Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down, but the only 1% mover was South Korea which moved up 1%. Europe is currently mostly up. Germany, Norway and Stockholm are up more than 1%. Futures here in the States point towards a moderate gap up for the cash market.

The dollar is down slightly; it’s been consolidating over the last week. Oil and copper are up. Oil has been consolidating too while copper is trying to break out. Gold and silver are both up.

The market has traded slowly and within a tight range this entire year. The only gains have come in the form of two gaps; otherwise the indexes are mostly unchanged since the end of December. Despite this we’ve had many very good trades. The indexes are going nowhere but individual groups and stocks are moving. I guess it pays to be more of a bottom-up analyst than a top-down.

I don’t think the slow market continues for long…but I’ve been saying that for a couple days. Sooner or later we get resolution. We’ll either get 1) a surge up (don’t short a dull market), 2) a false breakout to the upside followed by a stiff move down or 3) a sell-off which seems to come without warning. Be on you toes. There are times you can sit back and let the market do its thing because the dominant trend is obvious, and the psychology feels right. Other times the risk/reward isn’t great, so you gotta be a little more careful. The later is the current state of things.

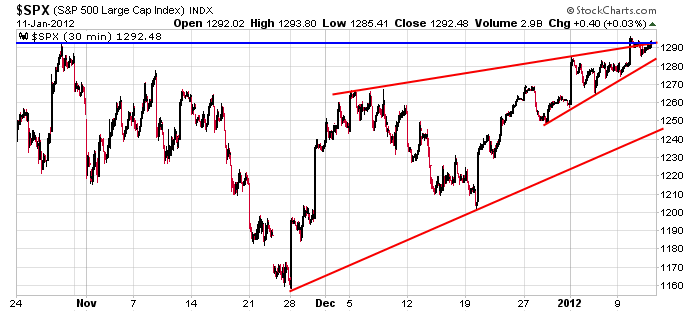

Here’s an update of the 30-min S&P chart. Today’s open (as of this writing) will be about 6 points above yesterday’s close which was right at the top of the wedge and very close to the October high. Is today the day the market makes a decision? We’ll see. Be ready. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 12)”

Leave a Reply

You must be logged in to post a comment.

number 2

Classic bear wedge with a double top formation. Look out below. HW/nyc

closed out my shorts now but shorted dji cash price 12512–spx 1300

ftse 5700-dax 5

closed out my shorts now but shorted dji cash price 12512–spx 1300

ftse 5700-dax 6250—-on the spain/italy bond issue spike

maybe i can reload again

i dont want to get greedy

Sometimes you have to look under the hood for strong groups / stocks.

TOL FTK BIDU AAPL etc

Sometimes you have to stand back and look at the big picture – weekly charts look like a lazy bounce off the bottom of a bull channel – so far.

Sometimes you need to question your beliefs (in indicators and other misused TA tools) that maybe wrong – paraphrase from Ken Fisher.

Why is Economics called the dismal science? Why are analysts and web pundits / gurus so wrong so often?

This all said, yup gotta watch out for and respect the reversion to the mean principle

All the best

Yup, reversion to the mean / perhaps a trend change, still holding last of some longs, may add back in if the trend holds.

For those who do not have a margin account to short with DUST (thin) TVIX maybe worthwhile hedge / short term plays if we get a trend change, tvix and ery made a start end of day monday, may not hold beyond today but….???

Good luck.

Everyone is making good points so I’ll add additional food for thought. As bearish as I am in the longer term, the shorter term picture remains bullish, IMO, in regard to the major U.S. stock averages. While I focus on SPX, consider that the Euro $ is oversold and showing indications of an oversold rally. The USD conversely, is overbought and pulling back as you would expect. If the Euro has been the dominant mover of U.S. stock markets, is that not bullish for SPX, for example? I’m just asking.

If I look at EW analysis (and you can apply other technical analysis as you favor) I see an incomplete 3 wave pattern from the Oct low. Using EW analysis, we’re in wave C and the targets can be from 1310 all the way up to the May high of 1370. Of course, anything can happen but I wouldn’t be too quick to call top here. For me, SPX 1282ish & 1267ish are important support levels near term. I still like 1310-1330 as an C wave ending target this month to complete the move off the Oct low and resume the longer term bear market.

PeteM – just saw your post. The 5th wave I’m looking at would be the conclusion the the “C” you refer to as concluding from 1310-1330. I think we are on the same page just different degrees.

Brian – Yes, I guess I’m talking in terms of a larger degree than you. Anyway, speaking on an intraday basis, I see a 5 wave decline on the SPX 5 min chart into today’s intraday low. A .618 retrace comes in around 1292-1293. I’m inclined to go short on a reversal from or around that level. The uptrend line on the SPX hourly chart going back to DEC has been touched 5 times now. To me, a break below it followed by continued trading below it would confirm that wave 3 (of wave C form 1202)of a potential ending diagonal may have been completed and I’d be looking for an overlap down below 1267ish to confirm it. That’s how I’m seeing it anyway.

