Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down, but only Taiwan (down 1.1%) dropped more than 1%. Europe is currently trading mixed and with a down bias – there are no 1% movers. Futures here in the States point towards a gap down open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

I don’t have anything to add to report I posted over the weekend. The long term trend is up; the near term trend is less clear. The market took a big hit last Tuesday but then recovered quickly the following three days. Overall it looks like the market has been in consolidation mode the last month. Zooming in there are hurdles that need to be climbed. The banks need to take out resistance. The semis need to hold support. The AD and AD volume lines need to continue up. New highs need to expand again. Several other breadth indicators need to reverse. The market has had a 1-track mind the last couple months; can it continue to ignore nonsupportive data?

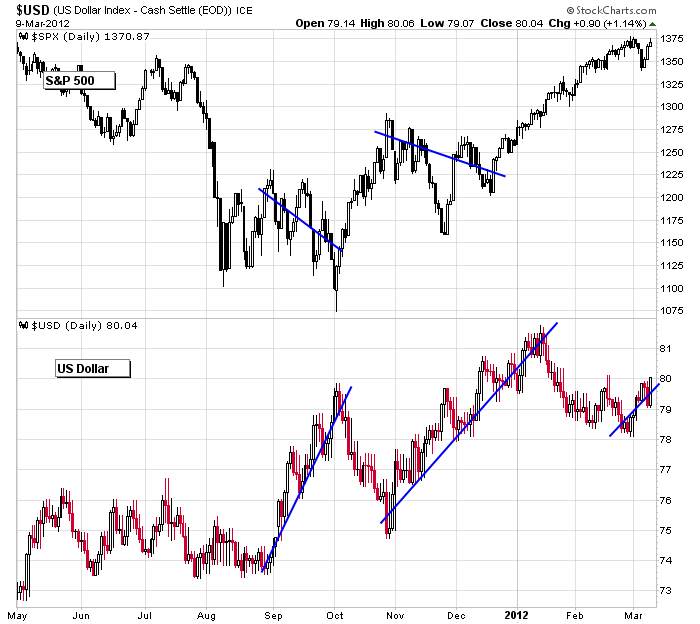

One key heading into this new week is the dollar. For the most part, the dollar and the market have moved opposite…when the dollar moved up, the market dropped. Here’s the S&P vs. the dollar. Last Friday the dollar moved up with force and closed at its highest level in two months. If it continues, the market’s upside potential is limited.

I lean to the upside, but I’m skeptical. The market has some proving to do in the near term. I want to know if last week’s drift up into the end of the week wasn’t just a move in anticipation of the jobs report. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 12)”

Leave a Reply

You must be logged in to post a comment.

We are only about a third of the way ito the EU swamp. It deepens when you get to Portugal, Spain, and maybe Italy as well. All smoke and mirrors with lots of pits in the road.

The US overhanging national debt and personal debt coupled with the financial depression now in use says the markets are not attractive in the long run. A few dollars trading will not greatly matter to anyone. In the meanwhile we have 535 violin band in Washington pretending they know what is happening.

As things stand munis and small caps are the long run winners.

Nothing good happening.

the up trend with no volume

maybe its a zombie trend

zombie trend – nice visual

Hey Raymond,

Nice call on YOKU, EH!

Thanks, TUDO was the big winner, sold at the open, sold 1/2 Yoku added back in.

Both have allowed me to reach my Q3 target. Maybe able to completely retire this year.

Still contend YOKU is chinas NFLX, its got some ways to run.

Just an observation – I’ve noticed a number of internet sites making bullish stock market commentaries, noting bullish “H&S” patterns forming (is that the same as “cup & handle?). Anyway, I look at the the USD and see the same pattern forming. Does that mean the USD & stock market will decouple from their inverse relationship that has existed since at least 2007 and both advance at the same time? If not, which (USD or stock market) has the best technicals to support the bullish case near/intermediate term (or maybe a bearish case) near/intermediate term?

Pete, I’m currently long the USD and my bias is to short just about everything else. I’ve been getting bombarded with bullish commentary from every source wanting my business. And, that is a remarkable change from early ’09 when it was ‘all’ negative – if all the passengers are on one side of the boat….. The one time I can hang my hat on as perfect timing (mostly luck) is cutting many of my shorts on March 6th in 2009. But, only a few months later I tried to reapply them only to find myself having to cut them as the market proved me WRONG. Once again, I see the lopsided views opposite of those in early ’09. I’m not willing to risk the long side of the market at this juncture.

Zombie trend dancing ti ‘Thriller’ with MJ : }

Pete has made an interesting remark about the decoupling aspect of the usd and market…ive used the usd as a trigger in the past and have noticed a slow decoupling effect taking place. The equity move up with low volume would suggest a mecca of HFT and fed involvement…Retail is dead… i would say 85% of the retail i talk to are on the side lines..they do NOT trust this move up….they do not trust the market/ wallstreet…

feds got the dollar up to keep oil down. they’re also propping the market up

last year when they tried this a lot of the money went into commodities and started to cause inflation worries and was raising the cost of food. they’ve fixed it. look at a 3 yr chart of AA. No improving economy, just a high stock market for pensions and IRA’s. Gotta let those oldies retire to make room for more drains on unemployment relief

ndx 100 weakest today

Re USD: it’s crude and PIGS debit.

Increase price of crude decrease USD and decrease EUR.

Increase U.S. production of crude increase USD.

Increase Europe production of crude. Oops no reserves in Europe

PIGS debt decrease EUR

The EUR/USD pair go down because EUR weak and USD stable. S&P maybe flat maybe up a little because production increase S&P but cost decrease.

the destruction of the usa has already been planned by the usa /china pollititions within 2 years the yaun will float and all yanks will be trapped with a usd half what it is now

–a good default–with supper hyper inflation

but for now we have a currency war between usd /jpy/euro

the euro is beeing artificially held up to stop inflation in germany and kill the piigs that need a low euro–japan wants a weak jpy yen–and usa doesnt care it just wants to print and spend usd

there has been some slight decoupling of up euro up stocks but the big boy insto computers are still turned to euro to buy shares

but some reverting back to the yen for the carry trade

does anyone know what the carry trade is and how it effects world shares

Re: Carry Trade. I don’t think it has the impact it used to when the cheap money was invested in small caps.

50% cut in USD will make U.S. net exporter and commodity compete with AUD selling stuff to China. LOL

lol ur right RichE

the original carry trade used to be financed in weak yen at half a percent to go elsewhere for higher yeild

then it went to usd at zero %–u need a funding currency thats not going to go up when u want to close it out

then it went to the euro,with the bet on it falling when they sold their aud at 5 %

they also call the carry trade the risk on/off trade and it has a correlation to shares and the big boy black box computers that make up 70% of all equity trades

Didn’t know it was correlated. What is the current and that should correlate 1:1?????

Some slop & chop but new leaders, old leaders still strong.

Maybe this way into fed chatter tomorrow.

MCP FIO making a grinding pullback but setting up

I think REE is making a run back up also

NBG IRE may be setting up to put in a technical bounce

Raymond – applying the same analysis used for MCP FIO etc., how would you evaluate PLW? Thanks!

I would never trade something this thin / illiquid. And I dont bother with debt instruments, not enough beta.

IBM, one of Buffets first tech forays continues to rock

Big money is coming into YOKU, check your time and sales

relative vol so far +10X avg

on daily note YOKU put in a cup & handle prior to todays explosive brk out.

40-60 of the time stocks come back to retest the brk out levels. other times they build an ascending base and explode higher.

we shall see

both YOKU and TUDO had alpha stock fundamentals backed by technical action prior to the brk out

that said TUDOs brk out was interupted by by last wks technical correction but mid week it validated its pedigree.

fundamentals (proper growth fundamentals) do matter, need to be considered. but only for potential. technicals validate the potential and trigger the trade both on and off.

this is how the big money is made.

the quad witches are coming to take us away

maybe, shld be volatile tomorrow, more to do with fed reading

good luck

stress test the banks, baton down the hatches, grab your ass and loose the crackers