Good morning. Happy Friday. Happy Options Expiration Day.

The bulls are resilient, aren’t they? Every dip gets bought…new swing highs were registered again yesterday. It’s now been almost 7 weeks since the SPX lost ground for more than 2 consecutive days.

Over the last week I’ve gotten less optimistic the uptrend would continue in the short run. I never turned bearish, I never added any stocks to our short list (stocks) or bear plays list (options), but given a laundry list of warnings and resistance just overhead, the prudent thing to do was tone things down and wait for the market to make up its mind – decide if it wanted to take out SPX 875 and launch upward or get rejected.

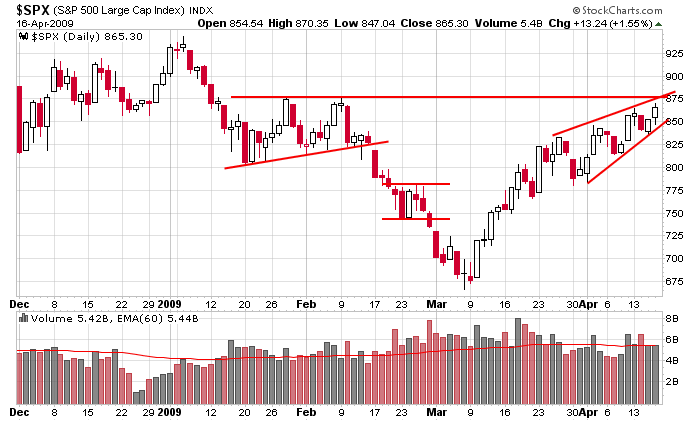

Here’s the daily SPX. The top of the rising wedge and horizontal resistance from late January/early February coincide at 875. I still wonder if the market is near an inflection point – a level or threshold that would produce either a parabolic move up or painful move down. If such a level exists, this may be it.

Research last night revealed many good long set ups and no good short set ups. If the market heads down from here, I’ll use the ETFs. I won’t be shorting individual stocks. Here are a bunch of decent looking set ups ->> click here.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases