Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. Australia, Hong Kong, Japan, Singapore and Taiwan dropped more than 2%; Indonesia and Malaysia dropped more than 1%. Europe is currently mostly down. Greece is down an amazing 7%; Belgium and London are down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is down and copper is flat. Gold and silver are down.

The big news this weekend comes from Europe where elections in France and Greece took place. Incumbents responsible for Greece’s austerity measures were punished, but no party won enough votes to form a government. Hence there’s a chance new elections will take place within a couple months – lots of uncertainty. In France, Sarkosy lost to the socialist candidate who wants to boost government spending.

Bershire Hathaway held its annual meeting this weekend. More than 40,000 die-hards made the treck to treat Buffett like a rock star even though the company’s stock has underperformed for several years.

Facebook begins its road show today to promote its stock before going public later this month. How will the stock perform when it starts trading? The opposite of whatever sentiment is. If the public is skeptical, the stock will do great that first day. If the public is super excited, the stock won’t do as great as some anticipate.

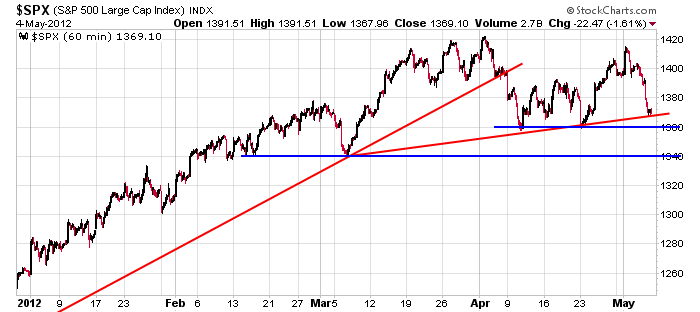

As stated over the weekend the market is in a fragile place right now. For a couple months dips have gotten bought and rallies sold. Directional moves have been scarce. After last week’s drop it’s time for the bulls to step up. Heading into last week they had a cushion to work with, but that cushion is gone. Here’s the 60-min SPX chart. Support comes in at 1360 and 1340.

I’ve been playing it safe lately. That means smaller positions, and I’ve had less tolerance for moves against me. In this environment you can’t let a profit turn into a loss or a loss into a bigger loss. If that means you miss out on a move, so be it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 7)”

Leave a Reply

You must be logged in to post a comment.

Brian – If a reversal begins off of new lows this morning, IMO, we may have completed wave 3 dwon from SPX . In that event, I’m covering one of my short positions and I’ll look to short again into wave 4. The downside target still appears to be 1340-1350 in a wave 5, IMO. If a rally gets above 1382ish, I may change my opinion on the downside target.

Hey Pete! I covered my short yesterday at 1347 (Jun ES Futures) – looks like a good move now. I contemplated adding to my short and dropping my stop. Had I done that, it would have been triggered. The futures chart shows a significant retrace of the opening gap down. Just can’t tell yet if the opening was the bottom of 3 of c of 4 of C OR the bottom of c of 4 of C. Looking like the former (sharp move up provides alternation to 2 of c). But, my target of 1333 (1340 in the cash idx) has not been reached. I am considering reestablishing my short at 1368. I’ll evaluate when I see the behavior when it reaches there. Clearly, the downside target needs to be abandoned if it appears we have begun 5 of C.

Brian, I’m assuming we’re in wave 4 as I described earlier. I haven’t coverd any short position because the bounce has been so weak. I’d add another short position if SPX fails in the 1370-72 area

Didn’t see your second comment until after I posted my first. I think we are pretty much on the same page regarding spots to watch and possibly take action.

Covered a short position at SPX 1368 & am looking for a test of 1372-74 as a place to go short again on signs of a failure. Jason makes good sense, EW aside, IMO.

Futures are currently trailing the cash by about 3-4 points. So, I think we are on the same page.

Hey Pete! Are we close? What would you say constitutes ‘failure’?

Brian – I’m looking at Fibo retracement levels from 1404ish to today’s low. We’re around a .236 retracement which isn’t much & the move down from SPX 1374ish doesn’t look a “failure”

either. If I see 1374 tested & another turn down, I’ll go short again wit a tight stop on the new position.

Short again on the move back below SPX 1372 and wanting to see follow through below 1368 with some indicatioon that wave 5 of some degree is beginning.

I just went short.

Brian – I’m curious to know your count on the overnight futures position you trade, i.e. form the overnight low do you see 5 waves up on the rally?

5-3-5 with 6 min bars from the low of 1342.5 yesterday.

Time wise, the count sucks. So, I have a tight stop in case I’m only riding a correction of 1 of 5 of C.

at 1368 (ES) with tight stop at 1373.75

squeeze for lunch again? really? geithner is as boring as dirt

has small tim been bowing before the chinesse again

onfussus say –know the future and u control the markets

the futures bottomed at equivilant to 1345 cash spx the first 10 minutes of asia opening

and have been slowly massarged back up since–maybe the start of small abc back up

buying has not been strong but little selling–so it may have been a exhaustion down

my tick ind has only now reached a up extreme

dax after much down closed slightly higher–ftse closed

naturally day traders take profits when they are there–so i need some bull please

unless we have a late sell ,looks like all markets will close just above fridays close

for a gap down recovery pattern—go the bulls

Today is the perfect example of why I don’t like to limit my trading to US market ‘open hours’, there is so much left on the table if you can take advantage of the movement elsewhere in the world.

can’t not can

so did the dax bottom for this counter trend,may depend on hoe ftse opens

did u see the japan n225

I don’t watch indexes I don’t trade. I just assume the effect of others play on the futures of the indexes I do trade. By trading the ES contracts, the only gaps I have to suffer are the ones created every week from Friday at 1:15 pm to Sunday at 3 pm PST. I hate gaps unless they’re in my favor.

sox bounced (or should I say was proped) off their 4 mth neckline at 396. to bad

sp 600 didn’t even get a chance to reach theirs. pathetic

nanke told geithner he needed a bull market and geithner thought he said bullshit market

THIS IS LIKE THE ‘BRIAN AND F’ING PETE ‘SHOW !…..BORING !!

I’ll take your review as a minus 1 on the show. I’d offer you money back on your tickets, but you didn’t buy any.