Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China and Singapore rallied more than 1%. Europe is currently mostly up, but there are no 1% winners. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

Yesterday the market gapped up and then sat in a tight range. Today we’ll get another gap. It’d be nice if the market could open flat and then move. Instead so much of the movement takes place overnight and then we’re left with scraps during the day.

In my opinion the long term trend remains up – this hasn’t changed. The short term is certainly in question. Was the pullback off the high just a pullback within an uptrend? Or is the bounce that started yesterday a dead cat bounce within a mini downtrend? I don’t have the answers. I do know we don’t have to always trade – there are times to trade and times to lay low, and right now is a time to lay low. Many good looking patterns have broken down and need time to fix themselves. And as I stated yesterday, it’s too late to go short. In the near term I’m keeping my defensive posture.

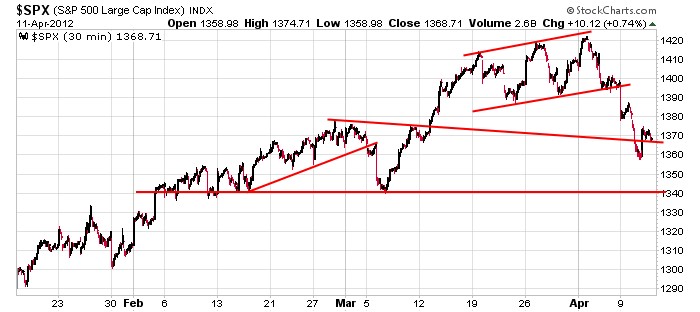

Here’s the 30-min SPX chart. I see resistance at 1400 and support down at 1340. Given yesterday’s close at 1369, the index is right in the middle of that range.

Trading isn’t hard when you do it under the right conditions (when you swing at fastballs over the heart of the plate), but it can be very hard if you push it when the coast isn’t clear (when you swing at curve balls in the dirt). Let things settle here. There will be plenty of time to get involved again. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 12)”

Leave a Reply

You must be logged in to post a comment.

Jason as long as we’re speaking metaphorically the 1340 bernank change up is looking like a grapefruit and I’m going take it downtown

Yo! Elliott Dudes, what’s a, ‘Red Wave v’? As in:

{snip} “However, if the market does move up into this region, but fails to hold 1370 as support on a pullback, then it is most likely signaling that it has started down in a red wave v, which can target the 1320-1330 region below.”

RichE – I don’t think it has any meaning other than the writer may have a few alternative counts in mind and is labeling one of the counts as a red count. Hope that helps.

Thanks I’d never heard it befor

Neal says dow 14000—i dont care–i say the dax/ftse have been stright up for last hour

thats my fun fast in fast out

much better daytrading day today

looks like it may be a abc intraday pattern forming

gee –see i can spel

dollar topped at 80 and 80 on the stochs. since market is oversold futures bet on going back to test the 20d’s.

looks like we’re there on the nas. SP is 1389. this should be resolved SHORTLY

Prediction: a trend line from 3/6-4/6 lows will be the center tine. The devil made me say that.

that would correspond to the usd dropping back to the recent low in 30 days

nas just broke through the 20. up we go

From an EW perspective, the rally in SPX from 1357 is a 3 wave affair thus far (hourly chart). If it finds resistance around SPX 1387+/- and reverses down from this 3 wave advance followed by a break of the 1375 area, we should expect at least a retest of 1357. New lows below 1357 is longer term bearish in my opinion and suggests 1340 may not hold as support. For today, my focus is on whether 1387 holds and the advance evolves as a 3 wave sequence (and not 5 waves) from 1357.

Pete, I could not have said it better myself.

traders like to short at the 20; 1389.6

the nas came down and tested the 20 at 3052 as support and it failed to hold so right now it’s a fakeout breakout. could be trade center scare

I could easily see the market sitting here between the 50 and the 20, (3000 AND 3050), consolidating with the blessing of the bernank. I will bet on whichever end of the hollow log the rabbit comes out of. smoke em if ya got em

When looking at RUT, if the move down has more to go, there should be significant resistance from 812 to 819ish, where both FIBO & 10,20,50 day ema levels are sitting.

have you noticed the adx on it? very stretched yesterday

a 40 -DI not seen since oct. smalls extremely oversold and due for a bounce

I agree. Looking at all the indices, it appears the downward move is going to be corrective.

SPX, for example , could end up going lower but in a larger 3 wave sequence down to 1340 or lower, implying that we would see at least a retest of 1422 and possibly new highs later in the year.

i say no one can tell yet –up or down

nor can we rely on the fact this has been a up trend

the top could be in or it may not

but what i can notice is the nature of the market has changed

no longer is it a buy the dips sell the rallies

in essence we have gone from trending to DISTRIBUTION

and with earnings now is the right time for that

there is no impulsive buying or selling

the global melt down will come out of europe or china,middle east

or a bankrupt usa doing qe3,thus inflating the rest of the world to a explosion

earth quake or the end of the world

Damn Aus., you need to layoff the cactus juice.

i vote for continued currency wars,which like the 30s depression is a form of trade barriers,

but soon the big ponsi will be all over

ESM12: 1380 overnight bounce w/1377.25 stop loss.

soon the usd will be a thing of the past

imo 2 years away

we are being told commodities are up on hopes of china’s gdp reflecting the trade deficit as seen in the rear view mirror and jobs here don’t matter any more. Volitility seems to have dried up. I’m not sure bernankes thumb is not still on the scale.

HAS ANYONE NOTICED SINCE THE FED RUN STARTED IN JAN ON THE SP, WE GET A LITTLE PULLBACK EVERY 5 WEEKS THEN RESUME OUR MARCH HIGHER? A LITTLE OBVIOUS I’D SAY. SMELLS LIKE A DEAD FISH

Funny, the general concensus has always been china gdp would slow to about 8 or 9.

Now all of a sudden whoever is behind this rally, WS or the fed (or both) is spinninning this as a startling new revelation and the greatest discovery since sliced bread.

Hell we’ve already had the rally. What a bunch of dung

Ya know… If the sp jumps the 20d like it did on march 9th, 5 weeks ago, The nank wins and we have no choice but to buy stocks

going back to take a closer look at march 9th, look how far we pulled back below the 20dema…exactly 10 pts.

Now…look how far we pulled back below the 50dema this time…exactly 10 pts

Tell me this markets not manipulated

I just bought back the shares I sold this afternoon. If you’re looking for ideas, look at a 5 yr of AA