Good morning. Happy Wednesday. Happy Fed Day.

Today the FOMC announces their ‘target’ for overnight rates which are already under 1% and sets the discount rate. No change is expected, so as has been the case the last few meetings, it’s their statement which will be read and dissected. I consider this a meaningless event, but as always, CNBC will turn it into a 3-ring circus and analyze every single word they say. For me, it’s usually a day off from trading. Sometimes I can jump on a move in the morning and then wait until about 20 min after the 2:15 announcement to see if we get a trend into the close. Here are some daily charts I’m watching.

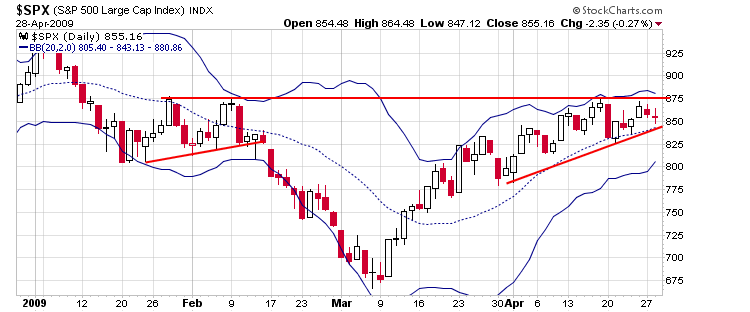

The S&P 500: It’s been trading between its upper and middle Bollinger Band since mid March and is now getting squeezed by converging trendlines. A move above 875 may cause a little squeeze. A move below the middle BB is likely to lead to a test of the lower BB.

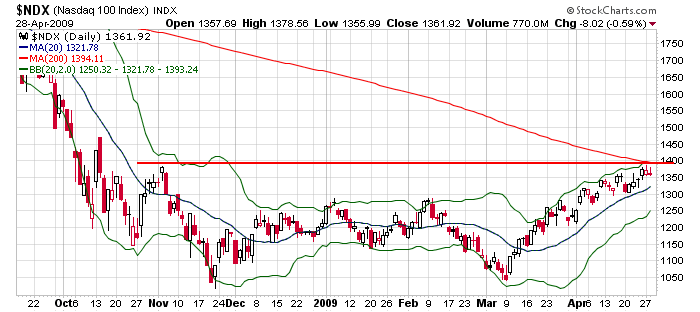

The Nasdaq 100: Similar story. Trading nicely between the upper and middle BB, and potential resistance sits just overhead from the November high and declining 200-day MA. A move could cause the shorts to cover while failure to move up is likely to result in the lower BB being tested.

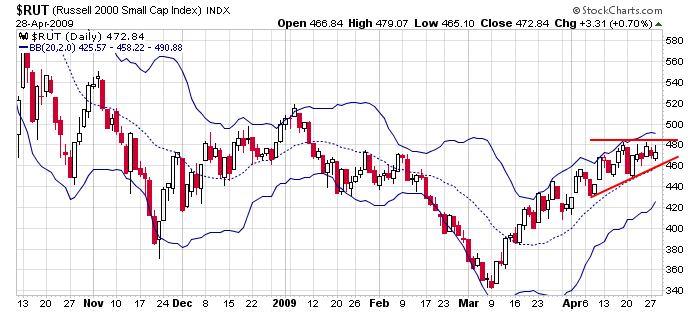

The Russell 2000: It’s consolidating between converging trendlines. A breakout tests the January high. Otherwise the lower BB is likely to be tested.

The worst breakouts are news induced. Let’s hope the FOMC is a nonevent and we get a move based on the natural forces of supply and demand (this is actually impossible considering the government’s heavy involvement).

Until resolution comes, I’m sticking with short term trades.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases