Good morning. Happy Thursday.

Europe is up across the board. Austria is up 3%, Belgium, France, Germany, Stockholm and London are up more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Copper and oil are up. Gold and silver are up.

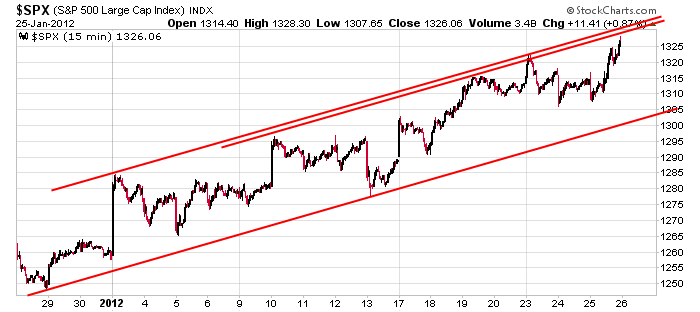

The Energizer Bunny market continues. The market keeps going and going and going…in one direction…up. Every dip gets bought. Every gap down gets bought. Bad news is quickly shaken off. It seems silly to look at a chart right now because support and resistance haven’t had much meaning the last month. Nevertheless here’s the channel the S&P has been contained by.

If you’ve been bearish you’ve gotten burned. Unlike 2011 where there were several tops to pick and being off with your timing was ok because prices never ran out of control to the upside, the current move has had more staying power and has been unforgiving. If you leaned to the upside but were in denial, you’ve missed some good trades. You’re probably too smart for your own good. Eventually – if you wish to stay in this business – you’ll have to dumb yourself down a little and stop thinking so much.

I don’t know when this move will end. At some point it will end, a top will be put in place and we might actually have a down week. How you trade it depends on the time frames you trade. If you’re short term, you can’t sit through a pullback. If you’re intermediate term, you can sit through a pullback with your best positions (I wouldn’t hold laggards). Regardless of when a pullback plays out and however long it lasts, the charts and indicators tell me the uptrend will continue. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers