Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets leaned to the downside. China (2.9%) and Hong Kong (1.5%) rallied while Japan, Singapore and South Korea dropped about 1%. Europe is currently mixed. Austria is down 2.1%, and there are no 1% winners. Futures here in the States are flat.

I don’t have anything new to add to the comments I made in the video I posted over the weekend. The market has done well but not great, and given several indicators are at high levels and starting to curl over, the risk/reward for new longs is not nearly as good as it was a two weeks ago. We’ve had many good breakouts recently, and you can still play breakouts – just know the market is due for a little correction, so your holding time may be less than ideal.

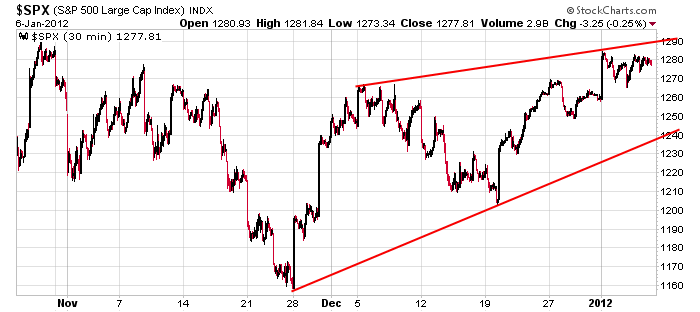

From the current level (the S&P closed at 1278 on Friday), my upside target is 1290 and my downside targets are 1275, 1260, 1250 and 1240. You can see 1240 and 1290 from the following chart.

I think this is a big week. Traders are back from vacation, so volume and movement should pick up. The grace period surrounding the holidays is over. It’s time for the real market to show to reveal itself. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 9)”

Leave a Reply

You must be logged in to post a comment.

Looks like the whole world is getting ready to short the $SPX at 1290. HW/nyc

distribution to the funny bulls at a go nowhere price for the last 4 days

the bears watch and wait as the instos get ready for zero as merkel plays the fiddle as

rome burns

a good nite for sleep

I remain focused on the SPX 60 min chart where the up trend line I mentioned last week connecting the lows from DEC 21st has held again today. A pullback this PM that holds the 1277 level and reverses upward would make me a buyer on the long side targeting a test of 1282 and above with a protective stop below today’s low.

Today is not a daytraders market ———no range–neutral tick ind

Great video Jason – many thanks for doing it, especially when they can be so time consuming.

I totally agree that the market looks very weak here and I remain bearish. On the DOW itself for me to feel more bullish it would have to seriously push through 12,420 and then make 12,800 decisively and hold it.

If anyone wants to read an article on the 2012 predictions I’m happy to send it on. Just email me at emac.84@bigpond.com I thought of posting it here but think it is probably a bit too long. It was an interesting read.