Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board. Taiwan rallied 2.3%; China, Hong Kong and New Zealand moved up more than 1%. Europe is currently mixed. Austria (up 2.2%) and Greece (down 1.7%) were the only 1% movers. Futures here in the States point towards a moderate gap down for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

May got off to a good start (aided by news 30 min after the opening bell), but then things fizzled in afternoon trading and left the daily charts with some ugly candles.

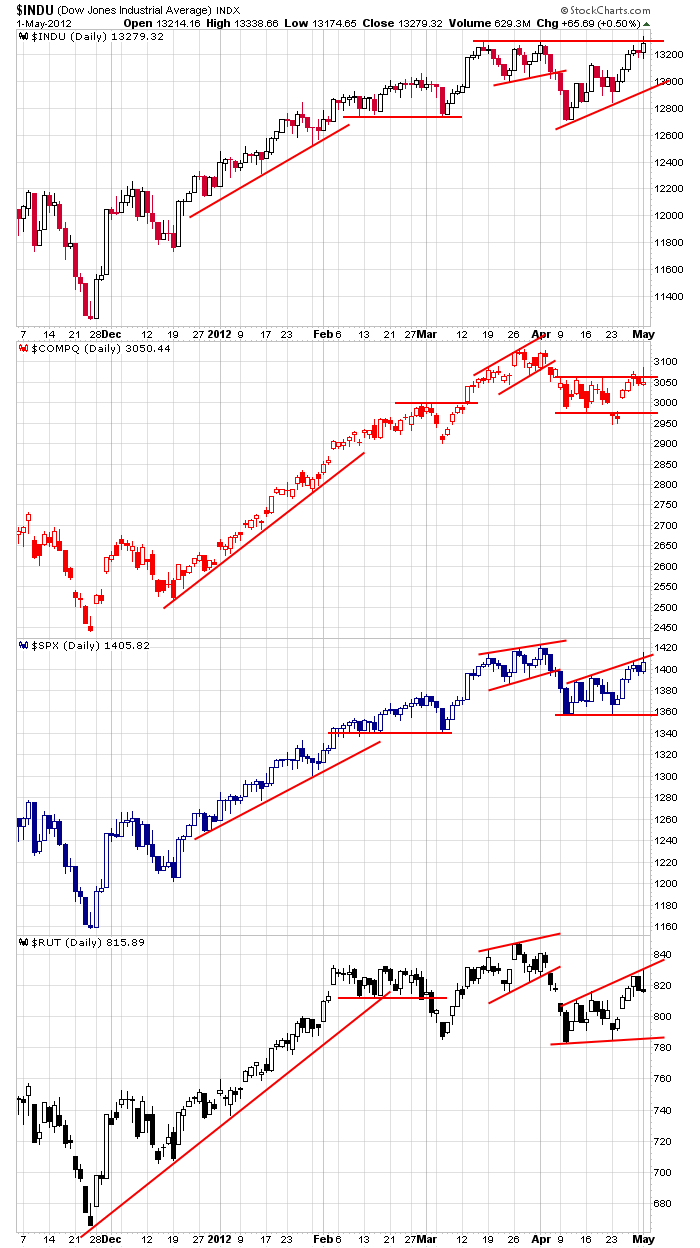

Here are the dailies. The Dow hit a new high. The Nas has been a mess – first it gapped below its pattern, then it gapped back up; yesterday it hit a 3-week high but then closed near its low. The S&P doesn’t look too bad. At its high yesterday, it was less than 10 points from a multiyear high. The Russell sold off the most yesterday afternoon; it was the only index to close down.

Trading has not been easy lately because moves haven’t lasted. Dips get bought, rallies get sold…no move has legs, so we have to be much less aggressive with our entries and ahead of the curve taking profits when they’re available. Until the market can break out of its funk, there’s no sense letting a profit turn into a loss or letting a loss grown.

Eurozone unemployment increased to 10.9% in March – in line with expectations. We get our own employment data this Friday. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 2)”

Leave a Reply

You must be logged in to post a comment.

the start of something big bold and wonderouse or just another half hour affair

i will be watching y/days high/low/close—ndx/dax the weakest

euro taking a intraday hit currently at support 3 piviot but maybe its intraday low

flat into open after a nice ride

“half hour affair” Is that daytrading with benefits?

can you spell hide the salami

Support held at the target of ~1390 on ES. Let’s see how it behaves at 1398, the underside of the trend line.

great trading for a contrarian. I love this rapid up and down. we were way overdue for some volitility per the extreme low stoch on the vxo I showed you friday

I think Europe is going to sell off sometime in the fall.

piss on e slobering again. prop in on intc ibm qqqq others

inside day of consolidation,with a slightly bearish touch or a outside reversal up for some

but euro is saying sleepy time and tick saying chop chop

in oz chop chop is home made tobacoo and illegal

when the fed runs up intc they get a prop on the dow, nas and qqqq. it’s one of their favs

ESM12 5d5m: Since the 12:05 bar was low volume I’m going to guess the 12:15 &12:20 are distribution.

put a little arch coal in my IRA. 8.50

I’m flat. This is like trying to milk an alligator. See ya tomorrow.

I’ve taken up working out. it helps

Brian – after today’s decline thus far, there are some who see the advance from SPX 1359 as a completed 5 wave structure for wave 1 of larger wave 5 of C, whereas I’m inclined to see it as wave “b” of 4 of C completed with wave “c” down in progress. Either way, the bounce off of today’s low would be expected to find resistance in the 1402-1407 area with a 3 wave up pattern. I’d be inclined to go short on a downside reversal in that area with a target in the 1380-1387 area as a minimum in the event that the lrger wave 1 up from 1359 iterpretation proves correct. In that event, 1380 would be the expected maximum downside from which a move to new highs above 1422 would be expected. If my interpretation works out, wave “c” down would test 1357-1359 in a “flat” correction to conplete wave 4 of C. What are your thoughts?

Pete – I’m currently working under the assumption we have begun a c of 4 of c. However, 1400 in the futures is critical resistance to prevent wave overlap. I’m still short and yet to learn the lesson to take profit when it presents itself.

Not liking the action at the close…

imo both bulls and bears are in hibonation

and when they wake up we will have bearish bulls

and bullish bears