Good morning. Happy Tuesday.

The Asian/Pacific markets closed mxied; there were no 1% movers. Europe is currently mixed; there are no 1% movers there either. Futures here in the States point towards a flat-to-slightly down open for the cash market.

The dollar is up (third straight day). Oil is up, copper is down. Gold and silver are down.

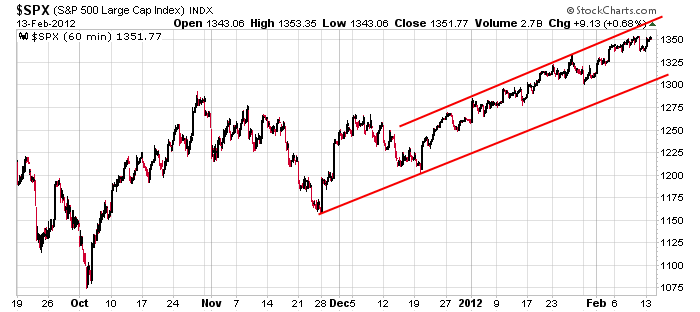

Last Friday the market dropped because of hiccups with the Greece bailout. Yesterday it was up because those hiccups were overcome. It was nice to see the small caps lead and AAPL climb above 500, but all the warning signs I talked about over the weekend remain in place. From a technical standpoint the market should at least rest to allow the indicators to cycle down and then give new buy signals. Perferably we’d get a 1-2 week pullback to allow the charts to reset and set up another round of breakouts. But the market hasn’t been acting from a technical standpoint. There seems to be an invisible hand keeping it propped up. I’m not a conspiracy theorist, but it’s not normal for the market to keep going and going and going without taking a break. This is not how markets typically work – healthy or not. Here’s the 60-min SPX chart.

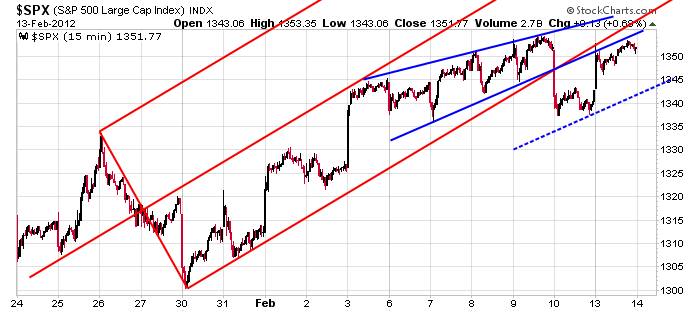

Here’s a chart I was working off of going into yesterday. The S&P was rejected by two different trendlines and then drifted. My upside targets are those same trendlines. My downside target is the blue dotted line which I just drew parallel to the blue trendline which has acted as support and resistance.

I remain in defensive mode. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 14)”

Leave a Reply

You must be logged in to post a comment.

when the markets go sideways (chops), i look for darvas (growth / momentum) stocks – n. darvas

if you cant use lobbying, bleep the bleep out of em with the illiquidity threat

http://finance.yahoo.com/news/volcker-stands-namesake-rule-050100332.html

and this too will pass, until then, some potential chop

we are the bastion of pure capitalism, the gate keepers of fair markets, you cant take prop trading away from us.

yeah, right. now that you’ve been kicked to the ground, just hold still while we stomp on your throat

😉

dang ww

wtw reports after mrkt, but still worth watching

Lets see what housing does this week and AA does at $10.

From an EW perspective, the major indexes seem to pose differing stages in the count off of their repective OCT lows, IMO. In each index, I see a wave C in progress. INDU seems to have completed wave 3 of C and is now in a wave 4 consolidation stage. SPX, RUT and COMPQ are not clear as to wether wave 3 has completed. Regarding SPX, the 10 & 20 day EMAs at 1341ish & 1328ish respectively along with the trendline connecting the OCT & DEC lows should provide support in a wave 4 correction.

It’s only a feeling on my part, but I’m thinking wave 5 will grind upward in an ending diagonal to it’s 1365-1375 target, reflecting decreasing momentum and potential divergences. If you think cycles are valid in technical analysis, the time frame for a potential top may be late FEB/early MAR – a few weeks away.

A point of clarification – last week you asked me about TGH. Perhaps it was in reference to one of my quips.

According to Ken Fisher TGH (The Great Humiliator) is the true name of the markets.

Thanks! I thought you were referring to a stock symbol and that was the basis of my technical analysis and the questions that followed.

While the indices, esp the spx (put together & maintained by the same charlatans and idiots of rating agency fame) waffles, the alphas keep rocking

BIDU

RAX

KORS

etc

etc

Trading is not easy, it does not reward the lazy or stupid. Put in the work, you will be rewarded.

And fortune and wealth favors the bold.

And ZNGA breaks out of its consolidation. Careful, earnings tonight.

But fortune favors the bold.

Careful, coming to trend line breakdown levels

Out 1/2 TVIX DUST FAZ

Still net long, stay with the alphas not the has beens.

BAC may be a good short

Raymond, Are you saying Rising trend lines breaking down, but you are selling FAZ ??

With extremely volatile instruments you need to use smaller positions and a shorter hold time.

If you are bold and confident of your analysis and have the acct reserves, then you can max out, even use margin. But take profits quickly, get off margin, eliminate too high an exposure.

And you should not be shorting on the basis of an opinion esp as yapped about by economists, publicly available fundamentals only or technicals only analysts and other idiots. You will confuse trading with investing (I screwed up but I wont swallow my pride, limit my losses, Im a long term holder, yup)

Basic rule – make money, keep it, compound it, repeat.

watch the last 30m if you intend to hold ultra shorts overnight. only 1/4 posns left in tvix & faz. full load still in dust.

met my qtrly target today. if i dont screw up on my wtw & znga into earnings i get a bump up into 4x a week reward plus a treat (you married guys know what i mean) 😉

all shorts dumped

The ultra shorts are firstly day trades. They can develop into swing trades, you have to be able to stomach the volatility swings.

They have a nasty caveat – something along the lines of we change the ETF based on daily changes. Meaning – we get to really bleep you if you hold overnight and you are wrong.

Once the potential for a strong down trend develops they can be swing trades. Shorting is more difficult than going long, esp with the ultra shorts.

There is a potential pullback threat but it has not been confirmed. Its always good to trade with a bit of paranoia but always with aggressive and decisive execution.

tvix closed the gap, another 1/4 out

LMT ww on next pullback. Broke all time highs. Weapons systems for hunting and killing terrorists – love those companies!

amzn

dang pcln pick your entry

UNG BOIL will likely confirm the trend change tomorrow

but do your own dd

same goes for GASL. did not mention before, thinly traded.

but do your dd.

how about some contribution of trade ideas?

added back into wtw in after mrkt, big buy back program announced.

selling some znga.

i get my 4x a wk upgrade and treats. gonna be a great valentines night date.

next target for wtw after some chop, 88+

need a pullback in the mrkts.