Good morning. Happy Wednesday.

So we had a massive down day Monday and a pretty good up day yesterday. I have no problem admitting I don’t know what comes next.

Word is the document circulating trading desks Monday morning which played a big role causing the selling pressure was bogus – totally fabricated. If that’s the case, can the day be ignored? Can we look at a chart and give any credence to the technical damage done? I’m not sure. Despite the reason for the selling pressure, it still happened, and it has the same psychological effect. And all the warning signs still exit: namely the proximity to resistance, 6 consecutive up weeks on declining volume and narrowing ranges, many unfilled gaps below, and more. So even if the selling pressure was due to a bogus report, it was due to happen anyways.

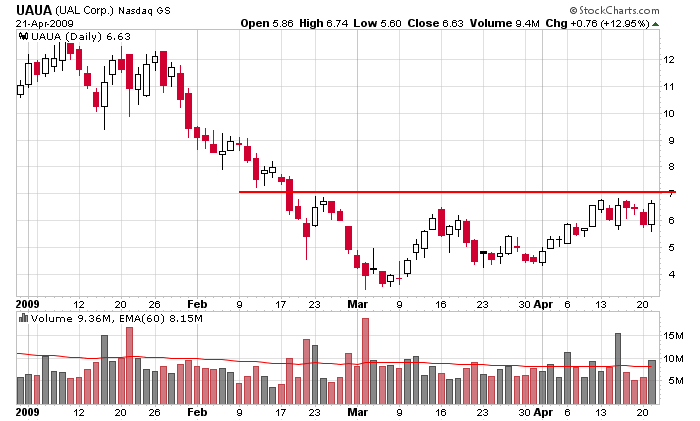

I’m in cash. I scaled out late last week, and if you held partial positions into this new week, you were out early Monday morning. Day trading is fine, but from a swing trading standpoint, I don’t see many high probability set ups. If anything I lean to the downside, but if SPX 875 is taken out, I’d cover. UAUA is an example of a set up that looks good (see below), but until the indexes show me their cards, I don’t think being aggressive in either direction is a good idea.

The market will gap down at today’s open. Resolution is coming soon. If the indexes can move sideways for the rest of the week, I’ll say it did a nice job shrugging off Monday’s selling and it would be nicely positioned to breakout. But if it moves down, we’ll know the technical damage caused by Monday’s selling is the most dominant force right now.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases