Good morning. Happy Friday.

The Asian/Pacific markets closed up across the board. Australia, Hong Kong, Japan, Malaysia and Taiwan rallied more than 1%. Europe is currently down across the board. Belgium, France and Stockholm are down more than 1%. Futures here in the States point towards a moderate gap down for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

This week we’ve had two big down days and two big up days, and the net change is a moderate drop. We knew the market would gap down a bunch on Monday, and after Tuesday, the indexes have recovered fairly well. The market had an opportunity to completely fall apart, but it didn’t. The bulls aren’t going to go down without a fight.

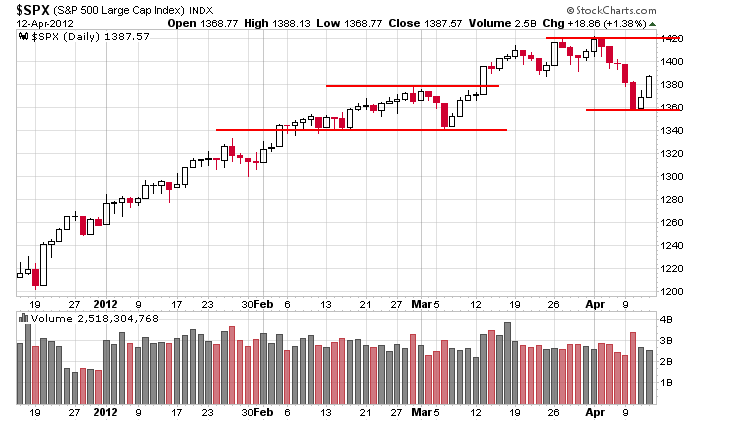

In my opinion, the long term trend remains solidly up, and since the trend has been up most of the last three years, it deserves the benefit of the doubt. I’d rather be a little late jumping on a downtrend than repeatedly be early guessing when it will end.

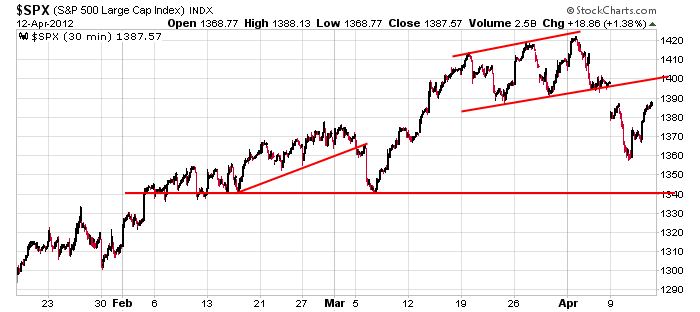

The short term trend is definitely in question. The S&P hit a new high and then dropped five consecutive days. A lot of damage was done to the charts, and where the market goes over the next 1-2 weeks cannot be predicted with a high degree of confidence. This makes swing trading hard and risky. If we aren’t sure where the market will be in two weeks, how do we enter swing trades we wish to hold for a couple weeks?

Yesterday I stated SPX resistance was at 1400 and support down at 1340. After the market gaps down today, the index will be in the upper half of the range but close enough to the middle to not have a great urge to go long or short.

Backing up, the S&P’s most recent high and low mark a range between 1360 and 1420. Yesterday’s close was very close to the middle. Today’s open will be in the bottom half but again, close enough to the middle to not have a strong urge to take a new position.

For now I am maintaining my defensive posture. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 13)”

Leave a Reply

You must be logged in to post a comment.

IMO, all of the major U.S. indices show a rally off of this week’s low that’s best counted as a 3 wave affair in EW terms at this point. Using SPX as an example, any move down today that goes below 1375-76 favors the bears and a retest of the week’s low. Conversely, if SPX can stay above 1376, and reverse upward through yesterday’s high, it favors the bulls and suggests a test of 1400 at minimum. Perhaps we’re going to be range bound in the broader sense between 1340 & 1422 for the intermediate term.

I feel a range-bound-down to starting-blocks then a rally sprint to the fall elections.

“cannot be predicted with a high degree of confidence”? I’m high and I’m confident, Just kidding.

Re: 1-2 week swing trades. I’ve been Day-Swinging the close. Doing good, but hard to sleep at night.

ESM12: I think it’ll be down today and maybe into May. The market’s gota position its self in the starting-blocks if it’s gona re-elect Obama.

bankers lie? say it ain’t so

Based on today’s action in SPX, the rally off of this week’s low appears to corrective of the decline from 1422 to 1357. Therefore,it would seem we should see a retest of 1357 and perhaps an eventual test of 1340. Also,the uptrend line connecting the OCT & DEC lows would be broken on a move down to 1357. The 50 day EMA is at 1370ish and rising and a FRI close below 1370 should give the bears every opportunity to press the downside next week, IMO.

Throughout the rally from the DEC lows, the bears haven’t been able to follow through when given the opportunity (3 wave corrective declines every time). Maybe this time it’ll be different.

Hey Pete, I see the prior drop to 1357 in the cash index as trend line test. Revisiting that support would be a break. I am anticipating a drop to 1340 as it is IMO a conclusion of a 4th of lesser degree. Prior to the open this morning, I went short on the June contract at 1382. My stop is currently set at break even. I am looking for the opportunity to lower it. We are flat lining and boring now. But, we should get a sign soon.

I think jobs and spains problems brought the fed back in. I think nank is obsessed and thinks the economy is his personal lifes calling

volitility is completely gone

I’d love to see a flurry of buying into the close.

Heading for the lows instead, it appears.

Brian – Do I understand you to be in the camp that sees a 1340 low as wave 4 of 5 of C that would complete the ABC pattern from the OCT low? That’s the real issue, i.e. have we already seen wave C completed at 1422 or do we have wave 5 of C above 1422 ahead of us yet? Either way, I think you may be positioned real nice on the short side regardless of the count. What has me leaning towrds C completed at 1422 would be the breach of the trendline from OCT, which I think is significant. With today’s FRI close sitting on that trendline, next week should prove interesting to say the least.

I’m not yet confident on the completion of C. But, I am acting as if it is. Confidence increases if 1357 is taken out prior to any rise above 1392. There is confusion between the cash and futures counts. The reason I use the futures is the off hours trading and greater density within the patterns because of that. If C is done, then 5 of C is painful to count in the cash index. But, it is a much cleaner count in the futures. The high in the futures is on 3/27. Whereas the high in the cash is on 4/2, providing a difficult count. But, if C is not complete, then the high on 4/2 on both indexes would be a B of 4 of C with a 5 yet to come. The problem with that is that the rally from 1357 to yesterdays high is 3 waves. So, ????