Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China and Hong Kong rallied 2%. Australia, Indonesia, South Korea and Taiwan gained more than 1%. Europe is currently mixed. There are no 1% movers. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil and Copper are down. Gold and silver are flat.

Yesterday the Nas and Russell made higher highs while the Dow and S&P did not. The divergence means little on a very short term basis but can’t persist for long if the trend is to continue.

As the market grinds higher, I’m finding myself having less and less to talk about because nothing seems to effect the price action. When indicators get ignored, the character of the market is changing…that’s what been happening. Overbought is staying overbought, and those who guess tops or are in denial and aren’t long aren’t happy right now. Sometimes you gotta lower your guard and not think too much.

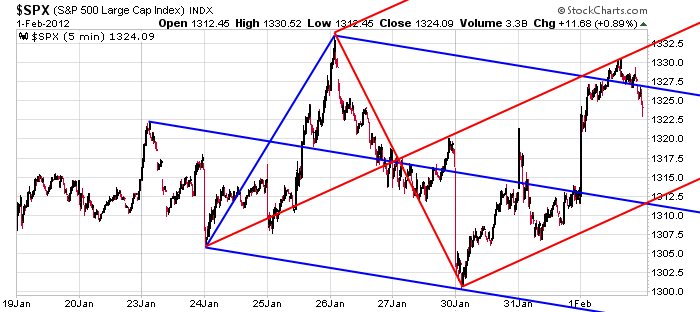

Here’s the 5-min SPX chart I posted two days ago. The red median line set is proving to be significant, so until it stops working, I’ll continue to watch for the price action to turn at the lines or at sliding parallels.

I’ll have more to say after the open. Right now I’m drawing a blank.

Employment numbers come out tomorrow before the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 2)”

Leave a Reply

You must be logged in to post a comment.

grind-hind-bind

round-sound–top top

four bore

zero oh dear oh

Price pays

feathering out nflx gmcr qcom sina

out IRE

indices are are and always have been ‘bleeped’ up

still a stock pickers mrkt

not for the lazy

good luck

Yep…if you follow the indexes, you’ll be mislead many. Look under the hood…lots of stocks moving favorably.

ZNGA FB(face book) sympathy play

will be interesting how FB fares when it ipos

chinese social ntwk stocks also worth watching yoku renn etc

Leaders showing signs of hesitation / weakness. May be a time to take profits if you entered late. bernanke may have some impact today.

looks like uncle ben handled himself well today, essentially in his modest polite professorial way-

– we the fed are here to help pump it up

– you congress are a bunch of bleeping bleep heads, stop the political grand stand nonsense

– it doesnt matter if they were red or blue, the prior admins bleeped us up, theres bills to pay and there is only one way out, now suck on our big QE, its getting bigger.

of course, congress needs to validate its existence and will exercise its political due process – get ready for a pullback.

many stocks are forming good basing patterns, cup of a c&h, rounding base, flat base etc. look for a pullback to enter on fundamentally & technically strong stocks.

in the mean time you can short term swing trade and if the pattern fails you know what to do.

best of luck

An example is HAIN

broke out of its handle on monday. blasting off today. wait for the pull back.

look at the wkly chart –

formed and broke out of a mjr flag in late oct.

formed the cup into dec

formed the handle into jan.

there are more.

put in the work, think for yourself, avoid the day trading talk & music video shows, i really care about you charlatans and other bleep heads. find serious hard working traders of similar profile and work collaboratively.

also shun the smug the fed is bad or the mrkt is manipulated mrkt dilettante idiots. like the useless slacker in the office who complains about the management, they go no where and only eat up your time and focus. or if youre a sucker and paying for that nonsense, you know what to do right away.

the essential pt is to make money, keep it and compound it.

well Raymond ,imo u have to look at all things and motives

esp the internals

if the strong stocks fail can the weak take over

it gets to a liquidity problem of sum gain–if the mutuals or the invisable hand stop buying

will the hedgies take over

seems to me this go nowhere market world wide is doomed for failure—BIGTIME

imo this is a distribution –roll over –rounding top

why is the ftse–dax n225 -spx-dji all being held a current levels –now for weeks

dont be folled into being a bull or bear—-be a daytrader

markets dont have to go up to make money

best money is on the downside

Best way to make money is on the side of the trend.

Some trade math, basic arithmetic really –

A stock rises from 10 to 20, 100% gain

The stock drops from 20 to 10, 50% gain

Pay attention to the %, thats where the big money is.

There are a few more basic trader math to consider and master.

I do day trade, but only for protection, opportunistic profits. The big money is in the swing, the longer swings.

as for reading hidden motives and true intent. none of us dumb money (retail traders) will ever know the truth. what we can do is look at historical mrkt and stock behavior and play the odds. its good to be a little paranoid, but too much means we have not done our homework, are not confident. when you feel the cajones suck up into their pockets, its time to stand aside.

some stuff that is out on the net is pure myth or sales bs for suckers to pay for the ‘magic sauce’ of trading. others have persistent and validated performance. the shrewd and successful trader is able to get past the crowd bs and his / her own bs and determine with decisive focus what works and what does not and when it does and when it does not.

😉

it all comes down to hard work and as dr kacher has said – insane focus.

not there yet, got the insane part, focus getting better. 😉

i follow the hedgies–market makers—-they sure leave foot prints

not the long only mutuals that are always fond on the wrong side in disbeleif

when a down comes

the VIX will tell us when to short the market as the markets are really run by the market maker hedgie big banks—follow their footprints

yeilds to bonds-currencies to shares

PeteM – did you get stopped out? This sideways action leads me to believe we have more upside in the current wave.

Brian – I’ve been out all day on appointments and just got back. I’m entering a breakeven stop at 1328 into the close. If not filled, I’ll stay short into tomorrow’s open.

I’m still short with a stop just above yesterday’s high.

YOKU BIDU moving per schedule, fake em shake em out, collect more float, move up take the weak hands money.

another trade to consider BOIL ultra long UNG nat gas. thin but the vol in ung will support the move. closed 2nd pull on KOLD ultra short UNG today.

but do your own dd.

it would be nice for someone else to share their trades / ideas.

some potential mrkt moving numbers tomorrow before the open.

Best of luck.