Good morning. Happy Friday.

It’s be a challenging week for swing trades. Monday began with the SPX near resistance with many warnings signs the market needed a rest, so although the trend was up, we had already shifted into conservative mode. Hence my trades this week have been day trades or 1-day trades. Monday was an intense down day; Tuesday a solid up day; Wednesday a pretty good up day until the last hour when the floor got pulled out; and yesterday was sluggish but in the end turned out ok.

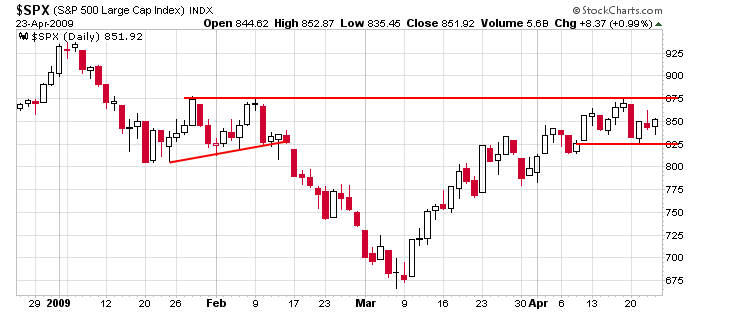

Here’s the daily SPX chart. Overall I’d classify the action as consolidation below stiff resistance. From a charting standpoint, there’s nothing wrong with the action. This doesn’t mean we’ll definitely blast off to higher levels (nothing is definite); it just means the trend has neutralized, and move in either direction is getting to be equally likely.

The SPX is down about 18 points on the week. Barring a massive sell-off, is it of great concern for the index to drop a few points given the last 6 weeks have been up? I’m not overly concerned, but again, that doesn’t mean I’m positioning myself for a breakout, it just means I’m not going to jump in the bear’s camp just because we have one down week.

I’m in cash right now and will be in cash at the end of the day.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases