Good morning. Happy Friday. Happy Quad Witching Day.

The Asian/Pacific markets closed mostly down, but there were no 1% losers. China rallied 1.3%. Europe is currently up across the board. Austria (up 1.2%) is the only 1% mover. Futures here in the States point towards a slight positive open for the cash market.

The US dollar is up slightly. Oil and copper are up small amounts. Gold and silver are down.

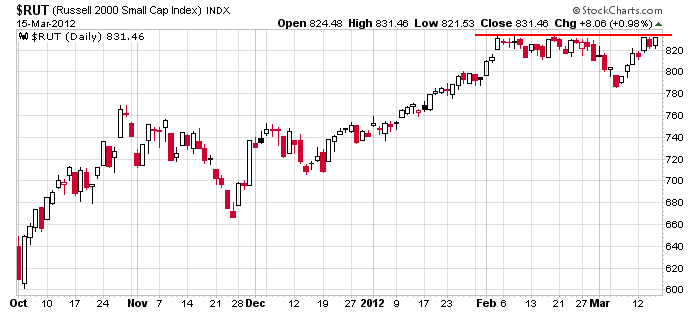

Today, contracts for stock index futures, stock index options, stock options and single stock futures (SSF) all expire. Perhaps there will be some odd short term movement, but overall this is an irrelevant day in the grand scheme of things. The trend is solidly up. Many of the indexes made a new high yesterday. The Russell is very close and holds the key. If the small caps can’t bust out soon, the large caps will not be able to run much further, but if the small caps can finally break through, well, the odds the uptrend continues will be very hight.

The market is clicking. Financials are doing great. Semsi are close to a new high. Transports are moving up. Consumer-related groups such as travel, gambling and recreational products are at new highs. Don’t fight this – even if it doesn’t make sense, go with it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 16)”

Leave a Reply

You must be logged in to post a comment.

How’s everyone’s March Madness bracket picks doing so far?

Yo! Brian! I can make out an SPX 5 wave sequence from 1340 completed at a Fibo target around 1407 9today’s high is 1406ish. However, higher Fibo targets are (for me anyway) 1430-1450 so I’m I’m not trying to call a definitive intermediate (let alone a long term) top. I just think the upside is limited now in terms of price and time.

By the way, IMO, XLF & XLK have been the leading sectors on this last move in SPX. XLF may have a 16.00 target +/- 5pts from what I see and XLK could be looking at a 30.60ish target. Just something to consider in what still is an uptrend in progress.

Pete – I see your point around 7:54 CST on the e-mini Jun contract. However, the sub-waves suggest correction since then. And, I’m liking a test of the underside of the trend line formed by the origin of 1 and the conclusion of 2 for this 5 of C. It just doesn’t look complete. A test on the contract would mean an 8 pt rally yet to go now. But, the line has a positive slope of course and will be higher on Monday. I say, close but no cigar yet. Futures start trading Sunday afternoon at 3 here in the Pacific time zone. I’ll be watching for a last gasp effort.

Looking at SPX – without after hours trading, I can’t get the same trend line. Instead, I would be looking for a break below the supporting trend line now at 1401 and climbing.

i will be watching the aud/jpy cross for a turn and a end of the world carry trade rally

or just a turn in the japan jpy=

imo the bears will be out to play next week but confirmation needed–i havnt received my invite yet

SPX in Oct.2007 territory. “Nothing but blue skies”

My conservative ES target 1525.

Geez! I’m sounding like Neal. I hope I don’t put on weight. LOL.

Neal says dow 13324

i say rut at a lower double/ triple top with overhead trend line down and trendline up

making it a irregular triangle at the 7/8 th fib line