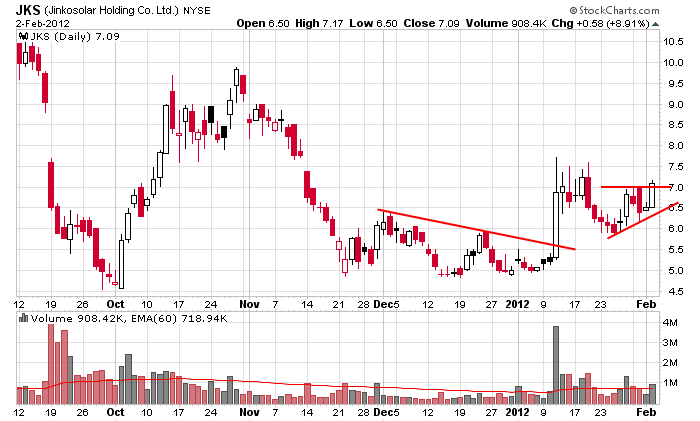

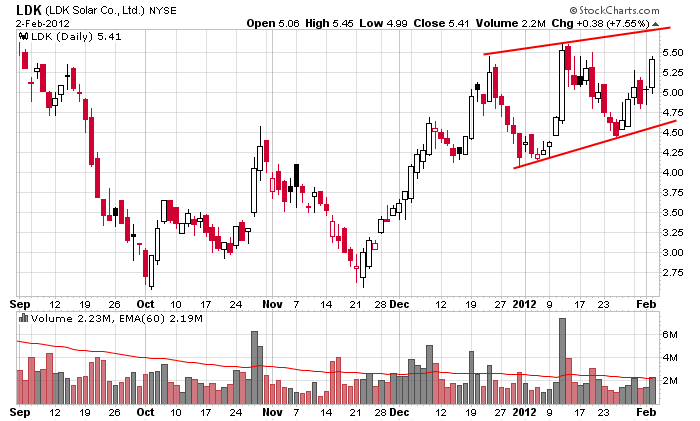

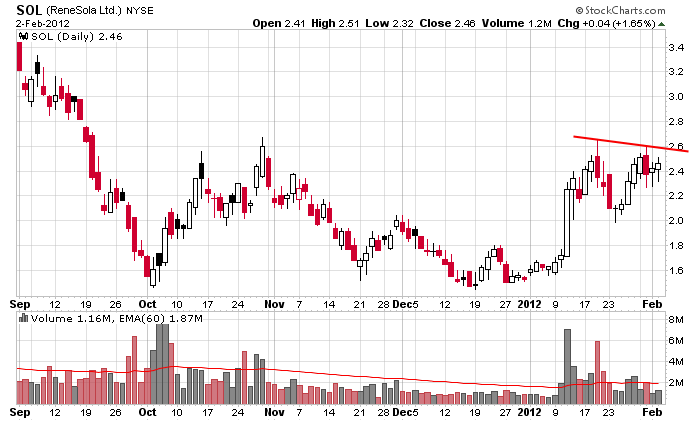

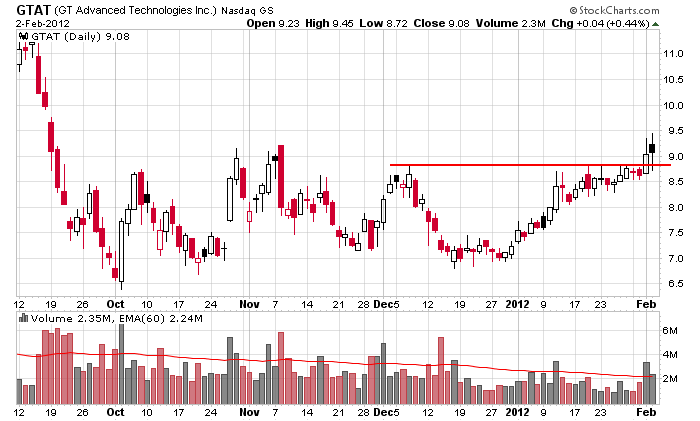

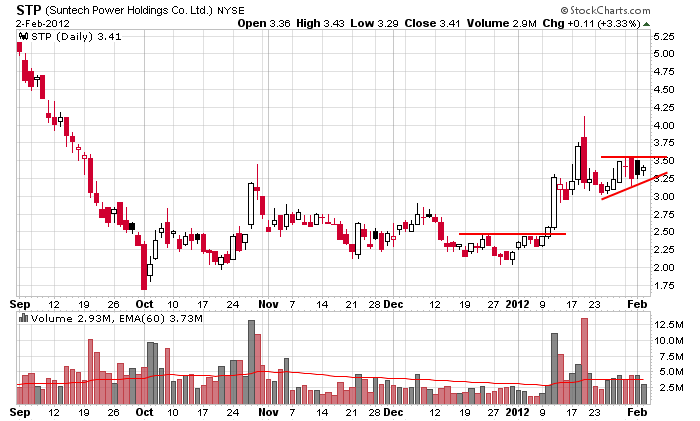

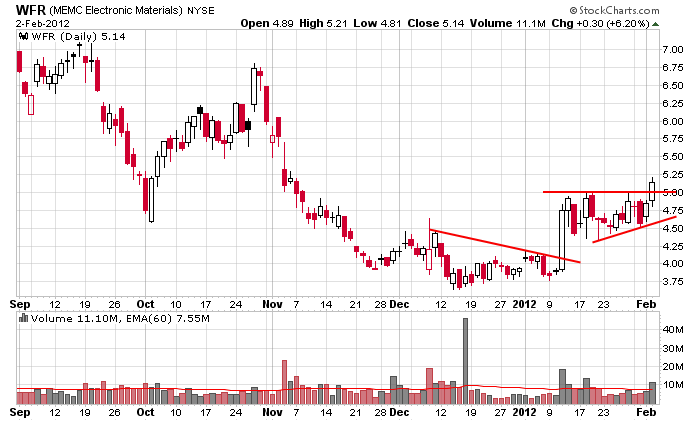

Solar has been the single worst group over the last two years, but in the near term, many of the stocks have perked up and are offering very good trading opportunities.

0 thoughts on “Solar Stocks”

Leave a Reply

You must be logged in to post a comment.

Before you even think about trading solar you need to understand the current state of affairs in the US and Europe.

~ Estimated module inventory world wide is still over 60+ giga watts. Estimated installations in 2012 should be around 30 to 34 giga watts.

~ The SolarWorld anti dumpcase against the chinese will tax importers retroactive to Dec 3, 2011 in the US. I think the the counter vailing duties are 30%. I’m sure the EU will follow the US.

