Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board. Hong Kong, Japan and India rallied 2%; China, South Korea and Taiwan moved up better than 1%. Europe is currently up across the board. Austria, Germany and Stockholm are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil is up. Copper is down. Gold and silver are up.

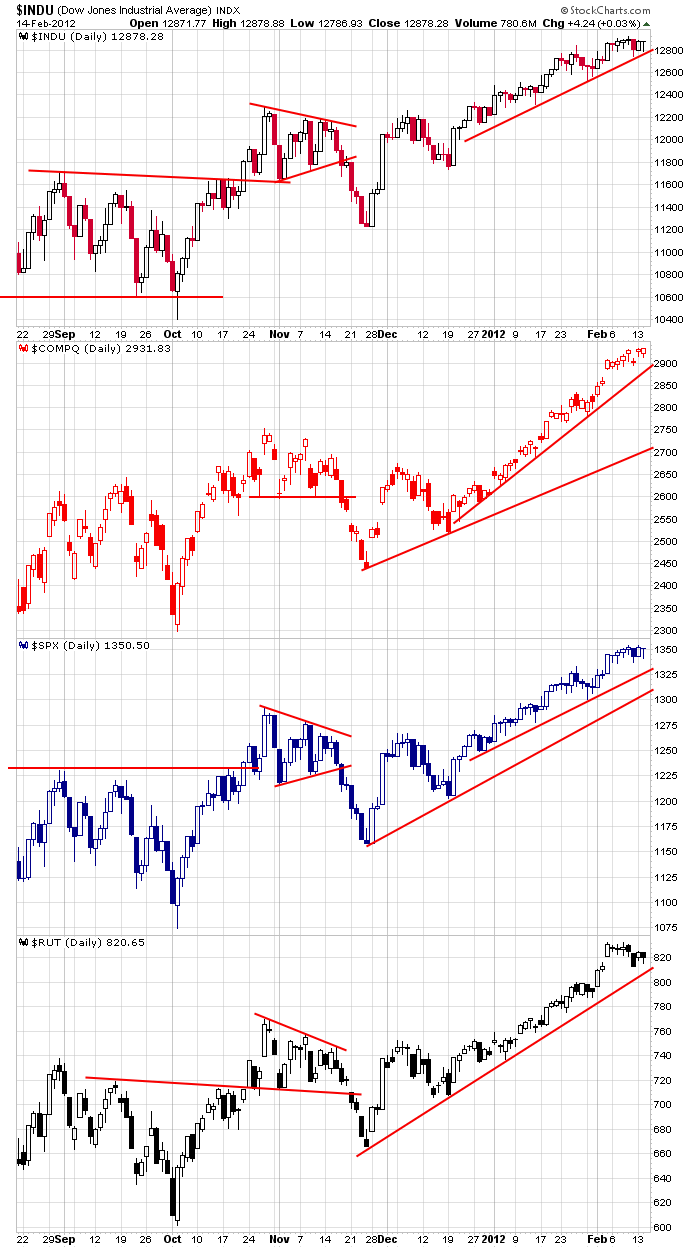

Here are the daily index charts. Although the market suffered its biggest down day of the year last Friday, and yesterday the market was weak most of the day, these charts look rock solid. The only notable is the slight under performance of the Russell small caps recently. The small caps do tend to lead the market is both directions, so it’s worth keeping an eye on. Otherwise the trend is solid.

I don’t mean to sound like a broken record when offering my stance on the market, but nothing has changed to force me to change. The trend is up, so the only direction I’m interested in playing is the long side. For many reasons, a pause or correction that would allow the indicators to cycle down is due. So in the near term I’m cautiously bullish. The bullish part means I only want to be long. The cautious part means I’m doing less trades and using smaller sizes, and with some, I’m being quicker to take profits. In the intermediate term, I’m bullish. If a correction plays out, I’d expect it to get bought and new highs to be made. In the long term, I have no clue. I don’t have a crystal ball. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 15)”

Leave a Reply

You must be logged in to post a comment.

Thanks, it is more of the same. The news from EU remains a mess, but may get lost in the election year rush in the US. The tax extension seems to be gas in the tank up til it not.

lol–dow 15000..?

I went long the US$ March contract, DXH12, at 79.48 yesterday morning. Resistance seems formidable at 79.76.

After a parabolic move, AAPL painting a bearish candlestick daily reversal with a long stick. EW showing an impulsive 5 wave decline on a 5 min chart. Several gaps on the hourly/daily charts below 500.

The $ is posing for a pop. I see the 5 waves down in Apple correcting upward right now. Finally showing signs of a crack in the trend??? S&P Mar contract tested the supporting trend line from the 12/19 to 1/30 – tested twice today.

Brian – I think your trendline support intersects around the area of the daily 10 day EMA now at 1343. The 20day EMA intersects with a trendline I’m watching at around 1330. The daily MACD is rolling over and turning slightly negative. All of this I interpret as the possible beginning of wave of 4 of C.

it was at the 1341 & change on the futures contract and breached it about 20 min ago. It is now rallying to test the underside. It has a positive slope so the underside is now around 1342. The next line down is rising and about 1330 now.

Watch Apple’s behavior at ~517.

Brian – you mean 517 = .618 retrace? That’s would be typical of wave 2 bounce (even up to 523. We’ll just have to see.

yes, at 514 it has retrace .5 – we’ll see if this is a serious move soon.

$ got rejected again with decent volume – hum…

There’s some buys in the $ – now looking for some follow through.

Apple gave it up at 50%

A move below 492 in AAPL leaves the door open to 477-480,IMO, especially if we’re in a larger wave 3 downside acceleration phase.

AAPL 495 is now important support to stem the downside action.

PeteM – Apple’s been here before. Look at 6/20/11 – 7/20/11 compared to 11/25/11 – today. Bigger scale. I think today’s low of 496.89 is a tell. Failure to drop below means we get a new high just as it did after 7/20. Then, it’s a perfect storm. Seems to fit with all of my general market counts. But, a little accelerated drop below todays low and confirmed with a cruise past 492 would support for a dismissal of my anticipated larger scale fractal move.

RUT is now trading below its 10day EMA, while other indexes remain above theirs. It shhould be an interesting close.

The fed is smoothing volitility. Slowing every move and dragging them out to avert the global meltdown. They can print money forever

Russ – they (central banks) can and will until they destroy the fiat currency system. In the meantime, they enslave my sons’ generation and I curse them every day.

If you perpetually give away an unlimited supply of money, eventually no one will want it.

i shorted the dji at 12936 –cash cfd price — pre market europe plus shorted ndx at 2601

–the dax was extremly volitile toping before rolling over

perhaps the top is in for this move–dont care –ill trade the reality of the intraday trend with live inds

worrying about any thing else but intraday just makes me miss trades and have a bias target

Long nicks in morn

Bears take warn

Long nicks at night

Bears delight.

The fed thinks they will withdraw the liquidity as things improve. Today auto makers do not look good. Tomorrow we will see about housing and jobs. Its amusing to watch homebuilders go up without copper and AA. I expect to short PHM more when the new housing starts number comes out tomorrow