Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board. China and Japan rallied 2%; Australia, Hong Kong, New Zealand and Malaysia rallied 1%. Europe is currently down across the board. Austria, France, Amsterdam and Stockholm are down more than 1%. Futures here in the States point towards a flat-to-down open for the cash market.

The dollar is up. Oil is flat; copper is down. Gold and silver are down.

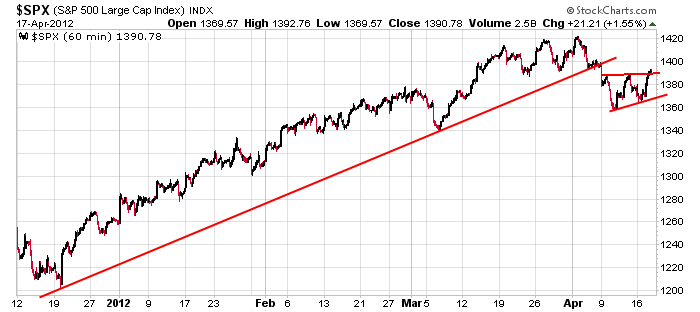

The market put in a big up day yesterday and closed at its highest level since the unemployment data was released 1-1/2 weeks ago. Here’s an update of the 60-min SPX chart. Allowing for a little wiggle room, this chart has bearish implications, but a continuation of the move up right now would neutralize the chart and hint at a large range rather than a break of support followed by a rising wedge.

Yesterday INTC and IBM dropped after releasing earnings. Before today’s open they’re trading down 2.6% and 1.7% respectively.

When the week began there were very few good long set ups to be had and a nice basket of shorts to pick from. Now, two days later, charts of individual stocks have neutralized. There are some shorts and some longs and definitely no clear bias.

Things are not very clear in the near term. We’ve had some ups and down, and as of now, the market is unchanged over the last five weeks.

Play good defense. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 18)”

Leave a Reply

You must be logged in to post a comment.

I vote for a range change, but the raising wedge is annoying.

A political question if I may. Will Romney or Obama be better for the market? If the market needs another QE would Romney push the button?

romney has 666 on his forehead… (thats not good)

Neal has ‘14000’ on his. LMAO

perhaps Pete can ask his fed freinds—Neal is taking his dow 1400 group on a tour of the fed betting on qe3

naturally i would never comment on a political question

LOL –i think they are all insane—a prerequisit for a pollitican

perhaps PeteM can ask his fed freinds

Neal is taking his group on a tour of the fed and betting on qe3 for dow 14000

imo we are in a topping process and wider distribution ranges are possible

i dont see a one sided bet here or trend ,but a lot of up AND down

maybe we have topped–maybe not

naturally i am bias as wide ranges are what a daytrader needs

i think we are in a wide range topping proces

good for daytraders

but would like to see next week after opts ex

the nank probably thinks the stock market smoothly inclining 5-7% annually will heal the world

I’ve been getting a couple 1% trades a day on AA being contrary during this churning period. who’s neal?

Neal made comments that would make Kudlow wince.

AussieJS – I put a call in to Chuck Plosser at the Philly FED. As usual, he won’t talk with me unless it’s over a cheesesteak for lunch (on me, of course) by the Liberty Bell.

Anyway, he’s hinting that QE3 could occur, but only on an SPX drop below 1100 before Labor Day. I’m not sure if he was kidding.

I think chopper papa would fire up the t shirt cannon @ 1260

Hi PeteM,

is ur labour day sometime before the end may as because of the election ,the end of may may be the feds last chance

1100 spx may make a nice broadening,jaws of death ending for the usa and is not far away–just a mere 250 points odd—now u know why i like being a bear–we have more fun than those somber bulls

imo qe3 will happen when and if china says it can–ever seen unckle ben bowing to the chairman

My crystal ball says; Obama will not fire up the QE3 T-shirt cannon. Obama will let the economy fall then ask Romney for solutions. Romney will only have business solutions. Government is not a business. Business solutions won’t work on government. When the VIX approaches Fahrenheit 451 (spontaneous combustion) Obama will save the day and be re-elected. It should be an exciting summer for you Aus.

i normally like florida for ur summer our winter

nice and hot and not many tourists