Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Hong Kong and Singapore dropped 2%; Australia and China dropped more than 1%. Europe is down across the board. Austria and Stockholm are down more than 2%; Belgium, France, Germany, Amsterdam, Norway and London are down more than 1%. Futures here in the States point towards a large gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

I stated over the weekend the breadth indicators had to reverse or the market would drop. There was no other way. Yesterday the market dropped (although the small caps eeked out a small gain), and today futures are down a bunch. Divergences can persist in the near term, but they cannot last indefinitely.

The 10-day of the AD line is now below 0; so is the AD volume line. New highs have put in a lower high. Copper couldn’t match the market’s higher high. The semis broke down yesterday. The banks got rejected by a key level. The sum of all this told us to be super careful.

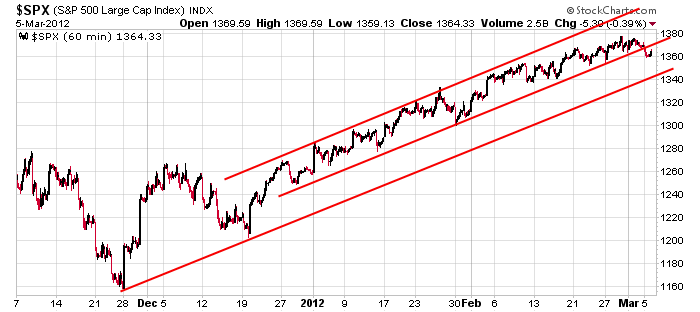

A minor pullback takes the S&P down to 1340ish (see chart below). A pullback this is more than an innocent correction within an uptrend takes the index to 1300.

Don’t be a hero out there. If the market wants to pull back, let it pullback. Don’t stand in its way. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 6)”

Leave a Reply

You must be logged in to post a comment.

Perhaps more concerns with QE flat lining, withdrawal.

Could be busy like Friday close. Best to be defensive but not overly committed to the short side.

Or just stand aside.

Good luck.

net long,

some profit taking in BVSN

looking to add to FIO etc

1/2 out EDZ SQQQ RUSS

maybe some more downside this week. but not all stocks go down or go up together.

looking to buy back / add to fatty stocks in days to come

closed all short etfs

Possible wave 4 targets met

maybe a dip and recovery day but not into possitive bull territory

before a truncated 5

jumbo my pet truncated ellephant told me this

germany dax rules the world and the euro

almost looks to close gaps, but still could be a brk away gap.

best to be patient, alert.

dont think so. germany holds most of the eurotrash debt, they are the euro unions bankers. but unlike banks they can actually create and do something. they are symbiotic parasites ;). i agreee in the sense that mrkts are linked to a great extent. but not all stocks etfs follow the so called general mrkts.

when most do then we need to be concerned and move most of our money to the right side. until then could still be slop & chop.

This looks like a good place to cover.

looks to have more downside on indices, a lot of the leaders are stabilizing – for now.

I agree, more downside, but it’s lunch time and it may mosey up a bit.

It will be interesting if AAPL comes out and announces a big ratio split like BIDU did.

SPX is at important trendline support (connecting late NOV 1158, late DEC 1202 lows on daily chart)in 3rd wave downside action from 1378, IMO. Assuming a bounce off the trendline,it will be key (from an EW perspective) to see if further downside action follows in an eveolving 5 wave downside bearish pattern. If it does, 1297 to 1330 should hold IF this is wave 4 of C. The other alternative (less favored,IMO) is that we’ve already completed wave 5 of C and the rally from OCT low of 1075 has ended with far greater downside potential.

I’ll go with Raymond that, so far, not everything is going down so this is probably wave 4 of C with another leg up (wave 5) to come. There could be a shorter term selling opportunity ahead followed by an intermediate term buying opportunity in SPX, IMO. For now, 1335-1340 looks interesting as potential support near term.

I would not ‘go’ with me. I have a 50-65%ish hit rate.

The idea is to collaborate, test, note and offer insights.

What are your observations and analysis on the sectors, ie – XRT XLP etc?

By the way, while I’m not as familiar with cycles, etc as others, from what I read – MAR is an ideal major turning point for the stock market. Since it fits with my EW analysis, I’m paying attention to it. So, while I favor this pullback as being wave 4 of C, the move down from 1378 (having met my 1375+/- target already) makes it important to observe whether this decline is evolves into a corrective (3 waves) or impulsive (5 waves) pattern.

We are done with the big name earnings season so the short term / late entry traders are taking profit / being shaken out.

Now we should see the real alpha stocks come to the fore or if indeed we are at the end of the presidential cycle, 3 yr avg bull or whatever opinion cycle then we may see something that is more negative.

