Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan and Singapore rallied 2%; China, Hong Kong, South Korea and Taiwan gained at least 1%. Europe is currently up across the board. Stockholm, France and Germany are up 2%; Austria, Belgium, Amsterdam, Norway and London are up at least 1%. Futures here in the States point towards a sizeable gap up open for the cash market.

The dollar is down a bunch. Oil and copper are up. Gold and silver are up.

The reason for the giddiness? Positive news from Greece. This allows markets around the word to breathe a sigh of relief (at least in the near term) and it props the euro up and puts pressure on the dollar.

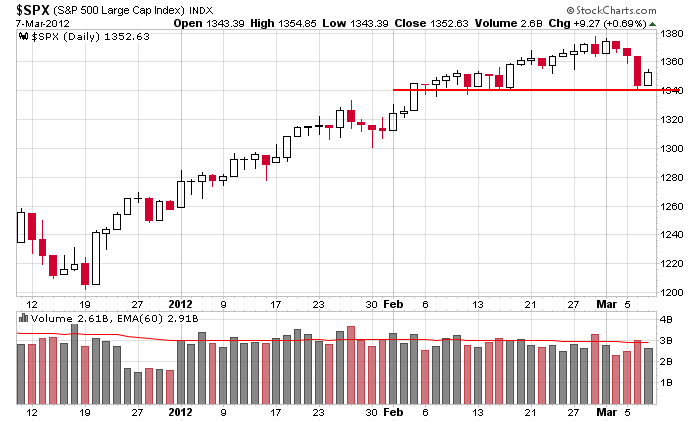

As of now, the loss the S&P suffered on Tuesday will be recaptured at today’s open. Here’s the daily chart. Support was found at 1340 – a level that supported prices in early February.

Long term I still believe the trend is solidly up, and we’ll see higher prices. In the near term things are less clear. Tuesday was one measely down day. The market can certain recover quickly from it. But there are still many indicators that would benefit from more downside – I’d rather the indicators drop to low levels before reversing. Technically that would lay a better foundation for the market’s next leg up.

Tomorrow before the open we get the latest jobs report. It could be another large opening gap.

In the near term I going to continue playing it safe. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 8)”

Leave a Reply

You must be logged in to post a comment.

I believe this is hope the greek bonds are picked up this afternoon. watch out for the boogieman

hope/and cautionary short covering

I lost a router last year right through a 4 year old surge protector. learned the hard way, some lose their effectiveness after a few years. headed to homedepot right after the market closes

Love the little bit of up and down this morning

ESH2 20d15m: needs to go up to 1375 then down to 1350 for my reverse HS prediction to work.

whats esh? rev hs on the sp?

ESH2 10d10m: Reverse HS, nick 1375ish, shoulder 1360ish, head 1340ish

what is on the charts is a top on just about every market—sub wave 1 down

and a tired dead cat running out of internal jucie,that is being used by the insto derivitives

and central bankers to create illusions to maintain the ponsi on no volume

but u maybe right if the dead cat can make it to the highs for a double top

then down for a shoulder and another no vol rally to break the neck

Dow 15000 with only Neal buying

it’s all greek to me

It just maybe Greece and GS. Quite a rush.

ESH2 is the March S&P emini futures contract.

Reverse HS, is reverse Head & Shoulder.

thanks… whats gs? greek speak?

GS: Goldman Sachs

thanks. so you’re looking for 1375. may get it on good news

Yes, 1375ish.

If news were a primary driver it’d always go up on good news and down on bad after

the event occured not five minutes before.

Yo Pete, I’m back without any confident insight. Best guess is b of 4 of c.

Yo, Brian! b of 4 of c is a valid interpretation, IMO. We seem to have completed 3 waves down from 1378 to 1340. My question – could that be all of wave 4? Or, are we looking at an abc flat pattern marking time? Or, perhaps we could see an evolving triangle (a typical wave 4 pattern)which would again mark time (like a flat correction) with little deterioration in price. Either way, that would allow all the overbought indicators to unwind.

As per Raymond, it probably makes sense to analyze the sectors for strength/weakness, look for the best bullish setups in the anticipation that wave 4 in SPX has not yet ended, and then go with the best industry (or strongest stock within the industry)for the expected wave 5 rally.