Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

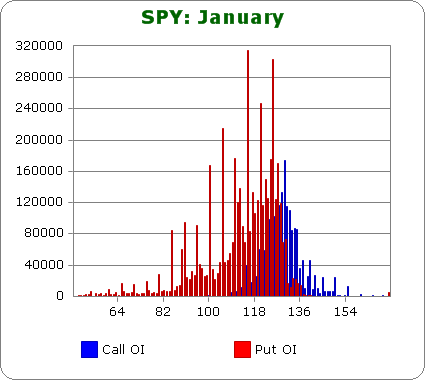

SPY (closed 129.34)

Puts out-number calls 2.4-to-1.0 – slightly more bearish than last month.

Call OI is highest between 124 & 132.

Put OI is highest between 115 & 128, and there are spikes down at 105 and 110-112.

There’s some overlap between 124 and 128. If the put and call OI was equal, a close near the middle of the range would cause the most pain, but since puts dominate, a close near the top of the range is needed (a one point move up would enable call owners to make a few bucks but many more put owners would lose). With today’s close at 129.34, SPY is already above the range. Pain would be felt by many if the stock closed here on Friday, but just as much pain would be felt if the market moved down the next couple days.

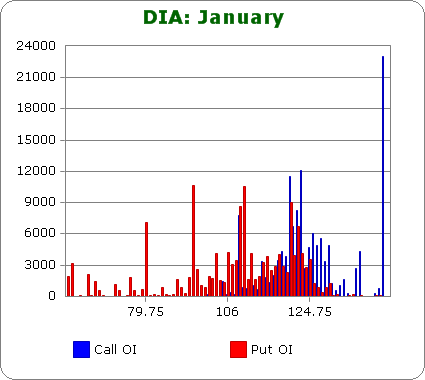

DIA (closed 124.62)

Puts out-number calls 1.2-to-1.0 – slightly more bearish than last month.

Call OI is highest at 120, 122, 123 and all the way up near 155.

Put OI is highest near 95, 110 and 120.

These numbers are obnoxious and unreadable, so it’s a good thing they’re irrelevant because volume is so much less than SPY.

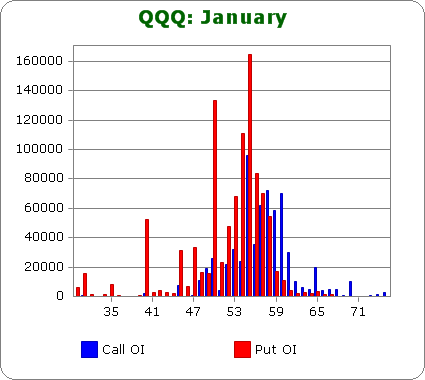

QQQ (closed 58.71)

Puts out-number calls 1.7-to-1.0 – slightly more bearish than last month.

Call OI is highest between 55 and 60 with 55 being the big spike.

Put OI is highest beteen 53 and 58, and there’s a spike at 40 and 50.

The biggest call and put spikes both fall at 55, so closing there or close to it would cause lots of pain. Incidentally this would cause most calls and puts to expire worthless too. With today’s close at 58.71, those who bought 55 calls will likely make a few bucks. To erase this, a move down is needed.

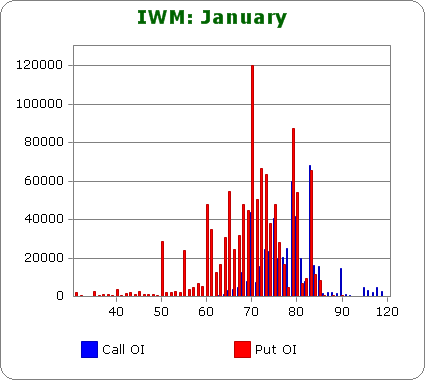

IWM (closed 76.36)

Puts out-number calls 2.5-to-1.0 – about the same as last month.

Call OI is highest at 70, 79, 80 and 83.

Put OI is highest at 50, 55, 60, 65, between 70 and 73 with a spike at 70, 79, 80 and 83.

The OI is generally bunched at every 5th strike, and the put OI smothers the call OI. Let’s focus on the puts because they dominate. Today’s close was at 76.36. A close here would allow those higher-striked put owners to profit, but most put owners overall would lose. A move up to 79 or 80 would allow a few more call owners to make money but many more put owners to lose. Hence a move up is needed to cause the most pain.

Overall Conclusion: The numbers are mixed. SPY could be flat the rest of the week and cause lost of pain, but QQQ needs a move down and IWM needs a move up. Since we can’t draw an obvious conclusion, this is one time not knowing what OI is long and short hinders our ability to draw a conclusion. Because of this I can’t say what the market is likely to do the rest of the week. Sorry. I can only call it as I see it, and that’s what I see.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

“the market conspires to cause the most pain” Who is The Market?

The invisible hand…it almost has to be this way…when too many are thinking the same thing, nobody is left to buy/sell to make it happen.

I never though of it like that. If everybody is long then there are no buyers to buy higher so the market goes down looking for buyers. If everybody is short then there are no sellers to sell so the price goes up looking for sellers.