Seasonality and cycle based trading all seem iffy.

Most of my friends used to use Hirsch & Thackary in Canada, both results in lame to negative returns. Still Hirsch does have some interesting ideas.

As for seasonality trading, on top of the annual seasonality one has to consider and overlay

– the presidential cycle

– the 10 or 14 yr cycle depending on who you subscribe to

The other problem with seasonality is that the seasonal info that is sold does not effectively take into account

– market texture & phase – range bound, trending up or down / accumulation, markup, distribution, mark down

– stock & group life cycles

A very accomplished trader / geek friend has used tradestation metastock and telecharts to run various back tests on the popular EWT, Gann, seasonality and Sam Stovall type sector rotation trades for various market conditions going back to the 1950s. Results are very spotty and needs a lot of situational curve fitting. Not good odds for trading unless you want to keep trades for 2+ yrs. But it seems some investors / traders can make it work, just hard find confirming back up data. And so I am always open to the idea.

This all said we do get a correlation once in a while. Like this recent rally is in keeping with the election year seasonality. But as for timing …..???

Better to research and keep on top of key fundamentals, find the alphas, trend follow, build a short term swing into longer swings for max profit, lock in, get off, do it again.

For short term and low capitalized traders following on the FIO trade careful of a pullback after gap close. It is back testing break out levels imho.

But it is a new alpha, starting to pop up on famous CANSLIM type trade watch / trade lists.

i covered mine to early as their was more downside

the dax and ftse both very large range days at key support and s5 piviot

next 20 mins will tell if we get a bounce or its a exhaustion move

usa markets tend to follow europe into early afternoon

euro at key support/usd at res almost

hard to say if its a bear or a bull—may be just a hairy bull

more shake n bake, slop n chop until we have a resolution. the true alphas move under cover of all bs.

Pump and dump,

scoop the poop

This is how

we make or loot.

Shake n bake,

Slop n chop

Aussie does it

’till he ???? (drops, pops, flops, stops, rocks)

or lose it 😉

Nah, Aussie lives on an island. You can’t lose something on an island.

Raymond – IMO, I think XLE,XLU,XLF,XLB and GLD are in trouble and may have topped. XLP,XLI,XLK and XLV are like SPX, i.e. they may have another leg up to go yet.

SPX appears to be trying to complete a wave 3 of some degree around its trendline support previously mentioned earlier today.

Tanks, general weakness all round.

But take a look on the wkly monthly going back to 2006 do you see any wave based indication in those groups?

Oh yeah, short Clear Channel. I bet the Rush boycott will morph into a Clear Channel boycott. Those ladies are mad.

Now theres a smart fella. If youre going to be a rogue be a charming rogue – women love that. Not a bleeping bleep head moronic rogue. Problem with becoming a lard ass, clogs up the neurons.

The ladies won’t rogue him after this. Going long Bayer. Obama’s throwing punches at him.

Just a thought – if SPX attempts a rally here at mid-day that fails below 1350, we could be setting up for more weakness into the close, coinciding with a wave 5 decline and imply continued downside weakness after an intervening upward bounce.

I am anticipating that in the leaders, after dax close & settlement within 2 hrs

Took a little more off on BVSN. May be nearing a top – for now.

Other leaders setting up. But general mrkt / group weakness.

Added to TTM F

hope the fed lets us do the up and down the rest of the week. where’s sema?

We need China Germany & France to join the QE coolaid doping party.

Somewhat betting on it. For now, defensive and patience.

Mainline it into the Greedy Exuberance artery – that will work ;).

not to worry. greeks can’t sell enough crapsandwich bonds thur, the bernak will turn the firehose back on

Even more weakness watch out

Alphas moving, could be short covering / AAPL excitment – who cares go with it.

If SPX can rally into the close, wave 3 may have ended at today’s 1340 low. Then we can watch the pattern formation of any rally and the reaction if it gets to 1347 or above tomorrow, which is where the broken trendline comes in as well as other resistance.

Pete,i was also thinking a little corrective consolidation tomorrow,based on the very large

rang days for ftse /dax

tomorrow is in a few hours for me so i will see how asia handles it–we had a down day y/day

on china

i need some big red blooded bull the laod up on short

Took some profit on PAY looking to add in future.

Gold miners look to bounce tomorrow.

Next stop “Shake ’em Up” Next stop @13:20, “Shake ’em Up”

copper bounced this morning. fcx bounced mid day. china excuse fabricated to stall commodity inflation. bama mama asking AG to thwart oil traders. maybe they can break their legs hahaha Is that control enough for u?