Good morning. Happy Tuesday.

Yesterday the market was weak, then exhibited strength, and then sold off some into the close. In the end the indexes were largely unchanged.

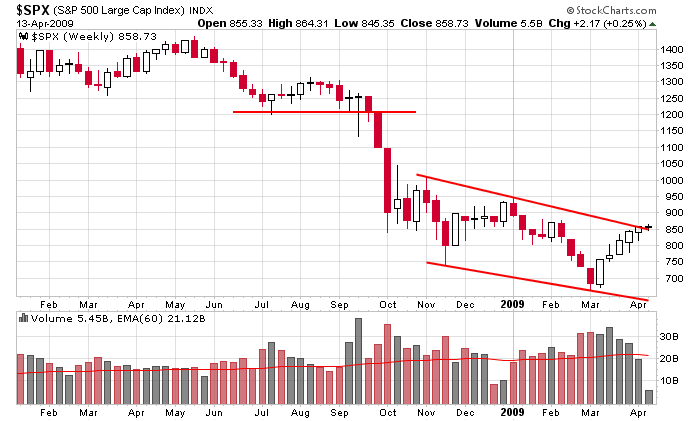

Here’s that SPX weekly I posted yesterday. The index is slightly struggling here near resistance while volume has fallen off each week, and although not easily apparent, the intraweek ranges are generally declining. Although the trend is up, this isn’t bullish. When prices appreciate while volume falls off and the range declines, you must start thinking defensively.

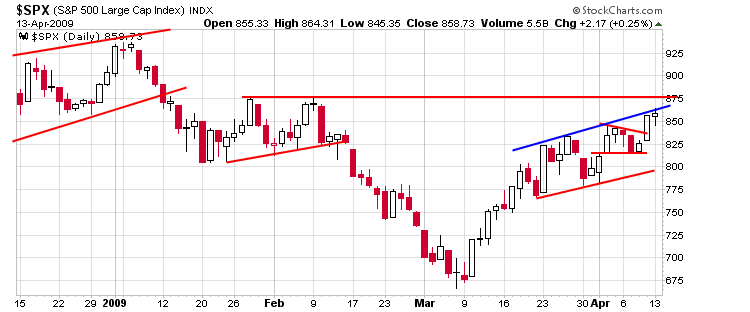

Here’s the daily SPX. Whether you consider resistance right here at the blue line or just overhead at 875 doesn’t matter. Fact is potential resistance is near.

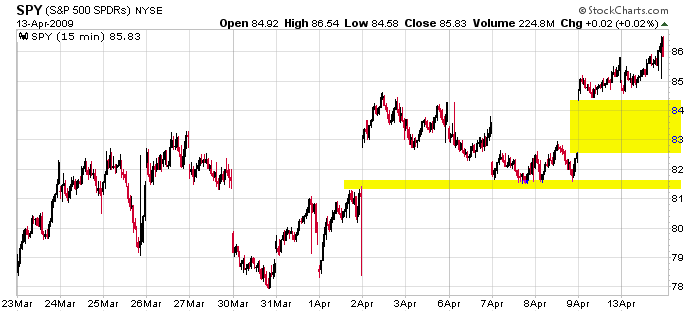

And here’s the 15-min SPY chart. There are numerous (many not shown on this chart) unfilled gaps below.

So the market is nicely trending up, but volume is declining and the ranges are getting smaller. Throw in a bunch of unfilled gaps below and we have a situation that can end with a big move. Very soon I think the market goes parabolic (against all logic) or takes a hard hit. Be on your toes.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases