Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Australia, Malaysia and South Korea dropped 0.9% or more. Europe is currently up across-the-board. Belgium is up 1%; France and Stockholm are up 0.8%. Futures here in the States point towards gap up for the cash market.

The dollar is flat. Oil is up slightly while copper is flat. Gold is up. Silver is flat.

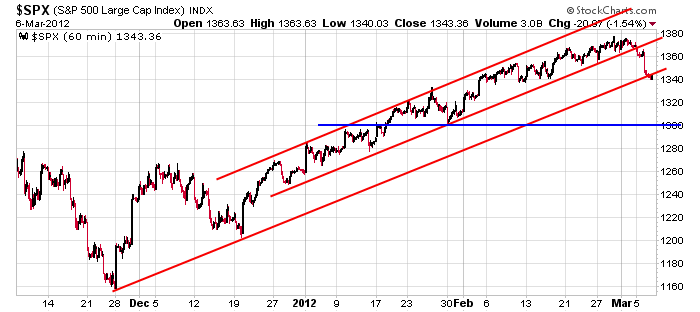

The S&P hit my first downside target (1340) yesterday. My next target is 1300. Here’s the 60-min SPX chart.

Unfortunately I’m not the only one eyeing 1300. In fact I’ve read numerous reports from various commentators who are all looking for 1300 too. When everyone seems to agree on something, it rarely happens. The market will either bottom before 1300 (and therefore not give dip buyers a chance to buy where they’d like to buy) or it’ll drop right through 1300 (thus causing lots of pain for those who bought too soon). I don’t know what will play out, but I’d be shocked if the S&P bottomed near 1300.

Yesterday was the single worst day of the year. The small caps dropped about 2%. The Nas 100 dropped 1%. These losses aren’t extreme, but remember the market is not very correlated right now. This means there will be outliers in both directions, and while this doesn’t seem like a big deal, it is. You can’t say: “the Nas 100 only dropped 1%, no big deal, I can hold my positions.” Regardless of what the indexes did, there were many stocks that dropped 3% or more and some that gained ground. Because of this you can’t use the indexes for assistance in deciding whether to hold or not. You must judge each position on its own. If the indexes pull back 5-10%, many individual stocks will pull back 20% or more. Again, don’t look at the indexes for guidance.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 7)”

Leave a Reply

You must be logged in to post a comment.

Look under the hood clean up your inventory. Indices are pretty useless

Good luck

drip…drip…drip…smooooooooth out that volitility. drag it out till thursday, then we’ll see if greece can sell bonds or we go back on life support…drip…drip

indeed, its not over. closed nugt for a loss. out aapl tqqq for some profit.

watch 1.31 on the euro and european barrier opts

did we just see a little intraday sub wave 2 up of 1 down or call it a small correction

actually there is strength in the leaders we shall see by fri

the cluster of distribution days in the last month per canslim methodology did come to pass, but leaders are still perking under the indices. they are still useless as a trading barometer.

the indices and the often mentioned fncls that is.

INVN has huge vol coming, another tech innovator, canslim type stock.

ww imho.

look at what PAY did after vol spike on jan 31, INVN will do the same imho

FIO is struggling with interim resistance, but expect it to punch thru

Would not be surprised if a big gun like msft intc or emc takes it out to secure the cloud efficiency / storage space.

YOKU may be putting in a sloppy handle on a bottoming c&h.

I think the pundits are wrong. its not a social media stock, its the next nflx for china.

Needs more slop and chop to bake in the upside potential. Then the dumb money will rush in.

makes more sense on daily & wkly

Hopefully in future yoku wont bring in western new age mngmnt ideas, romney type sissy boy, lets cut costs everywhere except the useless overhead, no technical / industry competence. screw the customer, the business, just float ideas, think out of the box bs – bring in steve covey, tom peters, and other bleeping bleep head cons. then they will really perform like nflx has recently done.

still a very good idea to trade and watch.

NDX has a clear bearish 5 wave down pattern completed on the hourly chart and is now in rally mode to test .618 retrace level at 2620ish, coinciding with end of wave 4 of its decline from 2650. With AAPL’s 1pm EST product release, it’ll be interesting to see what happens this afternoon. AAPL’s wave pattern off of 548 is not as clear, although you could make a case for a 5 wave decline on the hourly chart.

I think its important to watch the indices, but more important to watch the under the hood, the underlying groups like say XHB

For those of you who like eating Steven Covey type inspirational bz poop al mode (because you refuse to acknowledge you are bubbling fool), enjoy 😉

http://www.despair.com/viewall.html

take particular note –

ECONOMICS

The science of explaining tomorrow why the predictions you made yesterday didn’t come true today

John Mauldin and you useless bleep heads, please take a bow.

😉

INVN moving, makes more sense on daily & wkly

expecting some resistance around 17-18, scared early buyers, then possibly a rush of scared want to buyers rushing in as INVN pushes higher. but now im yapping like an economist.

daily relative vol at +5 now

Reverse HS a forming.

Tempted to rebuy more AAPL need to wait for mrkt verdict

As per Raymond’s suggestion, I’m looking “under the hood” at the various sectors relative to SPX. So far, from what I see, there seem to be sectors like xlp, xlu, xlv trying to find support while xly, xlk continue strong as xlf attempts to consolidate gains. So, this pullback in the indexes could be temporary “risk off” while sectors rotate into more defensive sectors, IMO. That would jibe with a wave 4 of C correction prior to another run at new wave 5 of C highs in SPX. So far, in SPX, the decline is a 3 wave affair but, unless 1364 is breached on the upside, there may still more downside ahead in SPX. Today’s action doesn’t tell much either way, IMO.

Most groups and leaders have pulled back to break out levels and seem to be bouncing.

We need follow through during the rest of the week.

In terms of indices small cap russell and dow30 have pulled back to brk out levels and are bouncing.

New leaders like INVN FIO are still strong and getting strong albeit with volatility to shake out the weak hands.

INVN +10% +8 rel vol for the day, something is happening

pay attn to it will likely play out like PAY has since its vol spike on jan 31

AAPL still in play, but I think we need to see the sales response when the new fashion accessory (my opinion) goes on sale. AAPL is not the mrkt just distracts a lot of the dumb money

LOW and others in the home retail sectors took off again.

FIO still setting up.

Oil bounced off brk out consolidations levels, though on low vol, today. Should continue to move up. Alpha pipeliners energy names bounced.

Beat drums in the east, attack from the west. The real name for the mrkts is TGH (the great humiliator) – Ken Fisher. More eyes and collaboration would be nice…

Best of luck.

1320 would make my reverse HS superficially pleasing; having an appearance of truth; seemingly or apparently valid, likely, or acceptable.

Indeed we may get a profit taking, reversal day tomorrow.

Still lots of news drivel manipulation it seems.

This may be the pullback that late buyers / doubters wanted

Gold miners starting to perk up GDX & NUGT

USO & UCO moving up out of bull flag