Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

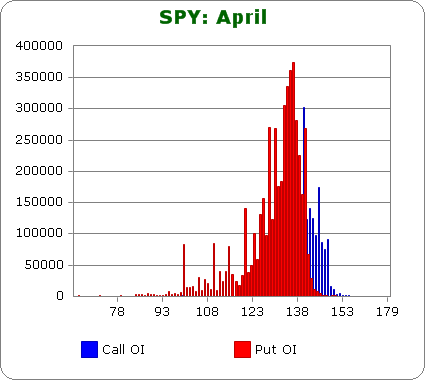

SPY (closed 136.89)

Puts out-number calls 2.7-to-1.0 – same as last month.

Call OI is highest between 138 & 145.

Put OI is highest between 125 & 140 with a few random spikes below 125 too.

Puts dominate. High OI for calls is 100K; high OI for puts is 300K. There’s some overlap between 138 & 140, but since puts far out-number calls, expiring the puts worthless would cause more damage than expiring the calls worthless. SPY closed at 136.89 today – just over 3 points below a huge put OI spike at 140. The closer we get to 140, the more of those puts will expire worthless, so from here, we need a move up of approx. 30 S&P points to cause the most pain.

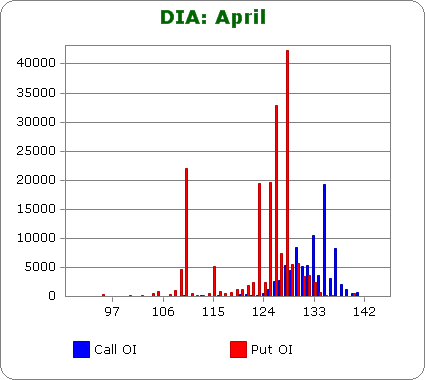

DIA (closed 128.88)

Puts outnumber calls 1.7-to-1.0 – more bearish than last month.

Call OI is highest at 130, 133, 135 & 137 – very random.

Put OI is highest at 110, 123, 125, 126 & 128 – also very random.

DIA hardly matters in this analysis because high OI is 10K whereas high OI for SPY is >100K. Nevertheless it appears a close near 130 would inflict the most pain. Today’s close was 128.88, so a slight move up is needed, but flat trading would be fine too.

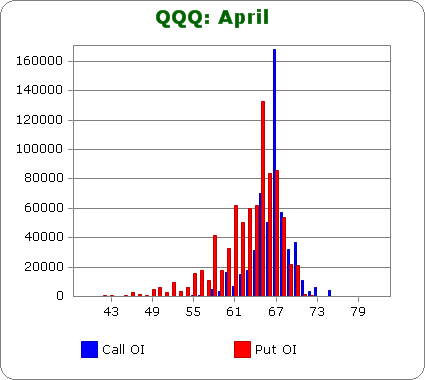

QQQ (closed 65.44)

Puts out-number calls 1.8-to-1.0 – same bearishness as last month.

Call OI is highest between 65 & 68 with the highest being at 67.

Put OI is highest between 61 & 68.

68 is the high side of each range, and there’s overlap between 65 & 68. Hence a close near the middle of this range would cause the most pain. With today’s close at 65.44, a move up is needed. Right now those 67 and 68 puts are likely profitable.

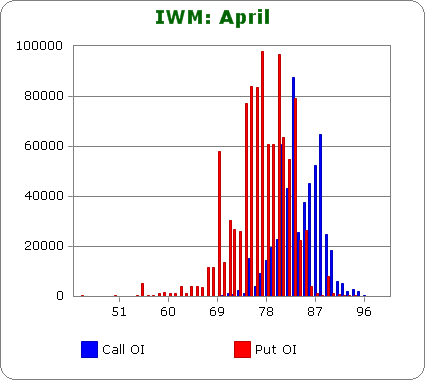

IWM (closed 79.65)

Puts out-number calls 2.1-to-1.0 – less bearish than last month.

Call OI is highest at 81 & 83, and then it ramps up between 84 & 88.

Put OI is much greater and much steadier. It’s highest at 68 and then between 74 & 83.

There’s some overlap at 83/84 – a close there would expire a majority of options worthless. With today’s close at 79.65, a decent move up is needed. A close at today’s level would expire almost all the calls worthless but let a couple of those higher striked put buyers make money.

Overall Conclusion: Most of the time, a week before expiration, the index ETFs are already positioned for max pain. Not this week. In all cases, a decent move up is needed. If the market closes right here or lower, most calls will expire worthless, but several higher striked put buyers will make money. We’re about to find out how strong these numbers are.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

is the market maker a bull or a bear

the insto bookmakers know were they want it

u cant get beat a good bookie,whom takes the opposite side to the retailers