Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed; only India (up 1.65%) moved more than 1%. Europe is currently mixed; only Austria (up 1.8%) has moved more than 1%. Futures here in the States are up a couple points.

The dollar is flat. Oil and copper are up slightly. Gold and silver are down.

I billed yesterday as a semi important day because I wanted to see if the Russell could follow through on Monday’s breakout. It couldn’t. It gapped down and lagged all day. This doesn’t automatically mean the the breakout was a false breakout and prices are headed lower, but it does get my attention – especially since so many other indicators which had been diverging from the price action finally started to support the upside.

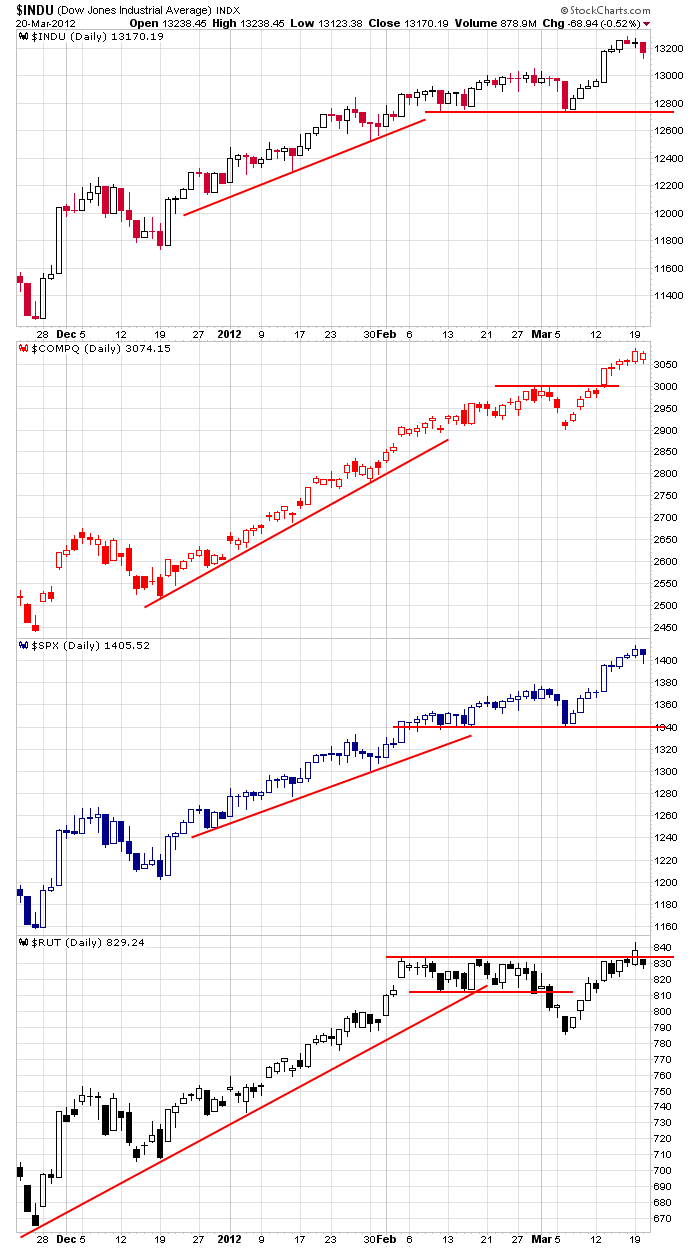

Here are the indexes. The Dow, Nas and S&P look great – although maybe a bit overextended in the near term. The Russell exhibits the same price action over the last two weeks, but has yet to clear itself from last month’s high. This non-cofirmation can last in the short term, but eventually the small caps will need to improve if the market is going to head higher. The flow of money from the small caps to the large caps is not what typically happens in a strong market. The trend is up; I’m long, but I’m on the lookout for subtle hints the upside energy may be running thin. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 21)”

Leave a Reply

You must be logged in to post a comment.

would someone ask Jason to update his economic releases

This is one of the better free economic info sites.

http://www.forexfactory.com/calendar.php

The edge is to figure what economic release has impact on what. Look at the provided charts and see what has correlation to what you are trading and what is just noise used by the smart money to shake out the dumb money so they can bleep you both ways.

thanks for the link

oops sorry about that

I stated a few days ago it would be smart for the fed to sell into ws window dressing, lighten up their exposure, take profit and give shares to ws. all you have to do is think like the fed

take a gander at a 5 yr chart of AA. Thats the economy and thats reality. the fed and the bama admin is trying to get it up on bs. you don’t need wave glasses to see the truth

Why is AA a proxy for the economy?

Does air plane construction (moving more to composites), beer & pop can use and minor use in construction provide a barometer?

I suggest looking under the hood a little more.

All through out on of the greatest rallys in recent history as measured by the alpha stocks (AAPL DLTR PCLN ALXN etc and more perking up) the idiot / con pundits and media fools have stated many false things to distract us dumb money

– mrkts are rising on little volume, oh no!

