Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. Australia and Japan moved up more than 1%; Indonesia moved down 1%. Europe is currently down across the board, but there are no 1% losers. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

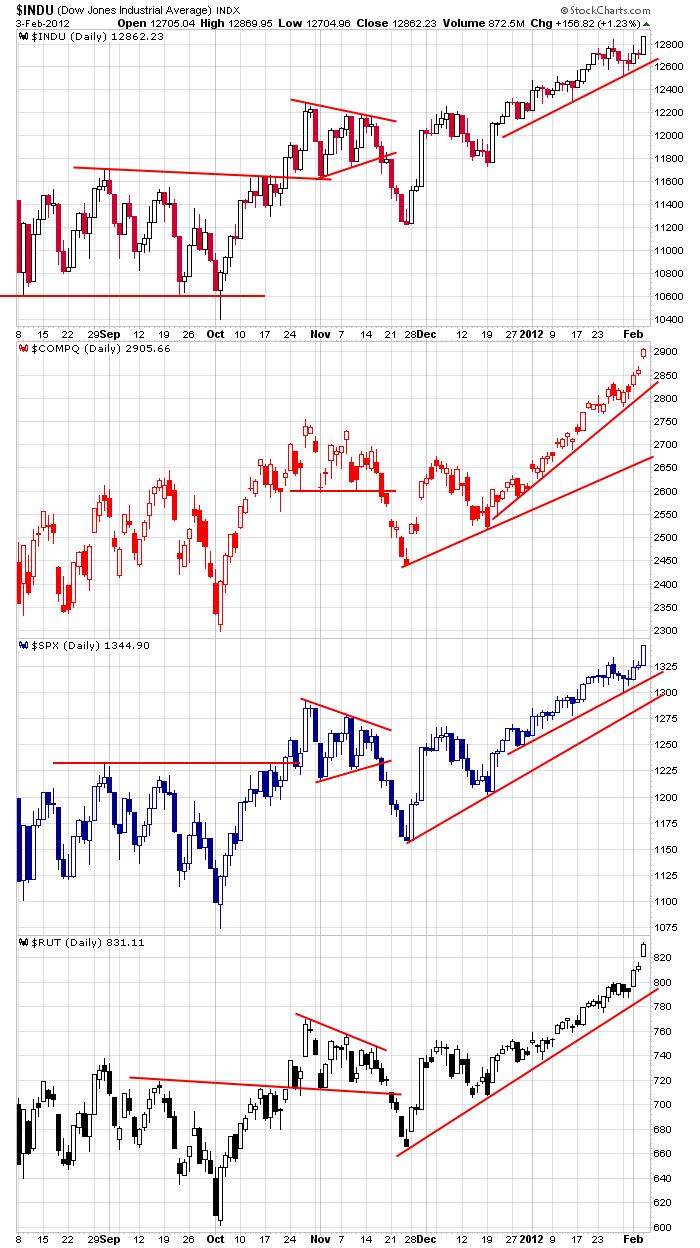

Last week was a good one. All the indexes moved up and closed at their highs. The Dow and S&P continue their steady climb; the Nas and Russell want to go parabolic.

A couple indicators have been completely ignored. This tells me the up and down range that characterized the market in 2011 is changing (when the indicators stop working, something is different). A couple more indicators that I discussed over the weekend have popped up. We’ll see how the market does in the near, but regardless of what happens in the next couple days and this entire week, the trend is strong and whatever correction that materializes should get bought up. The market has a mind of its own right now. It won’t go up forever, but it’s very likely to continue up in the intermediate term.

Here are the dailies. Don’t fight this. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 6)”

Leave a Reply

You must be logged in to post a comment.

dji—-double tops in bull markets seldom work

double bottoms in bears seldom work

take ur choice–bull or bear

today im sceptically cautiouse

Was bound to happen, too much chatter about the golden cross, usually means profit taking.

Should see by mid week if this is a minor pullback (my bias) or something more.

