Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed; only China (down 1.7%) moved more than 1%. Europe is currently down across-the-board; Austria and Germany are down more than 1%. Futures here in the States point towards a negative open for the cash market.

The dollar is up slightly. Oil and Copper are down. Gold and silver are down.

The market’s movement over the last couple days has been no different than the last two months…a gap followed by a tight range for 2 days…then another gap followed by another tight range for 2 days. Most of the gains take place via an opening gap and then little intraday movement takes place. This type of action has favored swing traders who enter and hold. The day to day action isn’t always pretty, but the net change over a couple weeks is very favorable.

My stance remains the same. I’m cautiously bullish in the near term and bullish in the intermediate term. Why the market keeps going up week after week is not something I care about. It is and I’m going to keep riding it. When it turns I’ll given back some profits. Oh well, it’s a small price for riding a 2+ month trend.

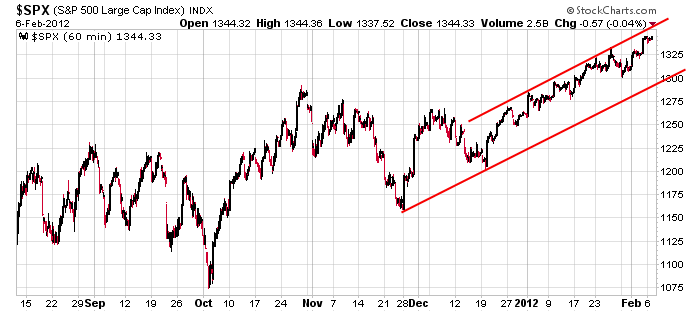

Here’s the 60-min SPX chart. If the market does correct, 1300 is a level I’ll key on.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 7)”

Leave a Reply

You must be logged in to post a comment.

volitility

Jason’s focus on SPX 1300 coincides with the daily chart pivot point (courtesy of stockcharts.com)at 1301.58. I note R2 resistance is 1376 (wave 5 of C target)and S1 support is 1269 (a break of 1267 calls the uptrend into question).

I’m watching 1328-1331 as potential downside support if SPX is already in wave 5 (assuming wave 4 ended at 1300). So far (at today’s intraday 1337ish low), it’s been a 3 wave decline since FRI’s high, IMO.

I appreciate your perspective. I’m beginning to doubt 4 has ended. This is behaving like a ‘b’ wave. ‘c’ of 4 may be just ahead. I just can’t get a good count if 5 has begun. Again, this highlights the difficulty in EW evaluation in real time.

PeteM, I’ve got 4 point contact on the upper boundary of an ending diagonal. Check out this chart and give me your opinion about the converging aspect of this move. Here it is: http://gallery.me.com/cmcmurry#100089

A “Swing Trader” that buys and holds would be a badger. They have rather short, fat bodies, with short legs built for digging out undervalued stocks. Their ears are small, and they have elongated point and figure weasel-like heads, their tails vary in length, the stink badger has a very short tail, while the ferret badger’s tail can be 18 to 20 ticks long.

im a short now daytrader

dont know how long i will stay in this condition

I’m going to short the close.

with dow and ndx making new 08 highs can the spx put up with its non confirmation

can some of the world be in new 09 wave 2 highs whilst some are still in wave 2 of 3

is this like the 07 then 08 highes with the marginal new high

Reaction to earnings both ok and good is showing the mrkt is getting more selective. But the move is towards growth and recovery stocks.

All techno-fundamental and pure technical plays with earnings

Down and giving back in after mrkt DIS PNRA both have had good runs. Believe there is more left.

Up and still holding up in after mrkt CERN BWLD GRPN, others, may meet my semi-annual target early.

Potentially setting up again for add in / re-entry

IRE

ZNGA

FSLR

YOKU

BIDU

FIO, now questionable but still ww.

AAPL NFLX, others still strong.

When leaders start to roll over hard with no bounce, no new leaders appear thats the time to get really concerned.