Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

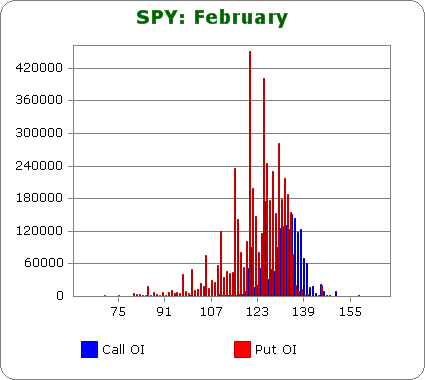

SPY (closed 135.36)

Puts out-number calls 2.5-to-1.0 – about the same as last month.

Call OI is highest at 126 and between 131 and 138.

Put OI is highest at 110, 115, 116 and between 119 and 134.

There’s overlap in the low 130’s, but since puts far exceed calls, let’s focus on the puts. A close near 134 or above would cause most put options to expire worthless. With today’s close at 135.36, SPY is already positioned to accomplish this. Any higher than this would give call buyers additional profits, so flat or slightly down trading the rest of the week is needed.

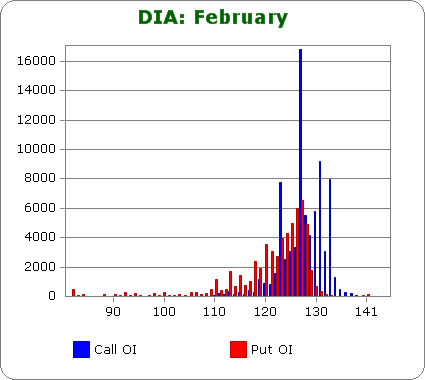

DIA (closed 128.59)

Puts out-number calls 1.2-to-1.0 – the same as last month.

Call OI is highest 123, 127, 130, 131 and 133.

Put OI is steady between 120 and 128.

There’s a big call spike at 127 and relatively high put open-interest on both sides of the strike. A close at 127 would close almost all the put options worthless and all but the lower-striked call options (there’s a spike at 123) worthless too. Today’s close was at 128.59, so a small move down is needed.

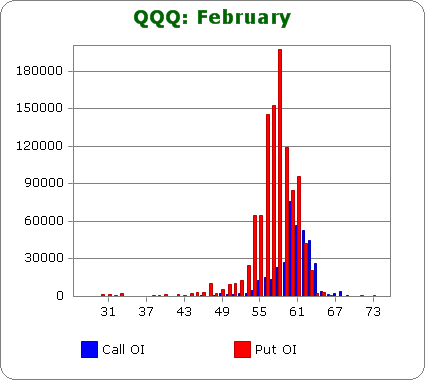

QQQ (closed 63.05)

Puts out-number calls 2.1-to-1.0 – more bearish than last month.

Call OI is highest between 60 and 63.

Put OI is highest between 54 and 62.

There’s some overlap between 60 and 62, but since puts dominate, let’s focus on those. A close near the top of the high-open-interest range would close most puts worthless. QQQ closed at 63.05 today – exactly where it needs to be, so flat trading is needed if indeed the market wished to close most options worthless.

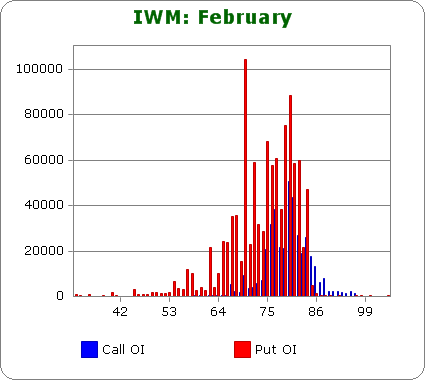

IWM (closed 82.32)

Puts out-number calls 2.8-to-1.0 – more bearish than last month.

Call OI is highest at 76, 77 and 80, 81.

Put OI is highest between 65 and 82.

Since puts dominate, we’ll want a close near the top of the put OI range, but we don’t want a close much higher than that. IWM closed at 82.32 today – a very good level. Flat trading would cause lots of pain. A move up would also cause lots of pain but would allow some call buyers to make money.

Overall Conclusion: The bears upped their bets on a market correction, and barring a massive sell-off the next couple days, they’ll lose again. The option activity for SPY and DIA was about the same as last month, but QQQ and IWM experienced elevated bearishness. The sum of the above numbers tells me the market is already positioned to cause max pain, or close to max pain, so flat trading the rest of the week would be just fine.