Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

SPY (closed 137.58)

Puts out-number calls 2.7-to-1.0 – slightly more bearish than last month.

Call OI is highest between 134 & 145.

Put OI is highest at 137 and below…all the way down to 105.

Call OI is straddling the current price, but put OI is significantly higher below the current price than above (ergo, SPY is already positioned to cause most of the puts to expire worthless). From here, for every point SPY dropped, 100K+ additional calls would be out-of-the-money while 100K+ additional puts would be in-the-money – it’s pretty much a wash for 2-3 points. Hence, a flat trading the next couple days would cause lots of pain, and a small move down would have the same net effect.

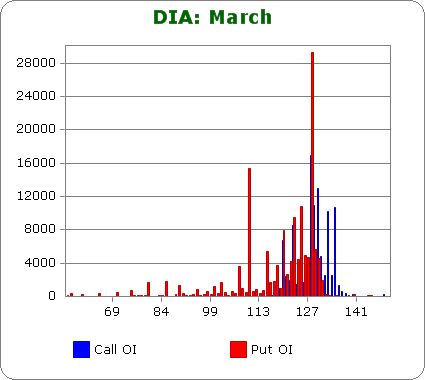

DIA (closed 129.46)

Puts out-number calls 1.5-to-1.0 – more bearish than last month.

Call OI is highest at 120 & 123, between 128 & 130 and then at 133 & 135.

Put OI is highest at 123, 125, 127 & 128.

This is the first time in a very long time puts OI significantly out-numbers call OI – they’ve always been approx. equal. Volume on DIA options is light, so we don’t get a smooth pattern here, but it’s meaningful 128 is the highest OI strike for both calls and puts. Ideally we’d want DIA to close there on Friday, but a point or so in either direction is fine too. With today’s close at 129.46, DIA needs to drop slightly the next couple days to cause the most pain.

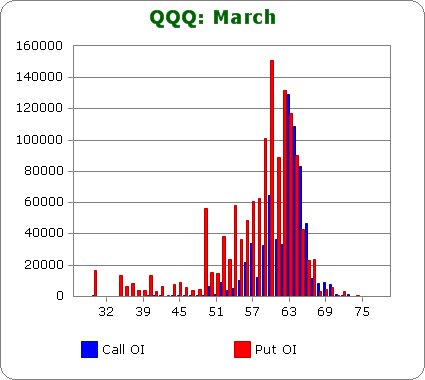

QQQ (closed 65.05)

Puts out-number calls 1.8-to-1.0 – less bearish than last month.

Call OI is highest at 60 and between 63 & 66.

Put OI is highest between 59 & 64 and it tapers off in both directions outside this range.

Put OI is highest in a 6-strike range; call OI is highest at the top of this range. Hence a close near the top of the range would cause almost all of these high-striked calls and puts to exire worthless, and for the few that may be in-the-money, those weren’t free, so odds are those traders have losses anyways. QQQ closed at 65.05 today – exactly where it needs to be to cause huge pain. Hence, flat trading the rest of the week is needed.

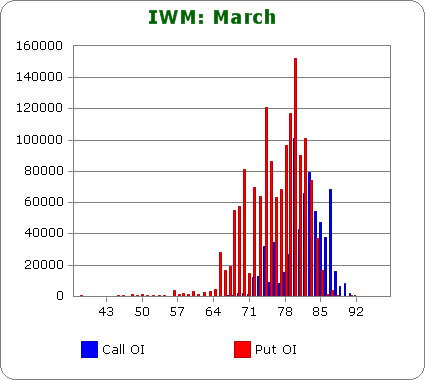

IWM (closed 81.44)

Puts out-number calls 2.3-to-1.0 – less bearish than last month.

Call OI is highest between 80 & 84.

Put OI is highest at 83 and below.

The highest OI strike for both calls and puts is at 80. Then we have some overlap a couple strikes above that. But puts far out-number calls, so for max pain to be achieve, we should focus more on the puts than a combination of calls and puts. To cause most puts to expire worthless, IWM needs to close around 83. With today’s close at 81.44, IWM is close but a slight move up would be much better.

Overall Conclusion: The bears again bet big and again they’ll lose. The two ETFs which carry the highest OI are SPY and IWM, and they need opposing moves to accomplish max pain. SPY needs a slight move down; IWM a slight move up – not a surpise considering the small caps have lagged. Let’s just say the market is already positioned to inflict a lot of pain, and if it moved slightly in either direction, the situation wouldn’t be much better. Only a huge move down would enable large profits to be recoreded – not likely to happen.

0 thoughts on “Using Put/Call Open Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

You state: “The bears again bet big and again they’ll lose.”

What if the bears are the financial powers that be?