– mrkts cant rise without the fncls

– GE is the mrkt, no GS, no C and now AAPL and so on.

This how so many retail traders / investors got suckered and continued to be sucker out of making money.

The mrkt indices are a mask, underneath the smart money are moving in waves between the leader groups pushing ever higher.

On AAPL I made a mistake getting out too early –

Look at both AAPL and BIDU on monthly charts. Draw a trend line along the bottoms and a parallel trendline across the tops before 2007 / 2008 – that defines the bull channel. AAPL has been on an ascending base and exploded this year. It is now in volatile territory like BIDU was before its roll over.

APPL has become a good day / short term swing trade stock for large accounts who need to deploy large fund positions.

Good luck

AA is a representation of production, manufacturing, construction and gdp.

This market is a representation of the fed propping up a fat pig. Thats why ta and fa don’t matter. Thats why we have no volitility and no volume. This is not a real market. Look where we were headed last Dec before the fed turned the presses back on

No, AA is just a company. Perhaps ready to go the way of the buggy whip – consider the concept of recycling, tax / fees for buying alu canned goods.

We need to consider but often times forget about the so call experts and think about practical considerations and facts as they appear before us.

Hahaha yeah right. Copper has been produced for ten thousand years, it didn’t disappear when they started making pennies out of nickel. steel won’t disappear because we have plastic bottles. lol

alumn alloys are being used in more copper aplications and so far carbon fibers are very expensive

like a bunch of magpies setting on a fence watching a Shakespearean play no fricken clue trying to make this market fit an e wave pattern is trying to put a square peg in a round hole

Sometimes the best move is no move and not to fully commit to turning points but to follow the momentum and to bail out quickly when proven wrong.

Sometimes you need to recognize a mrkt model, a trading plan / set up is not appropriate or plain wrong. And to recognize you need to dump a stale lame instrument and hunt down and use the perky ones.

Other times a better move is to take small moves long or short, then add to your conviction as the trade goes your way. A day trade becomes an over night hold, an overnight hold becomes a swing etc.

The best move is to analyse and wait and take money during the short term pockets of opportunity (forget intraday scalping unless you get a huge move) that are always there while always looking to build positions for big moves and the big money.

Good luck.

your dumping aapl proves you are smart enough to not ride this pig down. don’t lose that

No still day / short term trading AAPL long.

I made a similar mistake with BIDU in jan 2010. Every F head analyst, media moron dumb money chatter box was panicking saying it was a massive blow off top – that was my analysis as well.

I jumped back on as BIDU moved up, taking swings every few weeks and brought in another +60-100% for my ‘clients’ (family).

Also I would not totally dismiss the concept and observation of cycles. Just be very cautious of over committing. If its not working, figure out why. If you can figure out why, dump it.

All stocks and markets have a life cycle – accumulation, mark up, distribution, etc

Key catalysts come every 3 months or so, monthly and weekly

– earnings

– government approvals (drugs)

– economic numbers

The key of course is to find out what has fact based correlations, what has real lasting impact. Its hard work.

Collaboration helps.

I used to use the 2 yr semiconducter cycle. Its been blown up in all the manipulation

GOOG BIDU finally making a potential continuation break out.

Expecting a pullback test when they do.

IMO, with the exception of XLK & XLY, the other sectors look vulnerable to more downside (at worst) or consolidation (at least)before the broad averages can move much higher. Perhaps we must wait a few weeks for the next earnings reports to provide the catalyst for a resumption of this uptrend (or not).

The bigger issue, IMO, is whether the leading economic indicators (still negative) or the coincident, lagging indicators (seemingly positive) prove to be correct as to the future economic recovery (already priced into the stock market?) going forward. The second Q should provide the answer, but until then the trend is up.

All you can do is read the fed. If AA breaks 10.25, look to 10.00. Also watching INTC’s reaction to 28

This is exactly why e brokers have to give 6 months free trading and $600. They were told the fed was going to strangle traders and volitility. Notice how banks and trading companys have laid off so many people. You will do exactly what the govt says exactly when it says to do it

it is possible the ndx 100 has started its impulsive downtrend in the last half hour trading

after hiting 2751 top –a nice number for the derivitives guys

this is what the weaker dji and spx have been choppilary waiting for

and is comfirming the dax down move

good luck to the bears

Oh this fat bloated pig bernake has been dancing with has been dead for months, but he thinks he has us convinced she’s still breathing

Sad to see such dissention and condescenion over money. If we have a correction, it could mean QE3 which is unlikely according to the MAN, but might come off the shelf and be used as a cure-all: Reelect the President, pump up the market and herald the end of of the US Economy as anyone recalls it. Second thought, you may be right, there is little hope.

Have patience.

Agree, disturbing wide spread selling into the close.

Keep building up your short lists.

Well, looks like I will be hanging out on stocktwits a little more collaboration according to my friend.

Best of luck.

what r u waiting 4