Good morning. Happy Monday. Hope you had a nice weekend.

I’m going to feel like a broken record here because it’s the same tune I’ve been singing for the last week. The trend is up; new highs are made every few days; dips get bought; there are many great looking charts out there. But there are also many warning signs. Besides the market’s best winning steak in two years (too much too fast?), volume has fallen off and the intraweek ranges have narrowed. There’s no concrete evidence the housing market or employment situation is improving, and resistance is just overhead.

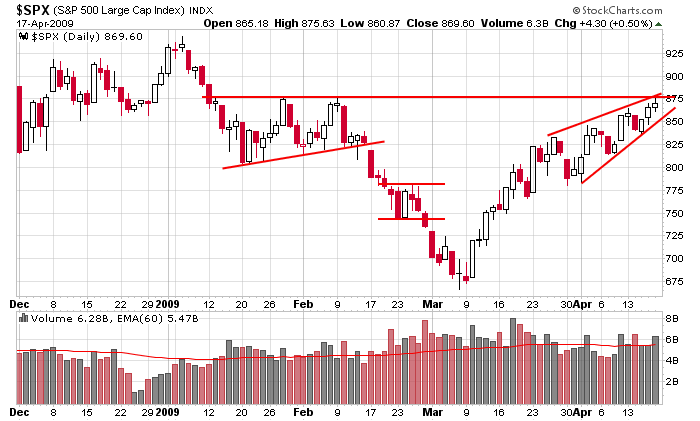

Here’s the daily SPX…a rising wedge right up to 875 resistance. It looks poised to either bust out or take a hit.

Premarket futures trading suggest a big gap down (Nas 100 down 27 and SPX down 17). This despite news Oracle is buying Sun and Pepsi is buying Pepsi Bottling Group and PepsiAmericas and Glaxo is buying Stiefel Labs.

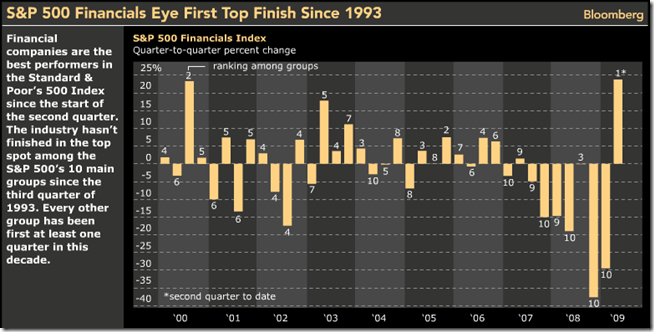

Here’s an interesting stat from Bloomberg. As of now, financials are the strongest group among the S&P 500’s main 10 groups since the beginning of Q2. The last time the financials led for an entire quarter was 1993 – 16 years ago. The graph below shows the financials rank each quarter since 2000. I don’t know what it means and I’m not going to read too much into it. Coming off two consecutive last place finishes, its strong performance this quarter has as much to do with “math” as anything else.

That’s it for now. I don’t have much to add to the weekend report. The trend is up, but there are enough warnings signs to keep me cautious.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases