Good morning. Happy Friday.

The Asian/Pacific markets closed mixed and with an upward slant. India rallied more than 2%. Europe is currently mostly up. Belgium, France, Germany, Norway and Stockholm are up more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The first quarter of 2012 comes to a close today. It’ll be one of the best quarters in several years, and for what it’s worth, April is historically one of the best months of the year.

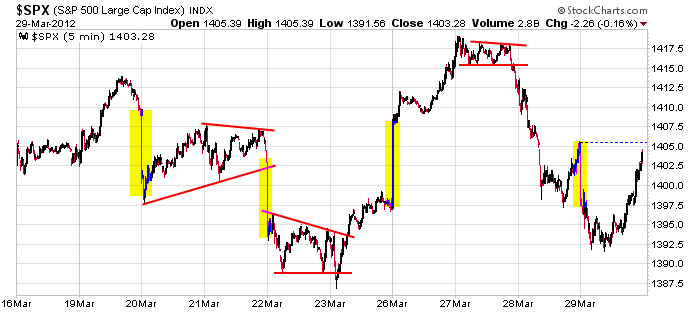

The near term is a little cloudy. Here’s the 5-min chart that covers the last ten days. Kind of messy, kind of random, no rhyme or reason, several big gap opens. We’ve had some good set ups that haven’t gotten much follow through after breaking out, so you’d be wise to do two things: 1) scale back a little, take smaller positions, 2) take partial profits on a trade’s initial move.

The long term trend remains rock solid. Here’s the 60-min chart going back to late November.

With the long term in good shape and the short term less clear, I’m cautiously bullish. There’s little doubt in my mind the market will leg up and make new highs, but in the near term we may have to put up with chopping and churning. Don’t chop and churn your account. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 30)”

Leave a Reply

You must be logged in to post a comment.

choppy toppy or

spinning distribution toppy

i now have 2 posts—cheif sitting bull and cheif crazy bear

just as well i am also a daytrader—go the volitility

ndx 100 looks like it has no cloths on

the market has taken on the bernanks persona. the sleeping sloth

with the first quarter in the books, my analysis suggests that bonds should be choppy, mostly flat, possibly slightly up in the second quarter (means buy the dips, sell out at the rips, but don’t short) and they should be roaring in q3 (meaning buy and hold, add at every dip). happy april and q2 all 😉

kunta kinte – do I take that to mean “risk off” as the year progresses?

Hi PeteM, how’s it going buddy?

I am not going to extrapolate my bond outlook to stocks and other risk assets yet. Technically I cannot say anything bad about equities for a 9-month period. And the flood of liquidity from USA, Europe and all over the world can certainly keep everything afloat. But that means as a long term position I’d rather own gold than stocks because if liquidity can keep stocks afloat, it will do the same to gold. Of course, there are many other scenarios where gold rallies and stocks don’t, but very few where the opposite happens.

Thanks!

Hey Aussie ! Thank God you don’t have to spell for a living ! LOL

Anyway, we’ve still got some more upside before the Roller Coaster continues on……

down mon up tues ?????

down with spelling–my exertricity