Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. India dropped 2.3%; otherwise there were no standouts. Europe is currently down across the board. Austria, France, Germany, Amsterdam and Stockholm are down more than 1%. Futures here in the States point towards a moderate gap down for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

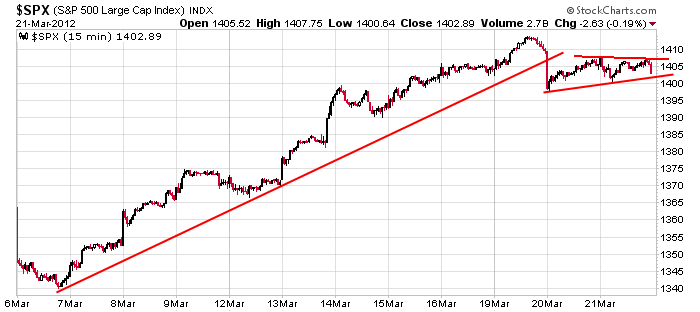

For the second straight day the market failed to follow through on Monday’s Russell breakout. On Tuesday the market gapped down and grinded higher most of the day, but the market never got above its unchanged level. On Wednesday it opened flat and grinded higher most of the day until some selling into the close. Now we have another gap down. Here’s the 15-min S&P chart. A steep support line was broken, and now we have two days of tight trading below support.

On Monday I mentioned that it was a perfect time for the market to pull back because so many things were finally lined up. Many indicators which had been lagging had curled up. Many events that could have caused selling were over. The small caps had finally hit a higher high. A wall of worry was climbed for several weeks, and as soon as the worry went away, it made perfect sense for prices to pullback. So far it has happened.

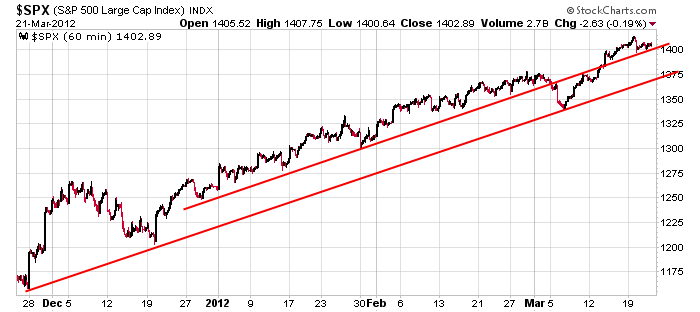

Here’s the 60-min S&P chart going back to December. You can’t argue or fight this trend. There’s support at 1400, but that level will be taken out at the open. After than support is at 1375.

The long term trend remains solidly in place, but we’ve had less good charts to play lately. I’d love a real pullback to allow the charts to reset, to allow better set ups to form. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 22)”

Leave a Reply

You must be logged in to post a comment.

Selling into window dressing. Bangin em to buy em

I thought the fed would sell into window dressing to reduce exposure and give ws their shares. Now they will be ready to continue support after the first. very nice

If this is more than an orderly pullback in the broad averages and sector rotation, we should start to see more pronounced weakness and downside acceleration, particularly at the end of trading sessions going forward, IMO.

Among the things I’m noting, e.g. is XLE breaking down to a new MAR low. XLF hit an upside target of mine i.e 15.98 (yesterday’s actual high was 15.97)and is now testing 15.50 (the 10day EMA). XLF has been a leading sector during the recent rise in stock averages. XLI has broken below its 10 & 20 day EMAs which is now resistance. XLK is waiting on AAPL (a heavyweight in the cap weighted SPX & NDX as well). In short (no pun intended), the setup is there for the bears to take advantage. SPX, for example, should be a gimme for a test of 1375-1380. Below 1340 it becomes really interesting. But the bears haven’t been up to the task recently.

Yo, Brian! Take a look at SPX on the hourly chart and let’s see what happens in the last hour of trading today and into tomorrow.

Hey Pete! I think I’m seeing the completion of c of 4 of 5 of C. If true, it should conclude soon with 5 of 5 of C to follow. It is getting exciting 😉

What’s up with TVIX – fear of default or anticipated drop in volatility???

Hey Brian – Don’t know about TVIX, but VIX seems to be acting as expected.

Regarding your reply to me, I was thinking more about the decline from SPX 1414. I’m seeing the initial move down from 1414 to 1398ish as wave 1 (or A of an ABC correction) and wave 2 (or wave B) ending at 1408ish. From there, I’m looking at a potential 5 wave sequence down for what could be wave 3 (or wave C to complete an ABC pattern). In the past, these downside moves have usually ended as a 3 wave corrective pattern followed by new highs. Maybe this time it’ll be different. I take it that your point is that this will be a corrective pattern ending wave 4 of 5 of C. Where would you see wave 4 ending e.g. 1375-1380?

1385 is potential first stop. Anything below 1375 is an overlap for my count and could be an early indication of a top is done. Still looks corrective to me.

closed world shorts will reload if a close bounce for a weak asia/europe usa open

dow below key support -ndx rolled–dax/ftse failing

germany/china in negative growth

i only consider intraday moves–anything else is to confusing for my small mind set

go the vix