Good luck.

bulls are stubborn

1/2 out 5th pull on BVSN, may go higher

BOIL still ww (worth watching)

FIO may be setting up again

others still strong, setting up

Explanation of FIO recovery trade

– support at dec 19

– vol spike last thurs

– completion of dbbl bttm today

still a volatile trade, lots of challenges on fundamentals, pe eps etc etc. the more useless bleep heads on the web and tv yap negatively or smugly about it the more bullish.

new technology, participation of tech giants, recent ipo tied to cloud, storage / speed requirements for more junk on the net.

but do your own dd.

how about some participation / collaboration. patience is running out.

break up above thurs close on UNG will be key for BOIL

ung does not correlate to eqtys, there are some fundamentals and seasonal influences at work. do your own dd.

and contribute.

BOIL continues to sneak up. stay away if you dont like volatility. may take a few more days to print a solid support and trend change.

Jason,

I enjoy your Chartbook. I use it regularly to analyse the 108 industries for market direction. Currently, 74 are bullish; 30 are neutral; and only 3 are bearish. In Oct. 19 were bullish; 20 were neutral; and 69 bearish. …a remarkable shift.

But we all make errors. In your SECTORS (Industries) part of your Chartbook you have $DJUSCG for Travel/Leisure when that is for Cyclical Goods and no symbol for Travel/Leisure.

Please make the correction whenever you get a chance. Thanks for all you do.

Thanks will do.

Kent…actually in stockcharts.com, DJUSCG is Travel & Leisure. Where do you see different?

S&P Mar Futures screen shot is here:

http://gallery.me.com/cmcmurry/100089

Looks like an ending diagonal to me.

MGA trade noted a few wks ago, consider taking some profit. 1/2 out $7k booked. looks to stall pull back.

Herd behaviour in DRYS EXM NBG are indicating a soon to be announced resolution of the Greek crisis entertainment. Could be just short covering, could be something more.

Next show for suckers – Portugal, Italy or some other unfortunate target for the latest gang raping by the mrkt gurus and media bleep heads … Gartman, Mauldin, pick your bleep head.

Played DRYS over the last two years. In at 3.50 then out at 6.10

Back in at 3.50 and now riding it down. Expect it to rise with oil.

Thanks for your posting. I’m still fairly new at this and don’t have a lot to add to the site.

I have to agree with Raymond’s early morning comments regarding a bias for a minor pullback. Lots of bullish chatter over the weekend argues for at least a few days of pullback. So far today, everything seems orderly on the downside.

I’d have to see some downward acceleration in late trading to think SPX has finally completed wave 3 of C and things are setting up for a test of 1300ish or a little deeper as wave 4 unfolds. But, until I see that, it may be that wave 3 completed at 1333 and wave 4 ended with a .382 correction at 1300. If that’s the case, we’re already in wave 5 and any pullback could find support around 1318-1321 or higher and then we take off again. Either way, the dominate trend is up and 1375+/- remains the target for wave 5 of C, IMO.

OK, your target of 1375 would make 5 equal 1 if my count matches yours.

the best buy of day——the VIX

the fix is in

Staying long, but looking for the pull back.

Anyone wishing to collaborate but reserved about posting trades, watch lists you can contact me via the Finviz.com mail system –

http://finviz.com/collaborate_profile.ashx?uid=14893695

Should be someone of similar profile, full time trader. Not interested in scams, mentoring or other nonsense.

I am no longer a paid use and only use part of the free features.

This has nothing to do with TA, but some may find it of interest. I’m a huge admirer of John Hussman (www.hussman.com) and I think you’ll find his latest “Weekly Market Comment” article of some value. In particular, read the last sentence in reference to FRI’s non farm payroll number. He deals with the details of the number earlier in the article.

My point? In terms of price, stocks may have further to rise (SPX 1375 = wave 5 of C?). But in terms of time, perhaps an important turn isn’t that far away. Until then – price, as always, is all that counts from a trading point of view, that is.

Wait for a spike in the VXN. Then get ready for a correction. Not major but one none the less.