Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China rallied 1.7%; Hong Kong and Taiwan dropped 1% or more. Except for Amsterdam (up 0.9%), Europe is down across the board. Belgium, Germany and Norway are down 1% or more. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

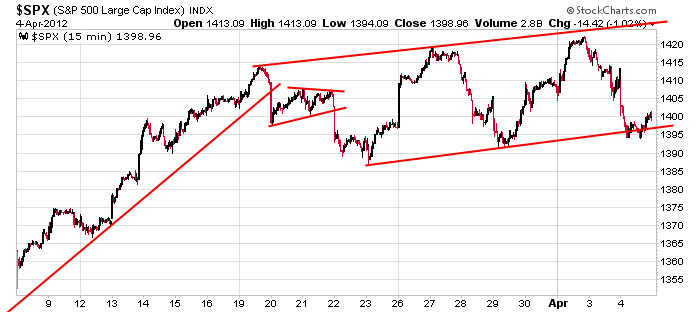

Here’s the 15-min SPX chart I’ve been posting all week. The week began with the long term trend being up and the short term trend being neutral (the indexes were in consolidation mode). First the top of the range was tested, then the bottom, and in my opinion, the long term trend is still up and the short term trend is still neutral.

But as of now, today’s open will be below yesterday’s low, so the market is in danger of losing its range and officially being considering in a short term downtrend. Play good defense. Don’t be a hero out there. We’ve had a really good run the last few months…lots of good set ups. But the market doesn’t move uninterupted in one direction. Maybe it has topped and a full-blown correction is underway. Or maybe it’ll just pull back a little to allow the charts to reset. Who knows. Your job is to enter good positions under the right conditions and then play good defense. More after the open.

(Oh and if you’re wondering about the tendency to move in a certain way before Good Friday, don’t. The indexes have been all over the map the last couple years.)

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 5)”

Leave a Reply

You must be logged in to post a comment.

This market may seem boring and a big waste of time, but remember our ONLY goal is to keep the vxo under the 50 dma. We must not have volitility, That would allow traders to take money out of bernankes stock market. That can’t happen. We MUST keep it propped up

Russ the cheerleader. Yeah!

Mop-mop-mop

Prop-prop-prop

Don’t-don’t-don’t

Drop-drop-drop

My take: it’ll run up today and tomorrow’s employment numbers will cause a spike then a massive Bull-Bear tug-of-war see-saw.

AA and X went up 1 – 1 1/2% until the VXO dropped below the 50 dma… then they both dropped back down. to bad you cant understand

Pete – I now just see a ABC correction from the 3/27 high in the futures. That would suggest another push upward to a new high. We’ll see soon enough. Otherwise, a 1-2 1-2 is forming ???? from the same high. A bit ambiguous for me right now.

Brian – I’m looking at the CASH indexes (not the futures) so we may be looking at different patterns. In SPX, I agree that unless we see further downside from here it’s likely we’re watching a 3 wave corrective pattern (especially if SPX gets above 1404 from here).

RUT (hourly chart) has a clearer pattern, IMO, i.e. 5 waves down from 3/27, then 3 up, and now looking to be in an impulsive 3rd wave down (uncompleted). I think you have to be careful here (long or short). Markets being closed tomorrow while the jobs number is released could create a gap up/down come MON.

Yes, the futures has the high on 3/27 before the open. So, it creates a bit of confusion when correlating the two. In the contract from that point, I agree there is a 5 down followed by a 3 up to 4/2 around an hour before the close. However, I see what could likely a 5 wave down since then. The cash index show the high on 4/2 with a potential 5 down from there. In both cases the final wave of the 5 down is now underway. Due to the differences, I am cautious as well. Fun times to be had by all. Just have to get through this rounding process and get some signs of commitment.

Just checked out the RUT – much cleaner picture.

imo usa will follow europe which has been down for 3 days and may have reversed back up today

euro down usd up 3 days–the EW 1-2 prob best describes it–we have had 3 thrusts to the downside and broken some support,that can giveway to a fast down or reverse back up

we have broken trendline in dji rut and at risk in spx

with all that i still cant call a definitive direction

Neal says dow 14000,but bears have more fun –i say zero