Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed down across the board. India, Japan, South Korea and Taiwan dropped more than 1%. Europe is closed today. Futures here in the States point towards a big gap down for the cash market.

The dollar is down. Oil and copper are down. Gold is up; silver is down slightly.

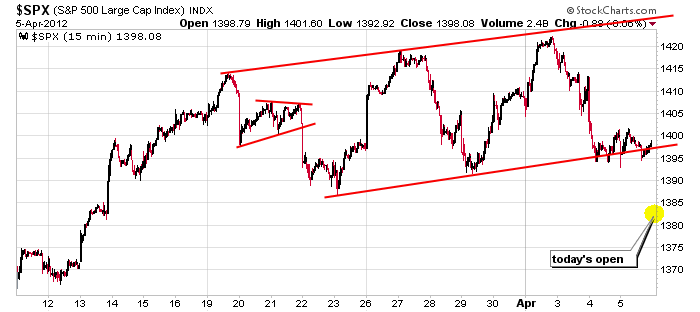

The market has been in consolidation mode for three weeks. Rallies have gotten sold, and dips have gotten bought. The Nas and Russell have under performed (not good), but while the short term neutralized, the long term trend remained solidly in place. Then the latest employment numbers were released on Friday. They were worse than expected, and the S&P futures responded with quick 15-point drop.

Here’s the 15-min S&P chart with an estimate of today’s open which will be clearly below the low of the last 3+ weeks.

We’ve been in conservative mode for about two weeks. Two weeks ago I stated the market is likely to chop around in a range until the employment numbers came out and/or until earnings season began. Conservative mode means only the best patterns are played, and quicker profits should be taken. It hasn’t been a time to sit back and let the market play out. In trading, sometimes you can sit back and let the market do the work for you, other times you have to do the work. For the last couple weeks, we’ve had to work hard.

Be defensive (I’ve been saying this for two weeks). Don’t be a hero out there. There’s a time to trade aggressively (when the “coast” is clear) and a time to lay low. This is definitely a time to step back and see what shakes out. Maybe the market pulls back briefly and then legs up again, maybe it actually corrects for a couple weeks. Nobody knows. Don’t chop up your account. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 9)”

Leave a Reply

You must be logged in to post a comment.

Pitch fork

yes the market is making technical formations. US steel is making a downward dog with a fed bone up it’s ass

yes RichE, The devil is here and he could force things for a larger down wave 4 to spx 1340 or even 1300 as a triangle or flat 4 ,before the good uncle ben comes in with some more free money qe3,his last chance in may before the election,but will he risk further inflating the rest of the already inflated world and china

my bet is on the devils pitch fork and the start of a trend change that could take a few months to reveal itself

but as a daytrader i cannot concern my self with such things as it takes the fun out of the intraday action—euro getting a bit of help moving up

uncle ben is on the hill pitchfork in hand and he’s maddern hell

ANOTHER MIRACULUS RECOVERY!!! WHO WOULD HAVE GUESSED?!!

cnbc’s spending a lot of time telling us a correction is imminent. wonder if thats the fed using them as a puppet. will be interesting to see what happens after alcoa’s report