Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down; Hong Kong, Indonesia and South Korea dropped more than 1%. Europe is currently down across the board; Austria is down almost 3%, Belgium, France, Germany, Amsterdam, Stockholm and Switzerland are down more than 1%. Futures here in the States point towards a sizeable gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

Everyday this week the market has been weak early (either via an opening gap down or an intraday sell-off), and everyday the market has V bottomed and rallied to recapture the losses and close near its highs. Is the market correcting with a series of mini thrusts down instead of an actual pullback? Maybe. Pressure seems to be building – pressure that typically leads to a blow-off top of quick sell-off – but each of these mini thrusts acts to difuse a little pressure.

I said yesterday at the end of the day today would be important. Who would flinch first? Would the bears throw in the towel and cover in total frustration or would the bulls want to take profits ahead of the weekend? This was the technical situation, but with Greece’s bailout not yet finalized, premarket futures are not letting the natural forces of supply and demand play out.

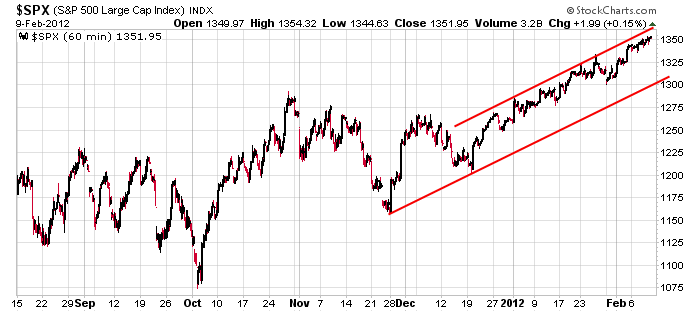

Here’s the 60-min SPX chart. If the market really did want to correct, a drop all the way to 1300 would not destroy the up-slopping channel.

I remain cautiously bullish in the near term and bullish in the intermediate term. But I’m a trader. I’m always looking to sell laggards or when my targets are hit to free up cash for new positions. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 10)”

Leave a Reply

You must be logged in to post a comment.

Time to be more defensive and very selective.

Should have kept my TVIX, thats trading.

“A drop all the way to 1350” isnt that a typo ?

yep, should be 1300

This may last a few days. If late to the long game dont listen to some ‘pro’ investment adviser idiot and ride your positions down go to a safe state.

Best of luck

good advice ,Raymond

do u only trade to the long side and do u use leverage

I trade both sides.But my focus is the long side, better odds for big gains.

I use leverage in my margin accts and the ultras in my retirement accts.

I am Cdn but lived and worked internationally so I can play (& get bleeped) on both sides of the border. My preference is US stocks and ETFs, I think Cdn stocks and exchanges are still inefficient and more bleeped up than on the US side, hang over from the time of the brits – the POME effect, you skippies know what I mean.

Thanks Raymond

when analysing ones comments its handy to know ones style and time frames

Aussie market dead with little volitility,but at least i know the oz stocks

and back in the good old days of the 2004-7 bull i traded like u

up to 20 commodity stocks at a time,flicking back and forward between charts and making heaps

And BIDU keeps rocking

ESH2: The EUR/USD don’t appear to be that excited. I predict this test of 1339 will fail.

ESH2: The EUR/USD is forming a bear pennant.

money leaving euro ahead of sundays greece parlimentary vote

Yep, looks like doom and gloom for Greece. I wonder if EU is interested in selling it. By the looks of the riots it would be a fire sale. Oh, that was bad.

lets buy a greak island

I’m in. Something on the North West coast unless you speak Turkish.

Everyone likes a story – 3 items

Annual chinese new yr bznss interruption / economy is doubtful cluster bleep

Euro big boys really want greece to leave, just do it quietly

Settlement of abusive foreclosure by the big banks esp BAC

Keep looking under the hood. Hunt and eat the alphas. Heed for but dont get lost by the indices. Same smug useless bleep heads that provides ratings put together the indices.

beat drums in the east attack from the west

make money, keep it, compound it

best of luck

Darn! Pennant failing.

Hey Aussie! What do you get when you mate a giraffe with a kangaroo? A stock with a long nick, long tail that jumps around a lot. Jittery market. Oh well, I think I’ll put this short on autopilot.

LOL—you get a camel that jumps

Taking some profit LNKD

For those that trade ETFs, SOCL but very thin. ZNGA profiles it.

Inclined to take more profit into the close.

Mrkt action after Euro close in 2-2.5 hrs and last 30min will be key.

the vix tells the story

time to trap the bulls

My feed doesn’t give volume on the VIX. That Feb dip looks bullish, but what’s the volume? Is there a VIX ETF?

dont know –use a opt

Time go do some skiing, good luck.

Which mountain?

ES: Looks like buying. Now why would Jason be buying this close to the closing bell on a Friday?