Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across the board. China and India rallied more than 2%. Australia, Indonesia, Singapore, South Korea and Taiwan moved up more than 1%. Europe is currently up across the board. Belgium and France are up more than 2%. Germany, Amsterdam, Norway, Stockholm and London are up more than 1%. Futures here in the States point towards a large gap up for the cash market which will open things well above last week’s high.

The dollar is down. Oil and copper are up nicely. So are gold and silver.

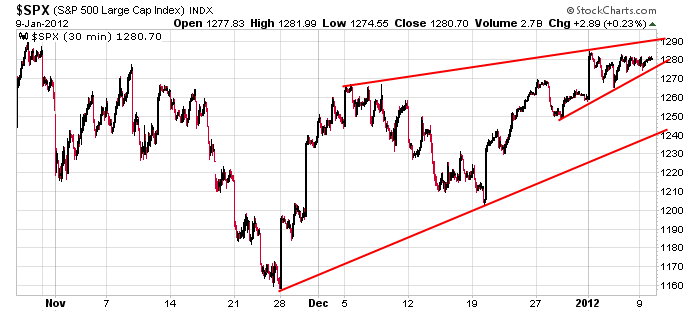

Yesterday didn’t change my stance. The near term trend is up. We’ve had many very good breakouts the last couple weeks, but the risk/reward right now is not as good as it was two weeks ago. This doesn’t mean to sell everything and go short. It just means to have a plan in place and be ready to flip the switch should the market roll over. Here’s the 30-min S&P. We have a small wedge within a larger wedge. Both have bearish implications, but the market has been quiet lately, and we’re reminded to not short a dull market. Today’s open (as of this writing) will not only be above last week’s high but also above the October high. Not bad.

I’m long, but I’m starting to be a little more defensive. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 10)”

Leave a Reply

You must be logged in to post a comment.

Agree, take the swings, limit losses and compound gains, use the windows of opportunity.

But its prudent to continually check under the hood, inside the indices. If indices must be the proxy then maybe its worthwhile to check against the mid 70s 80s 90s and 2000s index action on a log price scale. And are the indices really a good, and fast enough barometer of alpha stock action?

We find out this week if this just a short squeeze blow off top into overhead resistance or something else.

its a ponzi bounce

Right like

– the markets cant go up without the financials

– there is no volume

– its manipulation by the ppt and other conspiracy theory nonsense

– the markets have gone no where

– the ‘quality’ stocks are not moving

– its the economy stupid (or economics leads market speculation)

and other nonsense all throughout 2009 – 2011 while during the same period

BIDU went up +1000%

AAPL + 400%

ENB ABC LYB etc + 200%

Swing trade gains on ETFs

TNA +300% each swing

etc, etc

As Dan Zanger emphasizes – the market is here to take your money not give it. That includes all the charlatans, commentators, day trading sites and market dilettante fools who distracts you from learning to trade properly and to make and compound your money.

Learn to trade properly and read

Wall St the other Las Vegas – Nicolas Darvas

How to smell a rat – ken fisher

Markets never forget – ken fisher

and get your head straight (forget Mark Douglas’ trader’s comfort food BS)

Speculate intelligently, don’t gamble, don’t be a sucker.

All the best

im a gambler

i sell bulls

Just sell the weakening bulls, not the strongest bulls nor the weakest bulls (they may have rested enough to gore you).

Regardless, good luck counter trading. And if you have nailed the interim top and it does really reverse, congrats.

I remain focused on the SPX hourly chart and the channel that has developed since year end 2011. The midpoint of the channel had been turning back rallies and the lower trendline of the channel has been support – most recently yesterday. Today we have another opening gap upward beyond the channel midpont which is now acting as support. Perhaps we’re headed for the upper end of the channel which should take SPX at or above 1300. As Jason says, the short term trend is up and the reasons are unimportant. I’m becoming more inclined to view the lower trendline support going back to DEC 21st as most important. Only if/when it’s broken would I contemplate an end to he rally that began from SPX 1202.

Indeed, one option of the 3 things markets do is to go sideways. We may be witnessing the start of that. Regardless gotta look under the hood and ride the trend until it bends – ie FTK.

All the best

Yup some more weakness profit taking showing up. Look for support or abandonment after euro close.

Time to go skiing for awhile.

Perhaps the SPX wants to fill the opening gap over the next day or so. SPX 1282ish is a .618 retrace (just above the gap fill area) of the move from yesterday’s low to today’s high – which is about where the lower uptrend line going back to Dec 21st would be tested. It would be interesting to sse what happens if further downside action gets there.

By the way, in EW terms, the pullback from today’s high is corrective so far, IMO.

im a telepathic alien gambler