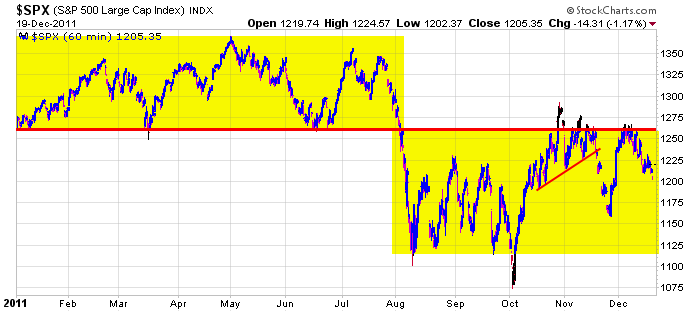

Backing up, looking at the bigger picture, until the S&P can get above the red line in the following chart and establish itself, we need to have a bearish bias. A top formed the first half of this year, and since then almost all the price action has taken place below the previous support level. The ups and downs may not be fun to deal with, but this is textbook charting 101…a consolidation (or distribution) pattern is forming within a newly formed downtrend. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 20)”

Leave a Reply

You must be logged in to post a comment.

From an EW perspective, I have to think that the probablities have increased that the correction of the rally from SPX 1158 to 1266 may have ended with completion yesterday of a triple zig-zag formation. If that’s the case, we may now be in the beginning stages of a 3 or 5 wave upside pattern targeting 1300-1330. With todays opening we appear to have completed a smaller wave 1 up (or wave a) and are now in some kind of small wave 2 (or wave b)pullback. Support would be expected any where from 1225ish down to 1215ish based on Fibo retracement.

I’ll look to go long somewhere but may have to consider chasing a further breakout with a tight stop loss.

AussieJS – I saw your late day post yesterday regarding the potential NDX triangle formation which is in play. You may also want to consider another idea. Take a look at a weekly NDX chart going back to the JUN ’10 low at 1700. Draw a trendline from there connecting the lows of AUG ’10, AUG’11, OCT ’11. Then connect the upper trendline from FEB ’11 high, APR ’11 & JUL ’11 highs. It may be that NDX will test a higher level of 2400-2500 as opposed to triangle resistance expected below 2350.

I’m long SPX at 1235

.618 retrace from 1266 to 1202 is 1242ish and then there’s trendline resistance at 1260ish, so upside targets initially are 1242 & 1260-67.

now that is to bullish for me ,Pete

but if the ndx100 triangle breaks to the upside we could have a 4th test of uper trend line

however i treat the feb and june 2011 lows as a megaphone jaws of death and the aug low as a break of that –which is prevelent on many a chart

we had a hindenberg y/day and the internals of all are very bad

im more inclined to think this is a bad baby bonus affair of the instos,which should end jan 2012 –if not sooner

conditions are good for wild whipsaws on no vol

ah! –1260-70 –ok

AussieJS – I don’t disagree with your longer term bearish view. It’s just that I allow for much more upside potential into year end/JAN than you do. That’s why I take today’s upside breakout seriously as a potential move similar to the NOV move up. Still, now that trading has calmed since the opening, I’ll cover my long SPX position at breakeven and jump in again on the long side at a preferably lower level.

to play the big moves –daytrading–u really have to start at the open of europe

after europe closes usa seems to go sideways untill the last hour–but not always

i usually wait till usa closing to see if i will stay in the dax/ftse for a gap up/down

see a chart of the dax today or even ftse which was tamer

AussieJS – that makes sense, given that Euroland news dominates the market movement.

I’m not daytrading by choice. I’m trying to establish a position that (one of these times) will evolve into a trade I can hold onto for a longer term move. So far, that’s not happening I’m willing to get in and out of trades during U.S. trading hours but I can’t/won’t trade beginnnig with the Euorope open. But that’s my problem, I guess.

euro hit res and going down now

also it quad opts ex in parts of euro/asia this fri and in oz this thurs

I have to think that this move up today has the strength to the continue through the day. If it can get to my first resistance at 1242ish, I’ll think about getting out and look for a pullback to reenter. Otherwise, 1260-67 can be reached rather quickly by tomorrow, I think.

If SPX starts tradiong below 1238, I may want to exit the long side as we got close enough to 1242ish resistance to perhaps warrant at least a larger pullback. If we should accelerate here from above 1238 after 2pm, I’d have to think we’re on the way to 1260 by as early as tomorrow.

What to do? 1242 (.618) resistance but not an hourly down move all day. Do shorts cover or do bulls take profits on the day? I dunno. At 3:30, if SPX is above 1240, I’ll put a sell order to cover at 1240 & if not filled before the close, I’ll decide whether to exit or stay long.

Well, that was quick. I’m out at 1240 for a whopping 5 pt gain on a 35 pt up move day. Maybe I get a chance to get long again below 1235 & maybe not.