The indexes have been slow but select stocks and groups have been offering very good trading opportunities. Here are some stocks from the industrial metals & mienrals group.

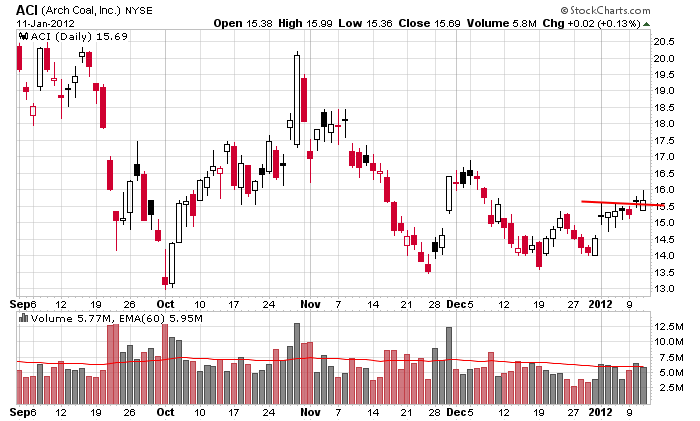

ACI After the big surge at the end of November, the stock needed to double-bottom before trying to move up again. Now it looks good for a couple points.

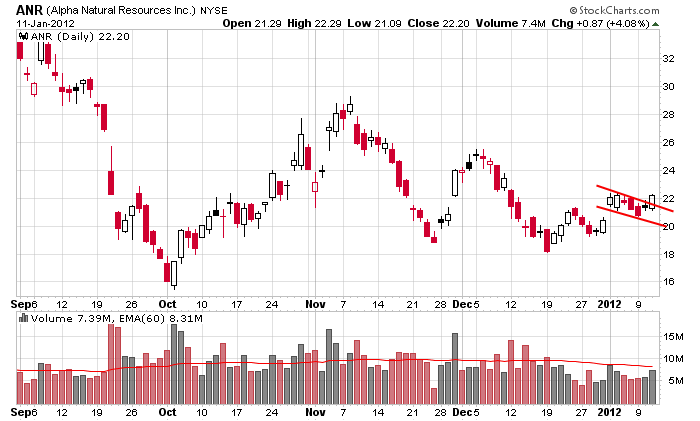

ANR Short term this stock is breaking out of a bull flag within a mini uptrend, but overall the stock is neutral. If the market moves up, this stock should be able to tack on a couple points.

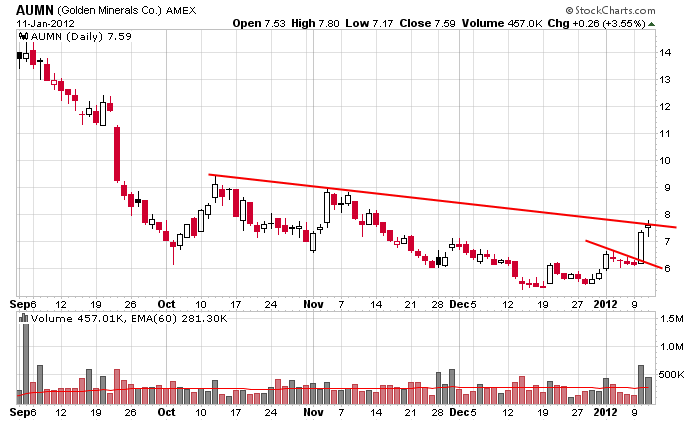

AUMN It exploded a couple days ago. Now we wait for a pullback or flag pattern to form.

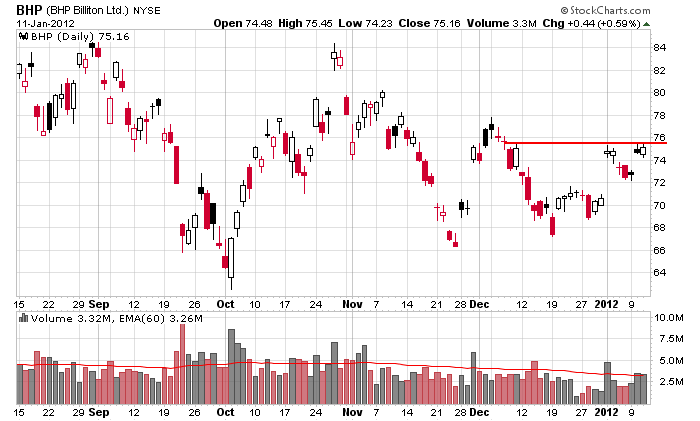

BHP Sloppy, lots of gaps. Tought to swing trade a stock that lacks smooth movement.

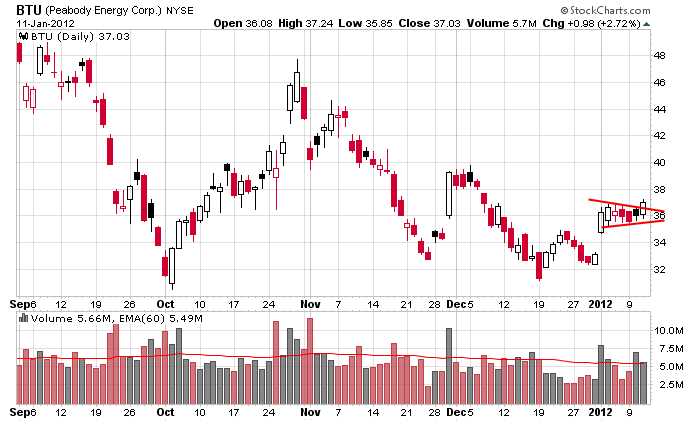

BTU It tested its October low a few times and is now breaking out from a bull pennant pattern. It should be good for a couple points if the market cooperates.

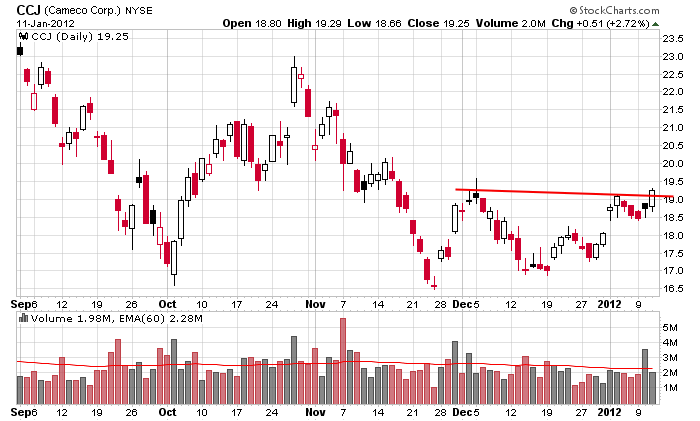

CCJ It put in a higher low and now is trying to move through resistance and put in a higher high. The depth of the pattern (from 17 to 19) measures up to 21.

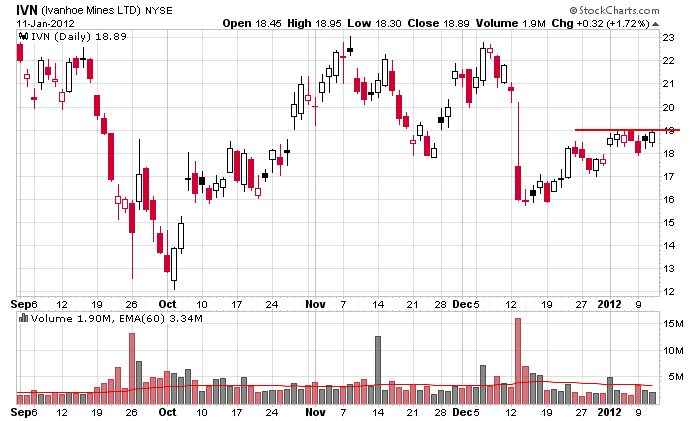

IVN A short term pop is in the cards if 19 can be taken out, but don’t get greedy. There’s lots of resistance over head.

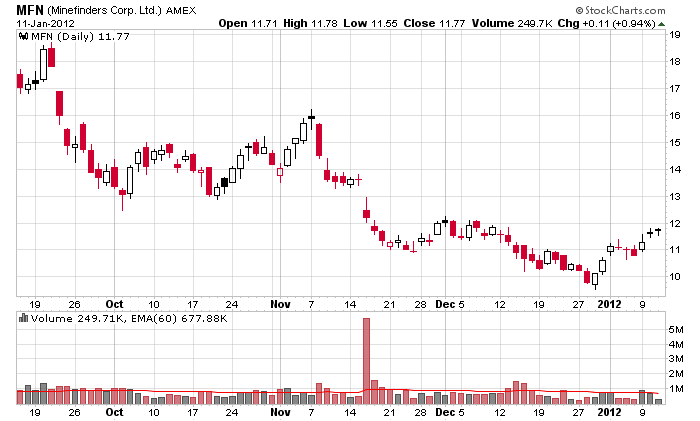

MFN Not sure where the entry is here. I’m waiting for a little dip or some sideways movement.

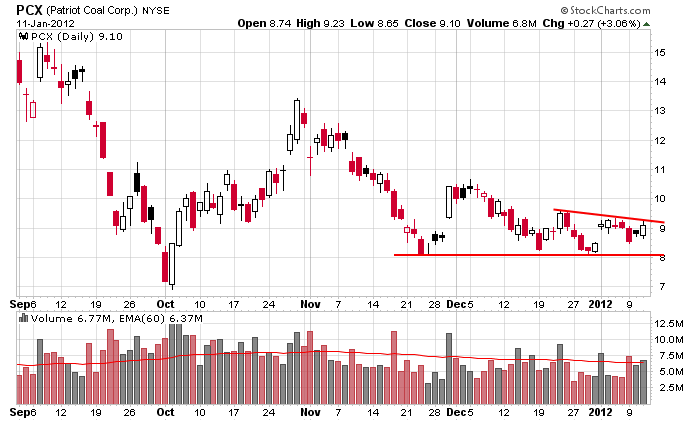

PCX Day by day this stock’s downtrend get more neutralized. A move through resistance followed by a successful test could start the process of moving up to fill the gap just under 12.

