Good morning. Happy Monday. Hope you had a nice long weekend.

Last Thursday all the indexes closed at new swing highs on pretty good volume. Many charts of individual stocks broke out last week and many more are sitting right at resistance. But we aren’t without warning signs. Most of the internal breadth indicators are in overbought territory, and the shear number of stocks on the LB Long List tells us the odds favor a pullback very soon. Hence my bias is to the upside, but I’m being cautious.

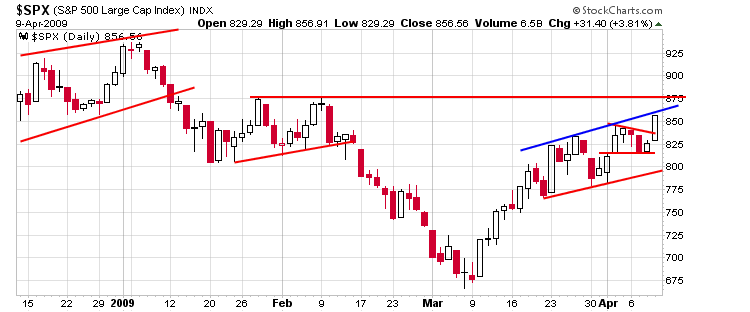

Here’s the daily SPX. The index broke out from what would be considered a pennant pattern within a mini uptrend. Potential resistance comes from the blue trendline which connects the tops of the last three weeks and 875 which was the high in late Jan and early Feb.

From here, the market will either go parabolic, or it’ll get turned back soon. Be on your toes for either scenario.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s earnings & economic releases