Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific market closed mixed and with a bearish slant. India and Taiwan dropped more than 1%. Europe is currently mostly up, but there are no big winners. Futures here in the States point towards a moderate gap up for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The market cracked last week. The S&P’s weekly loss was its biggest of the year, but considering it only dropped 7 points and it was only the second down week of the year, the bulls remain firmly in control.

Many money managers have missed the rally. They’ve been desperately waiting for a chance to get long but haven’t gotten the opportunity. Such is the nature of a strong rally – they won’t let you in. These managers are at risk of losing their jobs if they don’t catch up some, so with this week being the end of the month and quarter, window dressing may be a little stronger than typical. A money manager cannot be on the sidelines when the market is up 30% in 6 months.

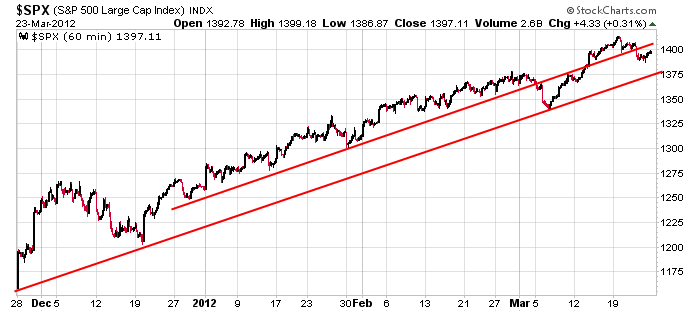

Here’s the 60-min S&P chart. Per the slopes of the trendlines drawn, my downside target is 1375; my upside target is a new high

Don’t fight the trend. You’re either long or on the sidelines. I’d rather stay long and be wrong once than constantly try and pick a top and be wrong constantly. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 26)”

Leave a Reply

You must be logged in to post a comment.

Today Bernanke says continued accomodation needed. Go long. 1500 in sight.

Meanwhile over at the courthouse we have a hearing on your rights to reject health coverage.

Or, as I put, the end of your freedom to live freely.

The Bush tax cuts still loom with all the new 2013 spending cuts already passed.

Avoid Fed bonds and in of the buying get thee some PM just in case this come out the way it

must. End of reason is coming soon.

oh its not bernanke, its the waves controlling the market. right Rich

Not sure what you mean. Elliott Wave is a form of TA, but I don’t believe in the math or logic of EW. I believe in his observations of wave intent.

but we’ve already established ta doesn’t apply here

We?

I have no idea what you’re talking about.

Brian – speaking of waves, the pullback hs unfolded in a 3 wave corrective decline so far & there’s nothing I can see that changes the uptrend remaining intact. SPX 1420-1440 seems attainable.

My first upside target for 5 of 5 of C is 1421. I’m looking forward to it getting there to see how it shapes up.

you can see the waves have taken the volitility out of the market and we have stabalized here at 1410. thats whats called the huge flat wave. when profits start being taken at the end of the day, thats a declining wave

it is amazing. its like the waves have a brain and are actually holding the market up here, on bad housing data. wow

I think I’ve figured it out. The waves are controlled by God. bernanke is Moses reincarnated. beard matches… yep thats it

the ndx 100 has broken out to new highs and should be contained here at 2760

the spx/dji are making a little wave abc up,with b at fri low and c at the high today

which would be the last wave up–ever

next we should hit the calm waters of streight down—forever

but as i couldnt care less and am only interested in horizontal s/res minor /major and piviots

then the above may be all boloney

correction to above—5 waves down to fri low and this is a abc up in dji/spx

invalid if new dji/spx highs made

They did.