Good morning. Happy Thursday.

As of an hour before yesterday’s close, it looked like the market was going to shrug off Monday’s intense sell-off, but then the floor got pulled out. The SPX fell 20 points in 60 minutes and closed at its LOD. Now we’re going to get a gap up open that recaptures half the late-day losses, but the overall environment remains cloudy. Perhaps we shouldn’t be surprised. With resistance overhead and lots of warnings signs – not to mention the heart of earnings season – traders aren’t sure what comes next. A breakout followed by a parabolic move up that cripples the shorts or a slow deterioration of buying from the bulls that eventually leads to a stiff sell-off. Until the market makes up its mind, I’m not placing big bets. No swing trades for me right now. Just day trades.

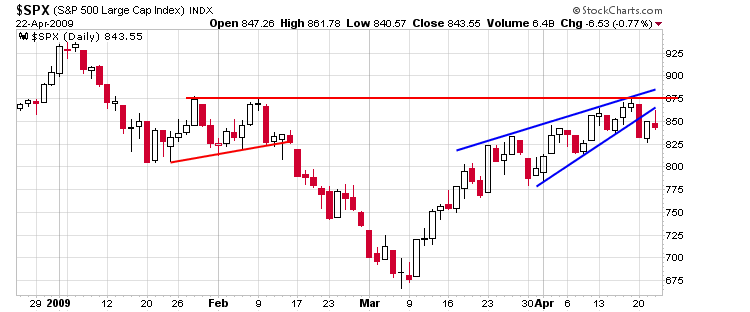

Here’s the daily SPX. Resistance at 875 has held, and yeah, the rising wedge resolved down. But we’ve had 9 complete days with price staying between 825 and 875. That’s consolidation. The market is either setting up for a breakout or building a top of the rally.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases