Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. China dropped 2.7%, but no other index dropped more than 1%. Europe is currently mostly down, but the losses are small. Futures here in the States point towards slight positive open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

The market sold off into yesterday’s close but is still up solidly on the week. At this point in time one would think any fund manager who needed to add some big name stocks to their portfolio has already done so, so the effects of end-of-quarter window dressing are subsiding.

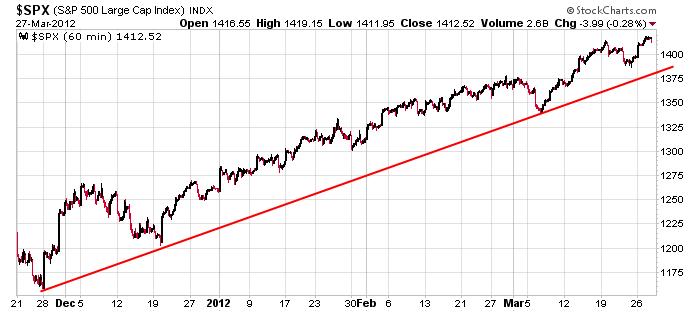

Here’s the 60-min SPX chart. Does anyone want to argue with the trend? I hope not.

When will it end? I have no idea. It’ll end when it ends. I know that’s a generic, open-ended statement, but it’s true. A scary financial situation in Europe hasn’t chased buyers away. Random negative economic reports haven’t induced selling. Random earnings misses have been mostly ignored. Indicators which typically lead to mini corrections have had no effect. The market has a mind of its own right now. It wants to move up, and you’re best off not arguing with it. If you stick with the best stocks in the leading groups, you’ll do fine. Just don’t think too much. That’s when you get into trouble. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 28)”

Leave a Reply

You must be logged in to post a comment.

there are many trends and time frames–intraday trend looks like may be out of steam

futures pos opening below y/days lows in dji /spx euro

naturally we will try for gap fill to y/days close or central piviot after open–on no vol of course

dont know what u would call a pull back here–corrective or the start of something big

who cares –i only trade intraday

its a liquidity driven computer market not t/a or fundamental

europe below y/days lows and follow through for the bears so far

the witches brew needs a good churn,churn

but to much churn churn may led to april fools

SPX (hourly chart) is declining in an apparent 3rd wave approaching a Fibo (.382)and chart support level at 1407. Below that, the next Fibo (.500) is at 1403ish. Interestingly, IMO,

the Fibo .618 coincides with chart and trendline support around 1400ish. The trend being up, thses are “buy the dip” areas for potential turns, or so it seems. If the decline unfolds in 5 waves down (hourly chart), however, it would suggest that the decline may have further to go and any upward turn from 5 waves down may only be a bounce before more downside.

that’s a great call.”whatever it does, its doing” stop it

fed unloading shares to ws during end of qtr window dressing. wow who saw that coming.

I’m sure it’s waves trendlines and fib numbers controlling this market

Yo, Brian! – given the uptrend, I’m thinking that an alternate scenario for SPX is a “flat correction, i.e. “abc” (or “a”) SPX 1414 to 1388 followed by “x” (or “b”)from 1388 to 1419ish and now the decline to test 1388. 1400 is now the important support in what so far is 3 waves down. Not bad place to go long with a tight stop.

Yo Pete! Bouncing back and forth between S&P and emini contract is challenging. The futures seem to have a more easily definable structure. But, I’m going to say since there was no push lower through 1397 on the S&P, the ABC interpretation is plausible and may be the case. However, the day is not over and the futures indicate we could be experiencing a 4 of 3 of 1 right now if a trend change has already occurred. I’d be hesitant to go long without a rise above 1405 in the futures.

1388 is also a good lower boundary test of the channel formed by the end of 2 and 4 of 5 as I see it now. Unfortunately or fortunately, I won’t have good eyes on how everything develops. About to head out for a long weekend of wine tasting in the columbia valley and gorge appellations.

Pinot Noir, Chardonnay – or both?! Some guys know how to live!

Anyway, I think you may have it right on, i.e. lower degree 4 of larger 3 with 5th wave yet to come. If we’re gonna have a 5th wave down, we should start seeing it develop soon.

hell, even back when the market was real, ws over ran lines to fool us small timers. times have changed. it’s all psychological manipulation to take your money. has been for a long time. now it’s just the fed holding the puppet strings not ws

{snip} “Does anyone want to argue with the trend?”

Jason, I think Robert Long is available.

Looks like wave 4 action (of some degree)on hourly SPX chart at this time, suggesting a wave 5 down later today or tomorrow to a level below 1400. 1395 seems to be a reasonalble wave 5 objective.

the huge iwm/spy divergence while bonds are beginning to firm up at support spells trouble for stocks. if iwm doesn’t rally at least 5 points above the highs soon, we may see 2012 end differently than it began. very differently, in fact. march is historically the month that marks turns both way, so watch out for any action that doesn’t take out march highs.

kunta kinte – nice to hear from you! You don’t speak many words but, when you do, it’s worth paying attention.

In addition to your observation, I found this info somewhere else: 1)Citigroup Economic Surprise Index may have peaked in FEB as it’s been in decline since – usually the prelude to a stock market decline 2) Rasmussen Reports shows consumer confidence at highs last seen in early 2010 & 2011.

My conclusion is that the uptrend, while still intact, shows signs of being more labored with divrgences continuing to build. A move above the current MAR highs may be the final one.

“It wants to move up, and you’re best off not arguing with it. If you stick with the best stocks in the leading groups, you’ll do fine. Just don’t think too much. That’s when you get into trouble.”

When S&P is over 1400 and vix starts climbing, everyone needs to “think” a lot more.

Michael, do you live in ny?

vxo has bounced off the 50dma 4 out of 4 times since nov. another sign the fed is smoothing volitility. thats why we’re frozen here. prop in place

Jason,

Any update on the fire that you spoke of earlier in your blog. CNN had a story this morning on it. Regardless, I hope you and the family are safe and out of harm’s way.

Kezha

trading is 90% mind set

i like eating nice flat bulls,bread on ponsi liquidity

go on fed —QE3 us –i dare u

bernanke says the market is a dead pig and you can only smell it

oh!–i see fed -u have to wait till later in the year ,so as to elect obarma

god help usa ,because the fed wont

obamas great redistribution of wealth. new cars for everyone

oz has just bailed out its car industry

can i have a new car

nope –we have good bankruptcy laws in oz and no free houses

so far we are not a ponsi society

tom McClellan says markets runing on air not real money

can some hot air push market up for close

looks like impulsive move down to me