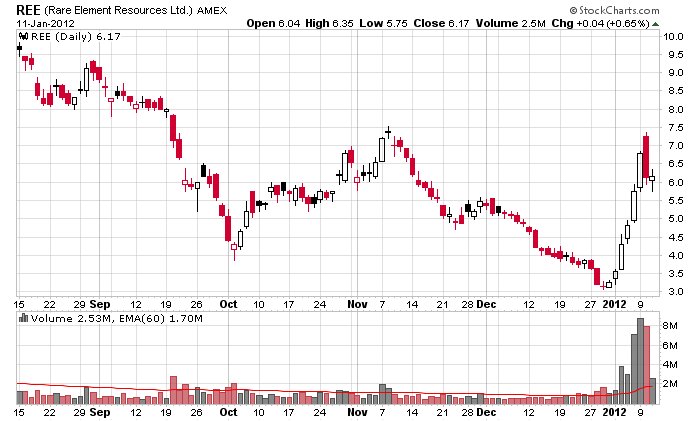

REE I have no idea where the entry is here. For now I’m watching for a pullback or some sideways movement.

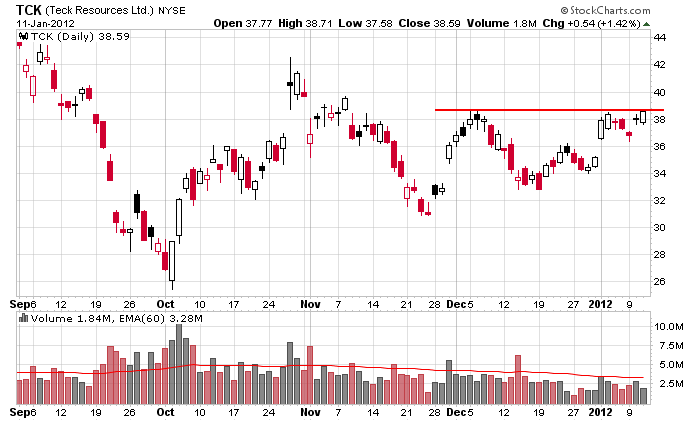

TCK Very nice short term set up here.

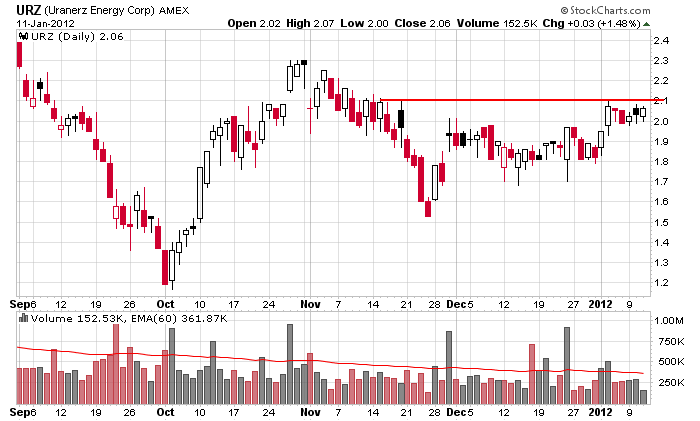

URZ Low volume and cheap – two characteristics that tell us to keep position size appropriate.

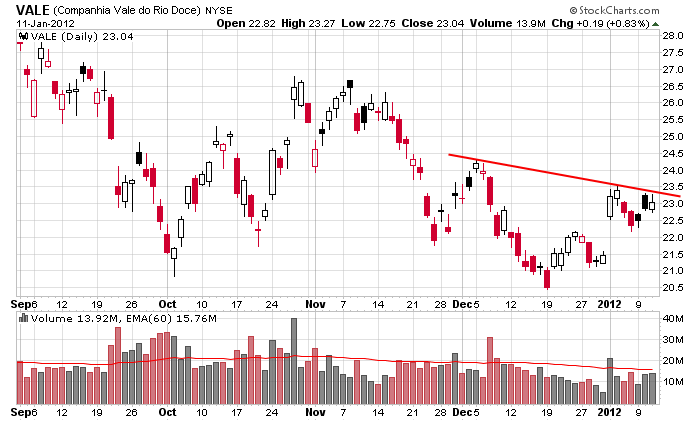

VALE Lots of gaps but still good for a couple points if the group moves together.

0 thoughts on “Industrial Metals & Minerals”

Leave a Reply

You must be logged in to post a comment.

Just want to thank you for your various information, especially group charts like these.

Sure thing Ralph. I’ll be doing more of these going forward.