I just switched over to SPX to see your view. I agree with your view. I’ve carefully drawn a trend line that indicates an underline kiss is currently at 1293.20. So, your test is coming soon.

First kiss exceeded the trend line and the second happening now has not yet. Based on the futures, .618 retrace is at 1291.10. A couple of minutes ago, it hit 1291 and is still climbing.

That is equivalent to about 1295 for SPX. The .618 retrace considers pre-market trading.

Before the open there was a serge in the MAR S&P futures (ESH12). Wave “b” can exceed the top of previous impulse wave. And, the rise since the bottom of what appears as “a” is 3 waves further supporting the interpretation. Therefore, the pull back from 6:42 CST is a “c” and appears to be fairly well underway and too late to short IMO. This interpretation also provides an opportunity to go long for a low degree 5th and final push at the conclusion of this “c” of 4. However, if I am correct, this 5th wave will stop on a dime and the market will turn down hard after it concludes. This could be difficult to time for anyone other than a serious day trader.

Brian – I see where your’e coming from on your above comments, i.e. I think you’re viewing this morning’s down move as wave “c” of a flat 4th wave to be followed by wave 5 upward. If that occurs, that would coincide with my idea that we may not have seen the end of a larger wave 3 of C, i.e your 5th wave idea would be the 5th of my larger wave 3 (of larger wave C).

My earlier reply to you, allows that we’ve already completed larger wave 3 and this morning’s 5 waves down on the 5 min chart is the beginning of larger wave 4 (of larger wave C). I have to say, however, that your interpretation looking for a new high may be more valid – at least in the short term here. Therefore, if the .618 retrace around SPX 1292-1293 doesn’t cause a reversal as I expect, I’ll hold off shorting. Thanks for sharing your thoughts.

with the premarket spike up on italy/spain bond buying in the ponsi fashion

the dji cash hit 12518 and the spx 1312 i think—thats the futures with fair value added

also ftse/dax exhausted up—-maybe thats all there is to be

europe is exhausted –maybe usa moves up after europe closes

as a magical bear i predict key reversal days down through out the known world

A non-trading friend just dropped by and I thought I’d share his perspective from our visit. He said, “I’ve concluded that humans are meaning making machines.” I just had to smile.

Indeed, a fellow engineer, exceptional swing trader does a lot of testing using telecharts for different instruments and market conditions. He has concluded traders big and small, great and incompetent are all prone to ‘curve fitting’ and recency bias. But that’s how all good things happen – with an observation, a hunch then confirmation by data / information.

Decided to add into the alphas, ie

TSL may be coming back from the dead, if it clears 9.5ish in days to come esp with good vol, it will confirm a drive out of a base and long term supply area going back to the 2009 bottom. Historically it had blow out earnings and sales, then the solar tax incentives etc vaporized. These are short swings with a potential for a position play, do your own DD.

Yes I am long and took profit the other day but decided to add back in today.

Some recent IPOs within the past 2yrs are also perky.

Regardless of volume and we went through the there is no volume nonsense all through 2009 and 2010 –

Flow price, price pays – Seykota, Covel etc

Price leads, fundamentals follow – Paul Tudor Jones

Best of Luck

This said you gotta pay attention to abnormal volume for individual stocks like the vol spike on the bottoming reversal bar on the daily on LULU on Dec 1. Once the profit was taken and dumb money shorts were sucked in for the necessary float….you know the rest of the story.

TSL looks like a break out. FTK weekly and daily charts may be the model of action to come.

I think both are putting 1st / 2nd stage bases. Weekly & daily will make more sense and you have to have account reserves to handle the beta – not for wimps.

Again, do your own DD & best of luck.

Raymond – All interesting comments today. More, please. Can you expand on your FTK “model of action to come” comment? What analysis drives your positions?

Look at the links below and do your own DD on your own trading platform using your own trade set-up please. No disrespect but if you don’t understand, don’t even think of trading something like TSL or FTK until you have a trade plan you have created yourself and fully understand and have the discipline to execute (words are cheap, god, I know).

This is a jumpy stock and not for investing or slower paced trading. That said I don’t day trade unless I’ve screwed up or I see a buy or add in opportunity.

Trades like these are for some of my friends and relatives with ~$50-100k accounts, using no margin and using up to 25% of their account. I do play them as ‘lotto ticket’ plays – taking off 1/2 – 3/4 of my position after a 20-40% move and leave a 1/4 position in play to develop into a longer play. In this case I added back another 1/4 position on the intraday dip as I am going with the momentum. I will watch it like a hawk tomorrow.

If you have a medium sized or larger account (~$250k) your position size should be smaller and perhaps something like AAPL may be more appropriate at the next buy opportunity.

http://finviz.com/quote.ashx?t=TSL&ty=c&ta=0&p=w

http://finviz.com/quote.ashx?t=ftk&ty=c&ta=0&p=w

Good luck….speculate smart, not gamble stupid or risk adverse dumb :).