Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Taiwan dropped 2%; China and Hong Kong dropped more than 1%. Europe is currently mostly down. Germany, Amsterdam, Norway and Stockholm are down more than 1%. Futures here in the States point towards down open for the cash market.

The dollar is up slightly. Oil is down, copper is up. Gold and silver are down.

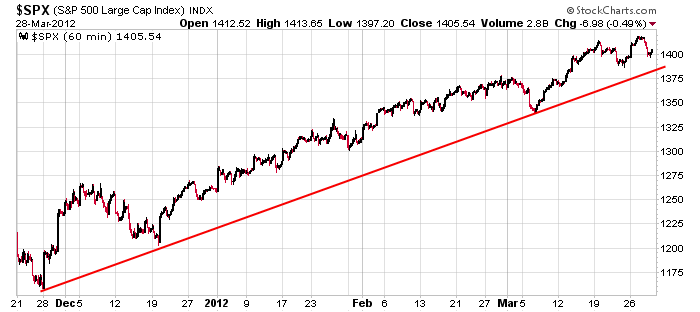

Yesterday the bulls got a little scare, but in the grand scheme of things it was just an ordinary down day within a solid uptred. Here’s the 60-min chart.

As always it’s extremely important to know what time frame you’re trading, to know how long you plan on holding a position before you enter. It’s common for traders to know their exit (a physical price), but very few know how long they plan on being in a position. In my opinion, it’s just as important. Short term traders should not ride out weakness. Longer term traders can hold their best positions. Your price stop is important, but whether you plan on holding for 3 days or 4 weeks is just as important.

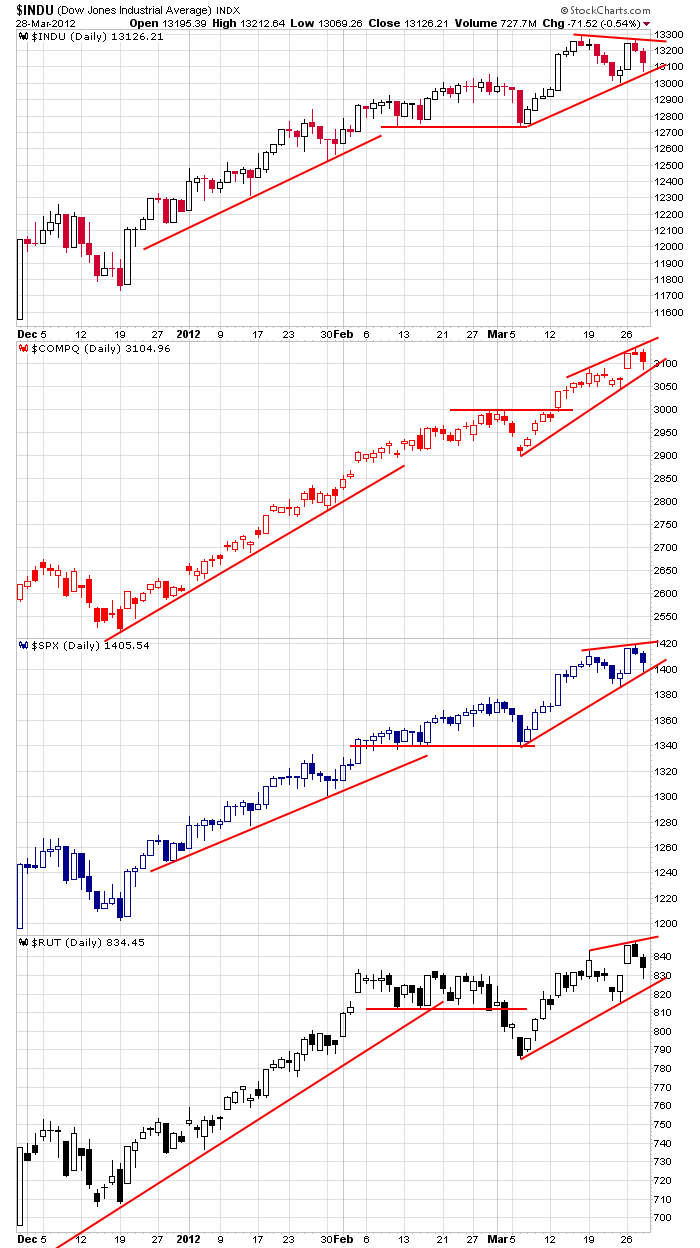

Just so we don’t get overly bullish, let’s consider a bearish scenario…that bear wedges have formed on the indexes. It’s something to keep in mind. You have to be flexible. There are no guarantees, so while the trend has been super solid, ask yourself ‘what if.’ More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 29)”

Leave a Reply

You must be logged in to post a comment.

bernank said the market may be ahead of itself. they won’t allow to steep a drop. they don’t want panic selling. I don’t know where or when they put a floor, but I wouldn’t count on them.

numbers yesterday showed a surplus of inventory. commodities. what do you know, AA has been telling the truth the whole time

oh yeah… I’m sure you soothsayers can find a pattern to fit what has already happened

who said they would sell into the end of the qtr? they don’t want the bar to high for june end

From an EW perspective, SPX appears to be in a “flat” correction, i.e. “abc” from 1414 to 1388ish followed by an “X” wave (5 waves up)from 1388 to 1420ish, and now a potential “abc” down to retest 1388 (this would be 3,5,3 wave pattern). Given the longer term uptrend & trendline support at 1388 & 1380, it may prove to be a low risk buying opportunity in the 1380-1388 area if we get there and see a good reversal pattern.

ESM12 5d15m:I don’t believe the structure and volume of this intraday consolidation is indicative of true accumulation. Down please.

china pmi reading out this weekend

SCCO in a tight range. copper will go the way china goes. our market will follow unless spain scares the geithner

SPX 1398-1400 would be an ideal place from which to reverse & resume the downtrend to test of 1380-1388

seasonallity may play a roll in it

nice insto bears dont want to get overrun by insane stampeeding bull buying on other peoples money

hark –hark the day is coming when the world will be purged of all the corupt,lying-self seeking PONZIEISUM and the markets will again be free to trade –uncontroled

on true supply /demand

Dec 21, 2012?