~ Still to many module manufacturer’s in the market, they will continue to dump their products driving prices lower in 2012. PV module makers won’t turn a profit.

~ Cell/wafer printers will struggle to make a profit.

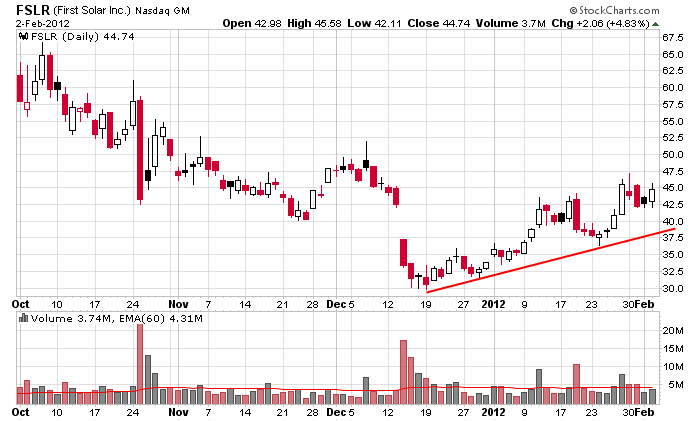

~ FSLR being in the TF technology will survive, they are the low cost leader; however, PV continues to put price pressure on them.

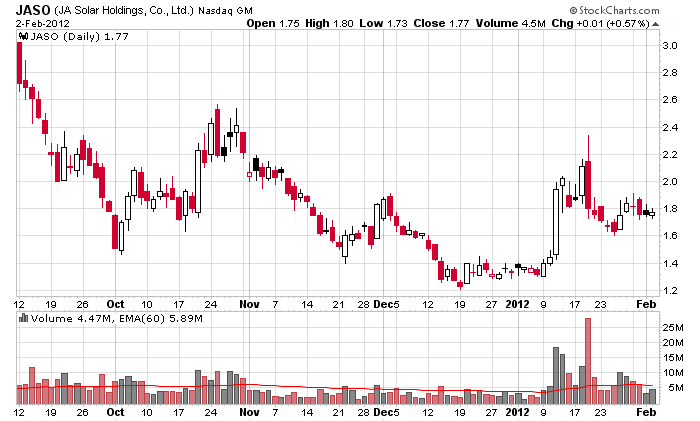

I already bagged and tagged a 37+% long trade in JASO.

If you’re a trader then I wouldn’t be opening any long positions at these prices, wait for a pull back, make sure the price holds and doesn’t make a new low, then go long when they start to move up again.

Thanks for the comments Aaron. Yep this are nothing more than quick trades. The entire group has sucked for a couple years.